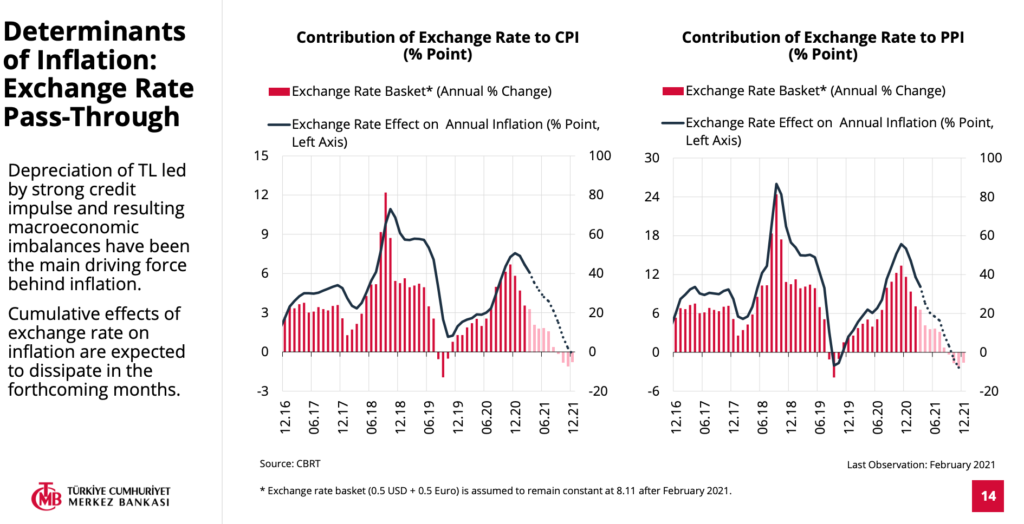

One of the favorite explanations for high inflation is exchange rate pass through. Central Bank of Turkey spares an important part in their investor presentation to this relationship.

Interestingly this relationship is very closely monitored by currency traders as well. Since Central Bank communicates with the markets from the perspective of exchange rate pass through, currency traders expect Central Bank to react depreciation of Turkish Lira at historical levels. This relationship of Central Bank with currency traders can be simply explained as: “scratch my back and I will scratch yours”. Central Bank gets rewarded by the economists as far as currency traders continue to make profit. But unfortunately this relationship is from the beginnning to the end very pragmatic. And it ends up when currency traders decide to unwind their position.

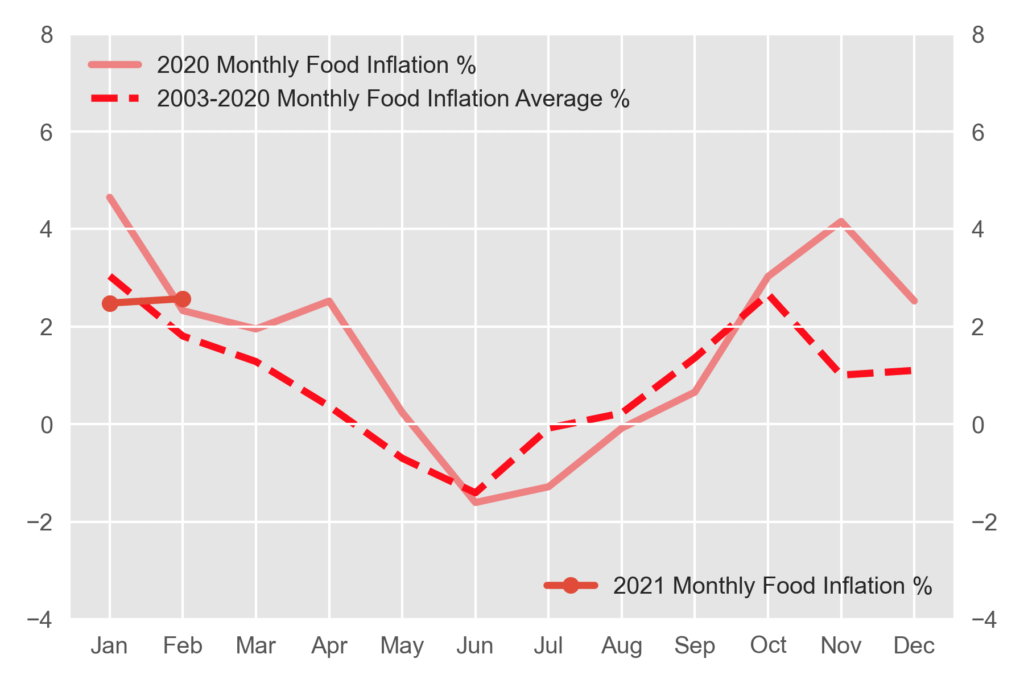

It is sometimes argued that increasing globalisation and openness to trade has exerted downward pressure on inflation in developed countries by, for example, reducing import prices. It is just the opposite what Turkey experiences. On the other hand food inflation is totally a different story. Food prices are composed of two groups: processed and unprocessed food products. Unprocessed food products are goods such as fruits, vegetables, meat and fish that are offered for household consumption without significant processing, whereas processed food products are sold after processing and completion of a value-added chain.

