Negative real interest rate policy is common in advanced economies. The idea behind negative real interest rate policy is to keep financial conditions loose enough to stimulate economic activity. Turkey re-implements negative real interest rate policy when inflationary pressures are building across the economy. The question is not if economic agents will ask for more money at lower cost but how will they use it?

What is Cantillon Effect?

The process of money creation is no more a secret. Banks create money whenever they make a loan. There is no physical or natural constraints on how much money is created.

A Cantillon effect is a change in relative prices resulting from a change in money supply, which was first described by 18th-century economist Richard Cantillon.

According to Richard Cantillon, the beneficiaries from the expansion of the money supply are the first recipients of the new money. As new money is created by banks, those who have the best access to bank credit benefit the most.

Inflation expectations in Turkey signal for high money demand if Richard Cantillon is correct in his assumptions.

Orthodox Monetary Transmission Mechanism Under Inflation Targeting Regime

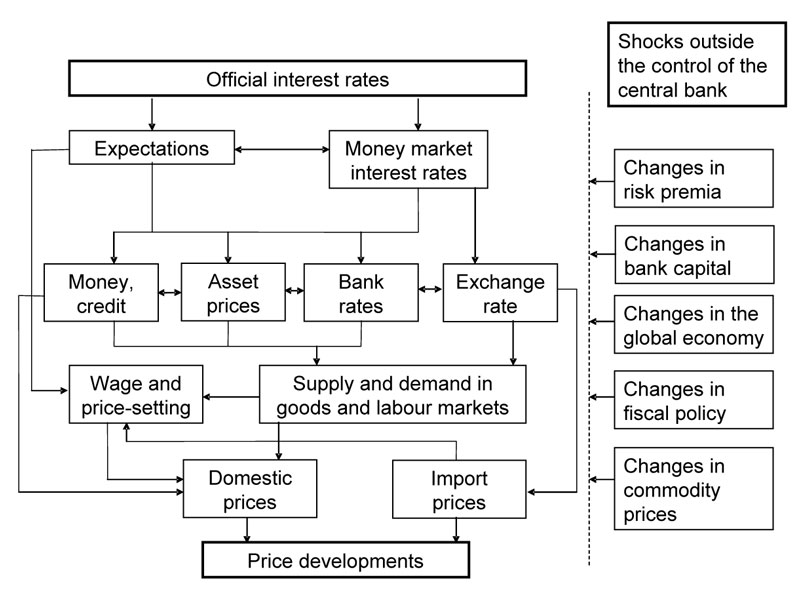

Although there is no quantity constraint on money creation, economic agents shift their money demand reflecting their expectations in the price of money. Central banks manipulate short term interest rates to manage expectations on future price of the money. This is basically called monetary policy transmission.

Expectations of future official interest-rate changes affect medium and long-term interest rates. In particular, longer-term interest rates depend in part on market expectations about the future course of short-term rates.

Monetary policy can also guide economic agents’ expectations of future inflation and thus influence price developments. A central bank with a high degree of credibility firmly anchors expectations of price stability. In this case, economic agents do not have to increase their prices for fear of higher inflation or reduce them for fear of deflation.

Transmission mechanism of monetary policy

During the global monetary policy normalization, Central Bank of Turkey followed positive real interest rate policy in line with inflation targeting regime play book until 2020. In 2020, Turkey implemented negative real interest rate policy which was halted after sharp depreciation in Turkish Lira.

Negative Real Rate Policy in Turkey

Once again Turkey will apply policy rates lower than inflation rate under new policy framework. According to the recent communication of the Central Bank, new policy framework will help the current account to give surplus and accumulation of international reserves.

The improvement in annualized current account is expected to continue in the rest of the year due to the strong upward trend in exports, and the strengthening of this trend is important for the price stability objective.

Briefing on 2021-IV Inflation Report

Negative real interest rates are expected to stimulate the corporate sector to produce more and overcome the supply side problems in the economy.

The tightness in monetary stance has started to have a higher than envisaged contractionary effect on commercial loans.

Press Release on Interest Rates (21 October 2021)

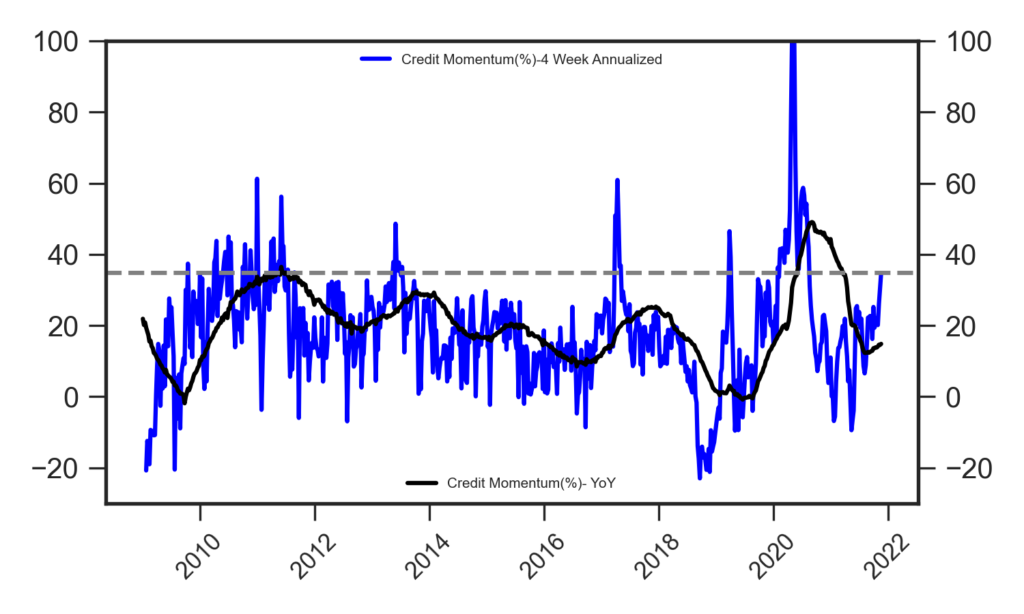

New Money Demand is On the Rise

Since the Central Bank implemented new policy framework, economic agents started to increase the demand for new money. I will use annualized Turkish Lira loan growth momentum as the proxy for new money demand. Annualization is an easy way of describing momentum. To annualize a number, multiply the shorter-term rate of return by the number of periods that make up one year. Below chart is a simple annualization of Turkish Lira loan growth rate. Calculation is based on 4 week average multiplied by 52.

As we know that monetary policy works with an overall lag of 12 to 24 months, or even longer. Outcomes of new policy framework will be more observable next year. At the moment markets priced these outcomes with higher inflation risk premium and higher cost of risk.