Ultimate objective of any economic policy framework should be achieving sustainable cost of borrowing for the overall economy. It is not because debt is good for the economies, but it is because economic agents are already indebted too much already. And I mean not only the government borrowing but private borrowing as well. How is it possible to reach this objective? Answer to that question is related to the basics of finance: risk free rate and expected return. Investors ask higher premium for higher risks. Risk premium is the expected excess return on a security or portfolio, where excess return is the difference between an actual return and that of a riskless security. That’s why I cover the relationship between macroeconomic policies and risk pricing in my lectures. Central bank balance sheet is one of the results of macroeconomic policies. So, I believe every financial analyst should have a good understanding of the basics of central bank balance sheet.

The very concept of the international foreign currency reserves is a good example of how a central bank plays a crucial role in risk pricing. What is international foreign currency reserves? To put it simply, foreign currency denominated liquid and safe assets held on the central bank balance sheet are reported as the international foreign currency reserves. It is important to note that foreign currency receivables from Turkish banks do not fall under the category of international. Gold stored in vaults of the central bank is a different story. Since there is no credit risk attached to gold, it is reported as part of international reserves.

There is a cost of holding international foreign currency reserves. This cost is simply the difference of borrowing from international markets and investing in safe liquid international assets. As you may imagine, safe liquid international assets yield much less than the interest paid for country’s international debt. On the other hand, everybody knows that when it is needed, no international foreign currency reserves are sufficient. If this is a true statement, why do central banks bear such a cost?

There are 2 good explanations for this question. One of them is the liquidity risk associated with short term foreign currency debt. Other explanation is related to how investors perceive the soundness of macroeconomic policies. Let’s remember the analogy of Keynesian Beauty Contest: perceptions matter more than the reality in the financial world.

