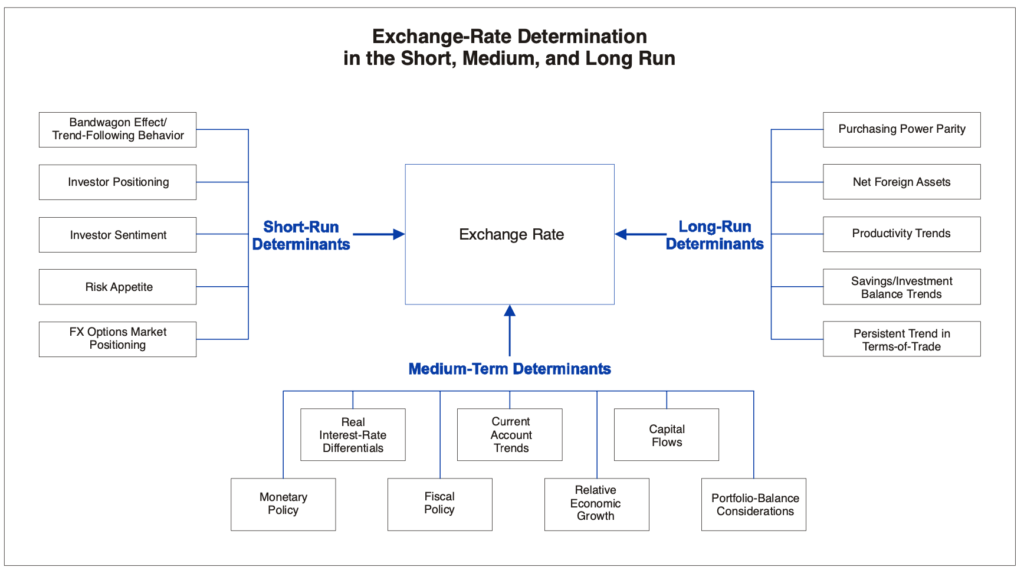

Many market players accept that exchange rate forecasting models are poor in performance. Even it is not easy to explain the exchange rate movements ex-post. Fundamental-based exchange rate models tend to perform poorly particularly over short-term periods. However they tend to work better over medium and especially longer-run horizons.

Exchange Rate Determination Playbook

Evidence suggests that for short term horizons, a random walk characterizes exchange rate movements better than most conventional fundamental based exchange rate models. FX market participants typically fall under into one of two camps:

i) Shorter-run technically oriented traders or

ii) Longer-run fundamental-based investors.

Below is an illustration of how currency might behave with respect to different factors.

Poisonous Policy Mix for Turkish Lira: Negative Real Policy Rates, Unlimited Endogenous Money, Exchange Rate Targeting

