Monopoly is a multi-player economics-themed board game.In the game, monopoly money is theoretically unlimited; if the bank runs out of money it may issue as much as needed “by merely writing on any ordinary paper”. I will argue in this post that central bank liquidity is no different than monopoly money for the banks. Central bank liquidity only matters in transacting with the central bank.

Basically the liquidity needs of the banking system results from the minimum reserve requirements imposed on banks and from autonomous factors that are beyond the direct control of the central banks.

How FED Floods US Banks With Liquidity

FED’s presentation of factors affecting bank reserves is a good example to understand how central bank liquidity moves in the balance sheet.

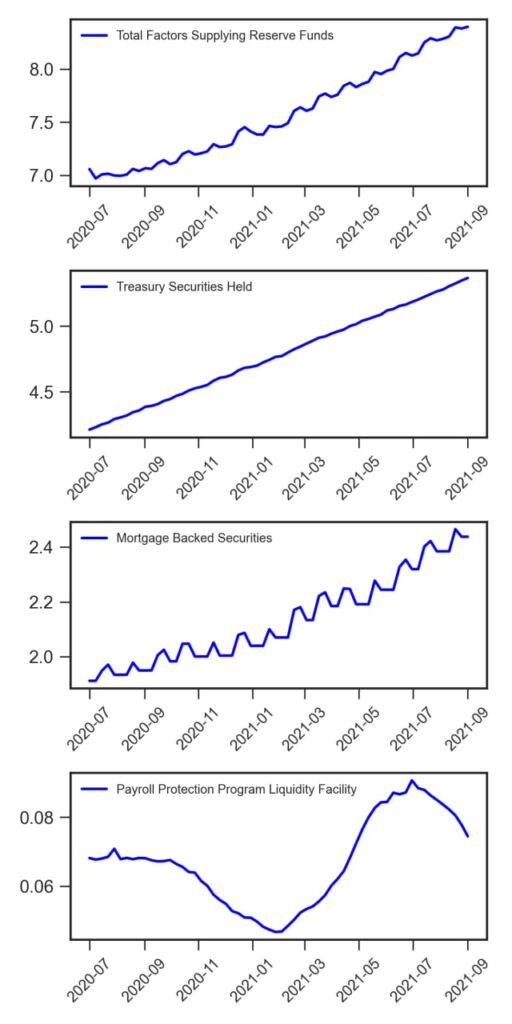

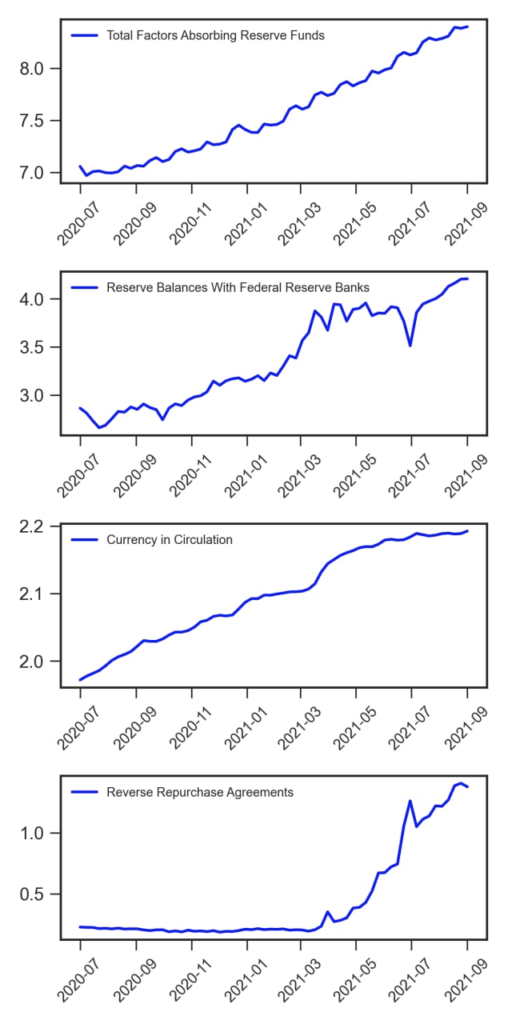

As it is seen from the table above, FED discloses the details of how 8.4 Trillion USD is supplied and absorbed.