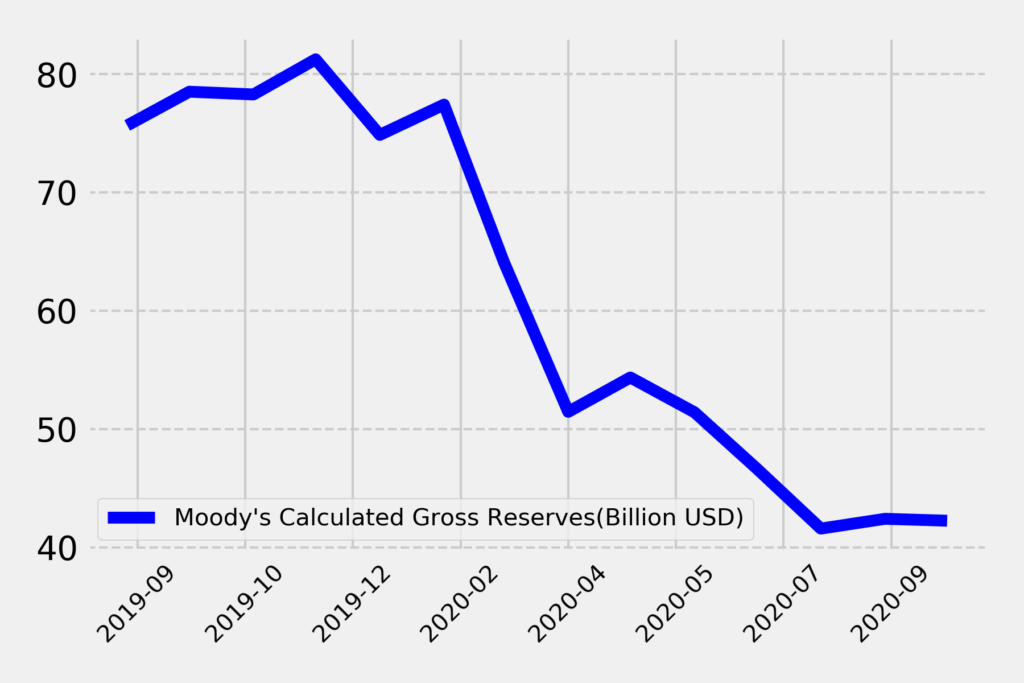

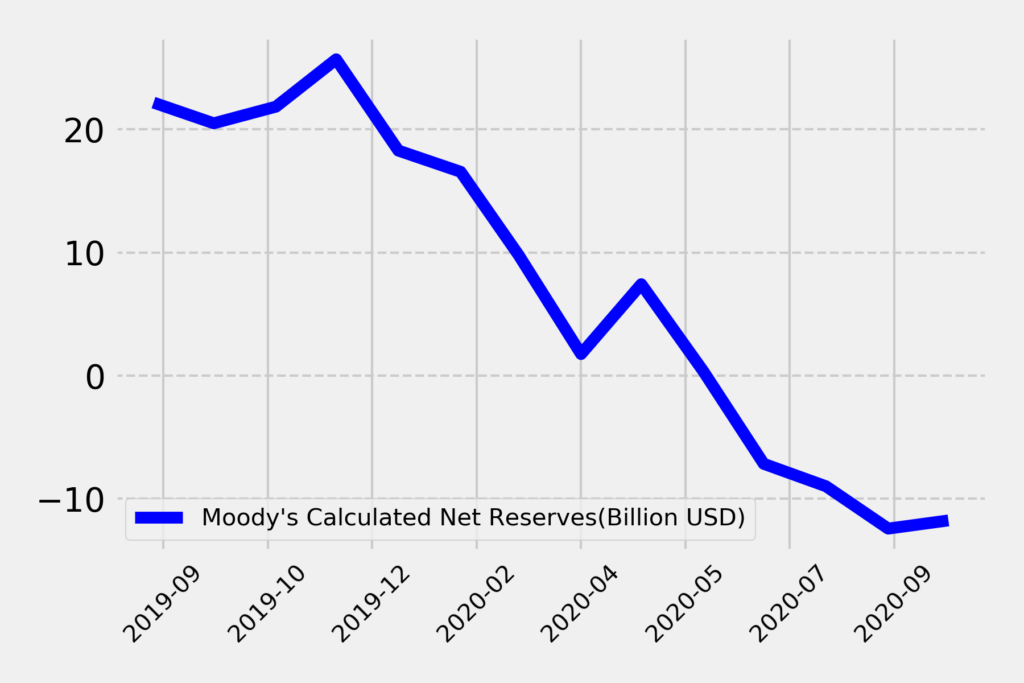

Scoring approach of the credit rating agencies to the external position is good example how foreign currency liquidity risk is measured. The latest Moody’s report on Turkey has a special chapter on this issue. Moody’s calculates two version of international reserves, gross and net foreign exchange reserves.

Net foreign reserves is calculated with netting out banks’ required reserves for lira and FX liabilities. It is unfortunate that not reserves are in negative territory which is no good.

While Moody’s take into account gold holdings of the central bank broadly, in their reports they make net reserve calculation particularly only for foreign currency reserves. I believe this method is used to be able to make cross country comparison. As mentioned in the beginning, this is a Keynesian Beauty Contest, so I will not discuss the problems of this calculation.