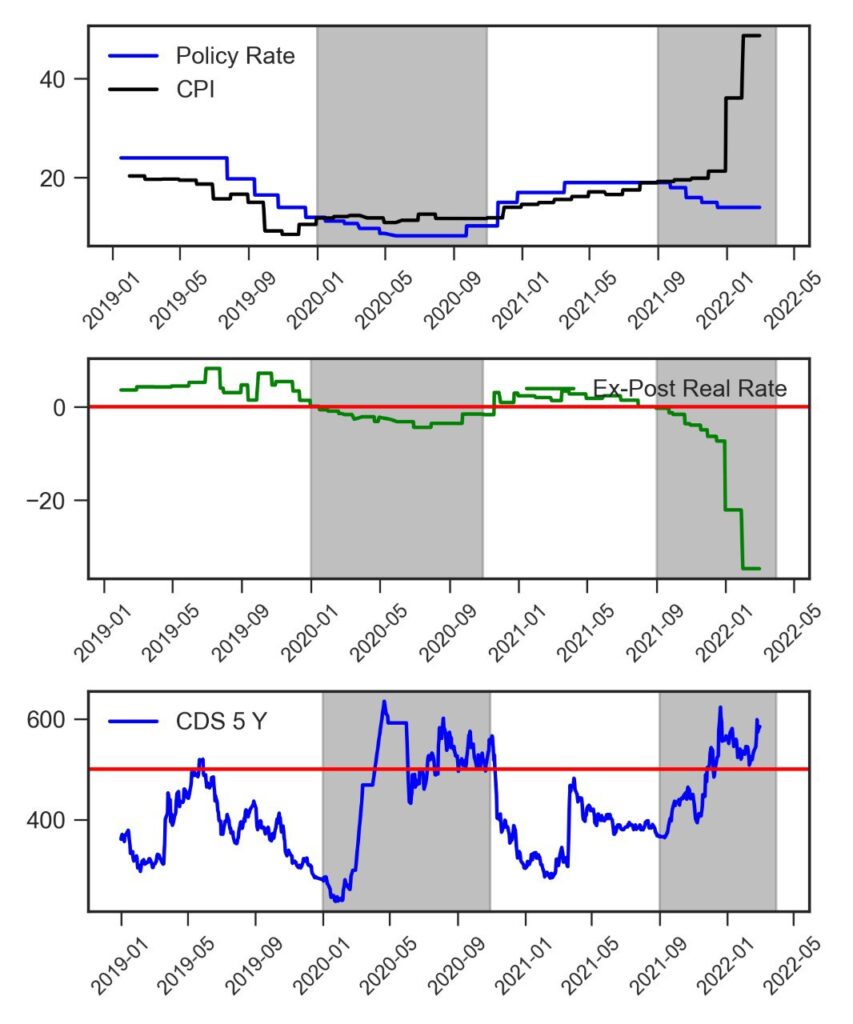

Having visited exchange rate determination playbook, it is obvious that short term exchange rate determinants are not favorable for Turkish Lira. International money flows slowed and investor sentiment turned negative. Turkish consumer price inflation reached 54 percent as of February and policy rate stands at 14 percent. Ex-post real interest rate is 40 percent. The momentum of inflationary pressures continue to build up given the recent spike in global commodity and energy prices. This also means that negative ex-post real interest rates will continue for an extended period. As it was observed in the past, Turkey’s credit risk priced in CDS markets increased following deteoriating macroeconomic fundamentals.

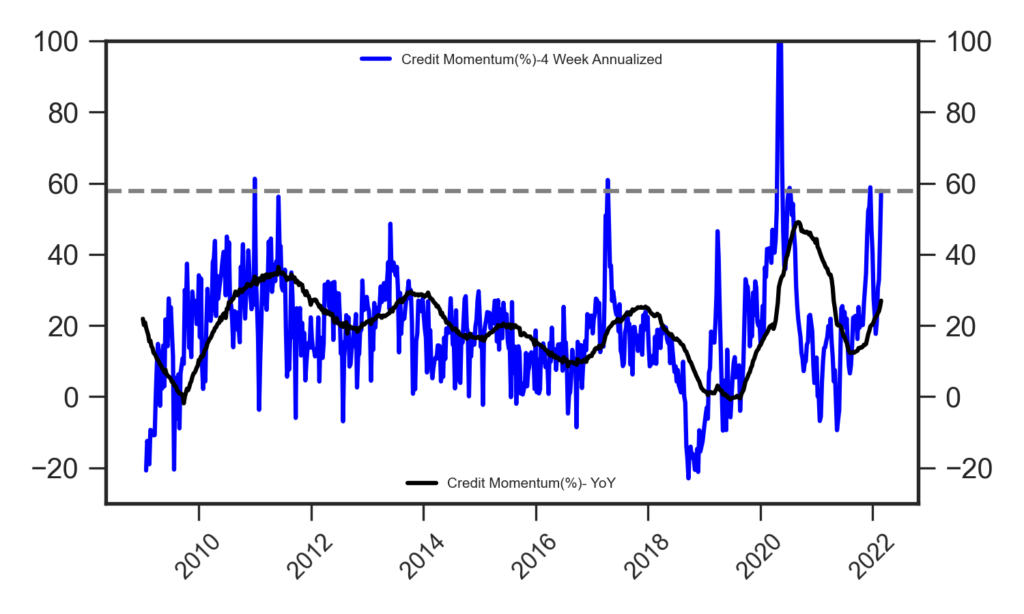

Negative real interest rate environment leads to front loaded money demand. New money is mostly related with traditional hedging assets demand which are mostly unproductive (like land, used cars). As a proxy of new money demand, Turkish Lira loan growth momentum which is calculated over annualized 4 week average recently hit 57 percent.

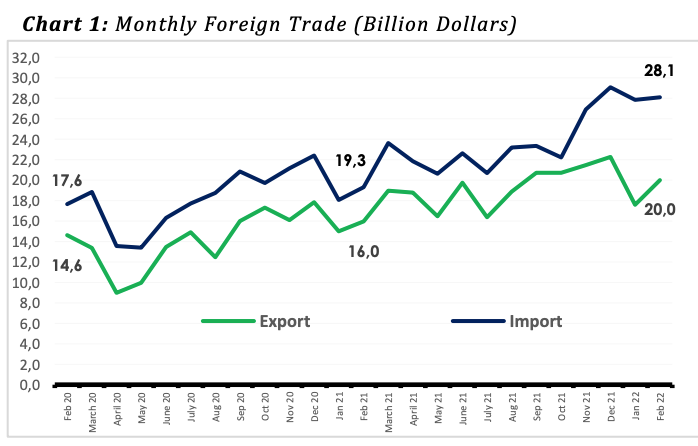

One of the important determinants of exchange rate is trade balance in the medium term. Although recent economic policy framework aims to achieve current account surplus and increase in international foreign exchange reserves, the outcome is totally different. Given the new money demand and unfavorable international political environment, trade deficit signals for worsening current account balance.

Turkey manages exchange rate as an anchor to help bring inflation rates down. In order to achieve exchange rate target new FX protected Turkish Lira deposit scheme is introduced. The government introduced the scheme to reverse dollarisation, support the lira and lengthen the tenor of lira deposit funding. Customers who switch will be compensated if the exchange-rate depreciation on their new holdings exceeds the interest rate, with the authorities covering the cost. FX-protected deposits were recorded as TL 520.14 billion in the week of February 25. In other words, potential foreign currency demand is appr. 37 Billion USD, thanks to unlimited and cost free government protection.

Although Central Bank of Turkey enjoys utilizing fx protected deposits to achieve stable exchange rate, short and long run determinants of the exchange rate suggest that Turkish Lira stabilization is mission impossible with huge risks building up.