3 largest supply factors:

(1-2) US Treasuries & Mortgage Securities Held Outright: The amount of securities held by Federal Reserve Banks. This quantity is the cumulative result of permanent open market operations: outright purchases or sales of securities, conducted by the Federal Reserve.

(3) Paycheck Protection Program Liquidity Facility (PPPLF): The Paycheck Protection Program (PPP) is a $953-billion business loan program established by the United States federal government in 2020 through the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) to help certain businesses, self-employed workers, sole proprietors, certain nonprofit organizations, and tribal businesses continue paying their workers.

3 largest absorbing factors:

(1) Reserve Balances with Federal Reserve Banks: Reserve Balances with Federal Reserve Banks is the amount of money that depository institutions maintain in their accounts at their regional Federal Reserve Banks.

(2) Currency in circulation: Currency in circulation includes paper currency and coin held both by the public and in the vaults of depository institutions. The total includes Treasury estimates of coins outstanding and Treasury paper currency outstanding.

(3) Reverse repurchase agreements: Reverse repurchase agreements are transactions in which securities are sold to primary dealers or foreign central banks under an agreement to buy them back from the same party on a specified date at the same price plus interest.

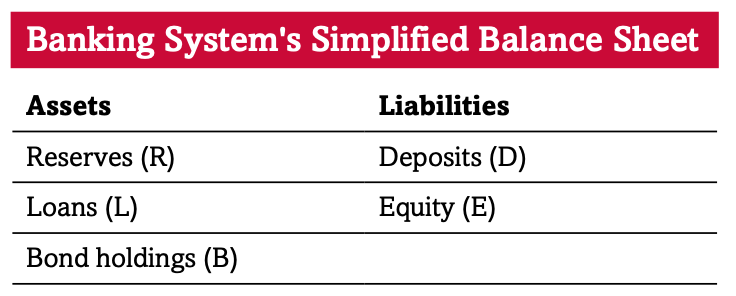

Interest-Rate-Targeting Central Banks Supply Whatever Reserves Are Needed

Banks lend by simultaneously creating a loan asset and a deposit liability on their balance sheet. That is why it is called credit “creation”–credit is created literally out of thin air (or with the stroke of a keyboard). The loan is not created out of reserves. And the loan is not created out of deposits: Loans create deposits, not the other way around.

If bank lending increases and the associated increase in bank deposits leads, as it will, to a higher level of minimum required reserves, the central bank will naturally supply those reserves. Otherwise there will be a central bank-induced shortage of reserves, and the overnight interest rate will go up, meaning that the central bank will not be hitting its interest-rate target. Central banks, in normal times, cannot target an interest rate and independently restrict the amount of reserves they supply. That’s the reason why Central Bank of Turkey’s liquidity is needed by banks to meet obligations.