What makes food prices so rigid ?

The high degree of climate dependence in production, high number of intermediaries in the supply chain, uncertainties surrounding agricultural subsidies, concentration of agricultural production in certain geographic areas, fluctuations in external demand, price structure of export goods, consumption pattern.

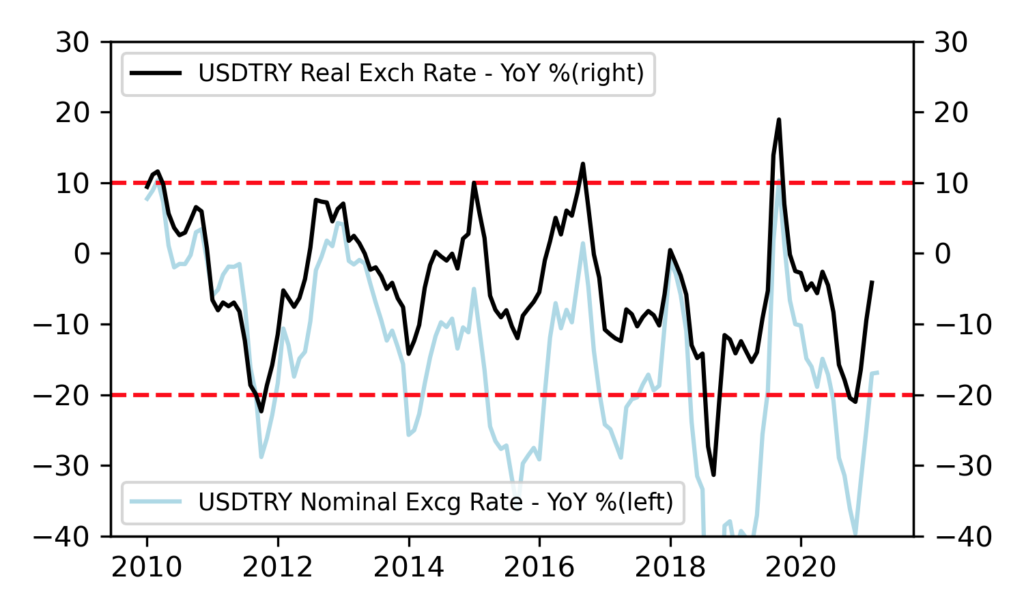

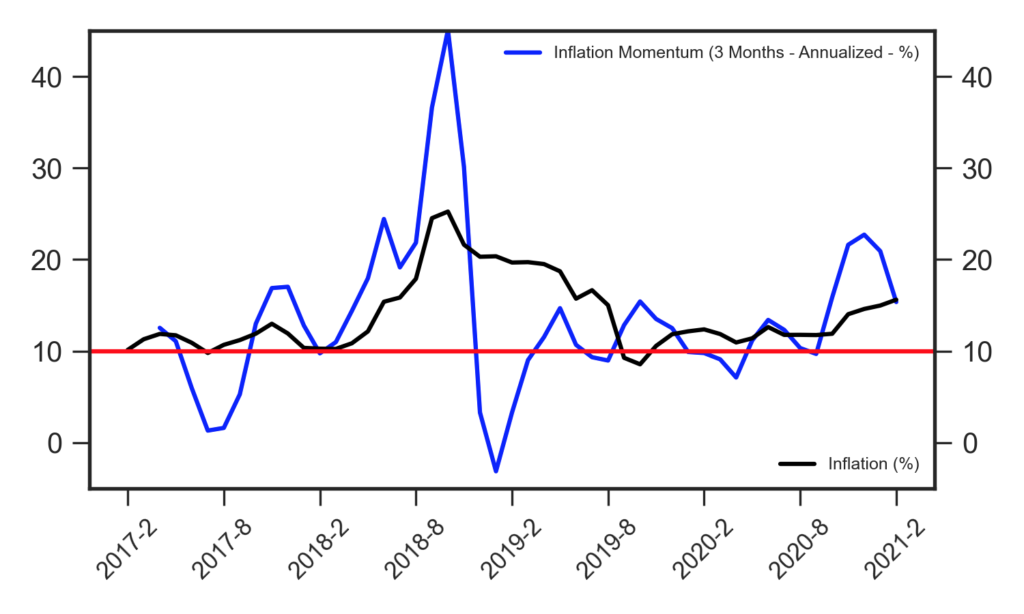

In 2021, it looks like that we will observe lower inflation in the coming period, thanks to the real appreciation in Turkish lira and seasonal behaviour of food prices. As tight monetary conditions remain intact, this pattern will become more visible in inflation as well.

Likewise food price seasonality, short term money managers also have its own seasonality. Both of the factors have been supportive in efforts to manage inflationary forces so far. The question remains what will happen when conditions become unfavorable?