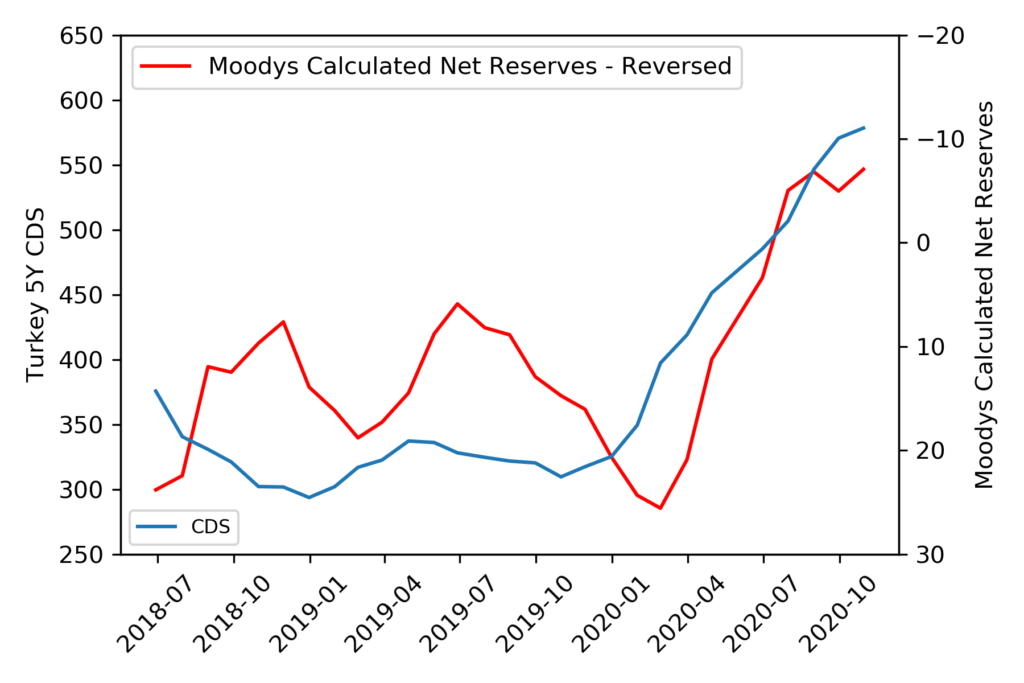

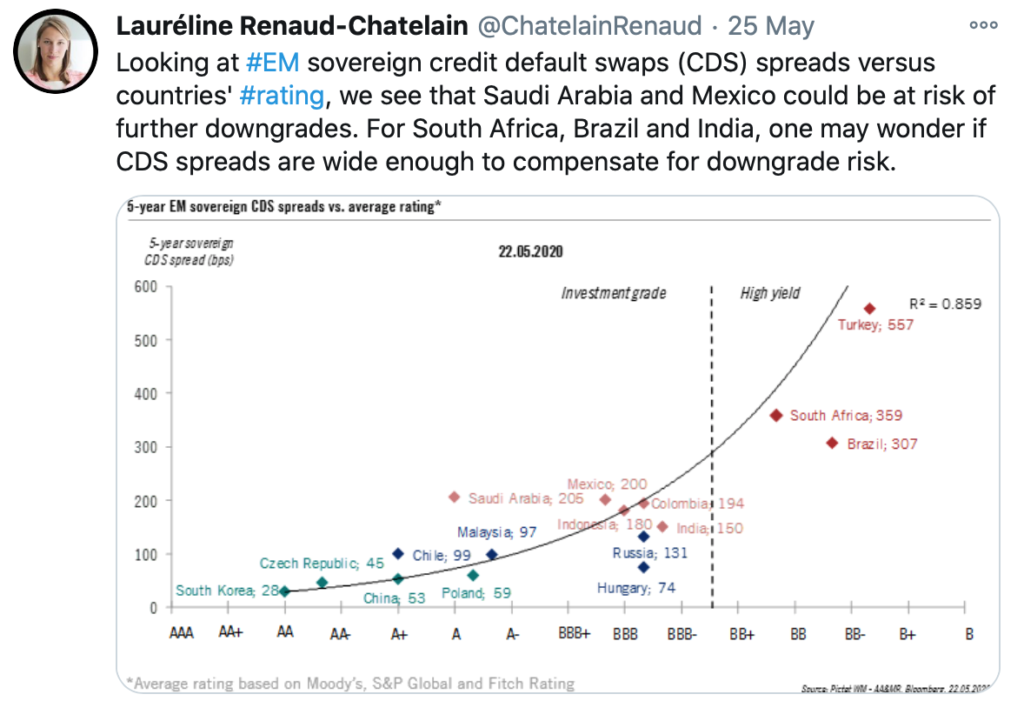

Do the credit market investors price similarly like Moodys picture it? A credit default swap is designed to transfer the credit exposure of fixed income products between two or more parties. 5 year sovereign CDS spreads are strongly correlated to sovereign ratings. As expected like other derivative markets, sovereign CDS is traded to discover price of the country credit risk.

This kind of relationship is visible also for Turkey’s net reserves and sovereign CDS spreads. Policy makers need to calibrate monetary and fiscal decisions in order to achieve lower risk premium in the long run.