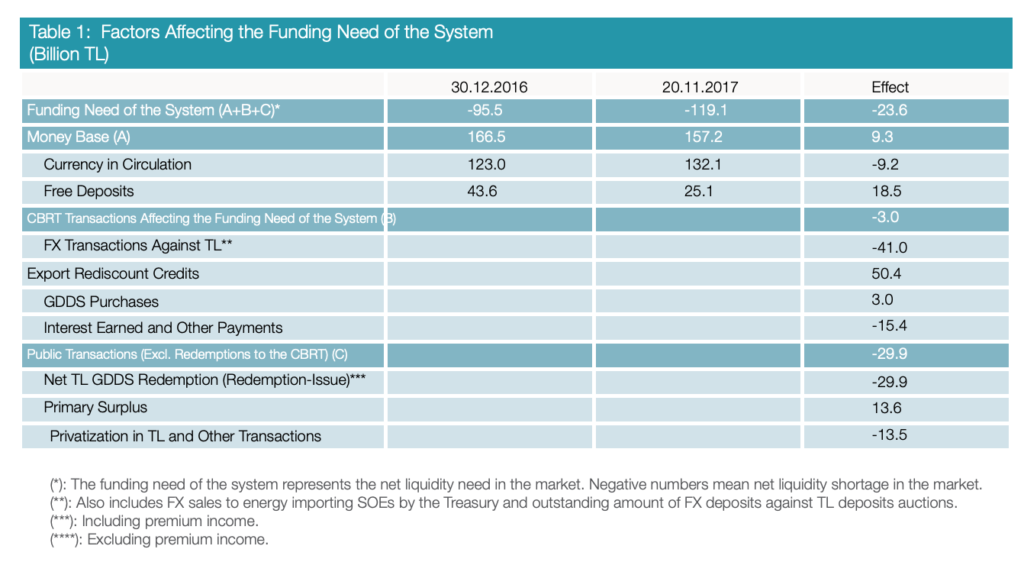

It was in 2018 (pg.7, Monetary and Exchange Rate Policy for 2018), the last time Central Bank of Turkey disclosed details of liquidity affecting factors. The funding need of the banking system is mainly determined by the following factors:

Changes in monetary base,

a) Changes in the volume of currency issued,

b) Changes in banks’ Turkish lira (TL) free deposits at the CBRT.

The CBRT’s Turkish lira transactions in the market,

a) FX purchase/sale transactions against TL,

b) FX deposits against TL deposits transactions,

c) Export rediscount credits,

d) Government domestic debt securities (GDDS) and lease certificate purchase/sale transactions,

e) Interest paid/earned, current expenditures.

The Undersecretariat of Treasury’s Turkish lira transactions in the market,

a) The difference between the redemption and issuance of GDDS and lease certificates (excluding

redemptions to the CBRT),

b) Primary surplus inflows,

c) Privatization and Savings Deposit Insurance Fund (SDIF)-related transfers and other public

transactions

Developments in Selected Factors Affecting Central Bank Funding

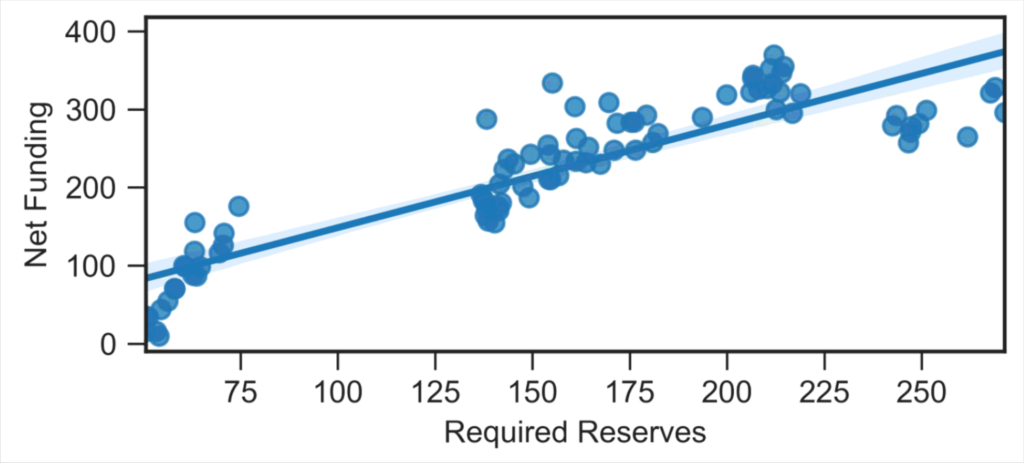

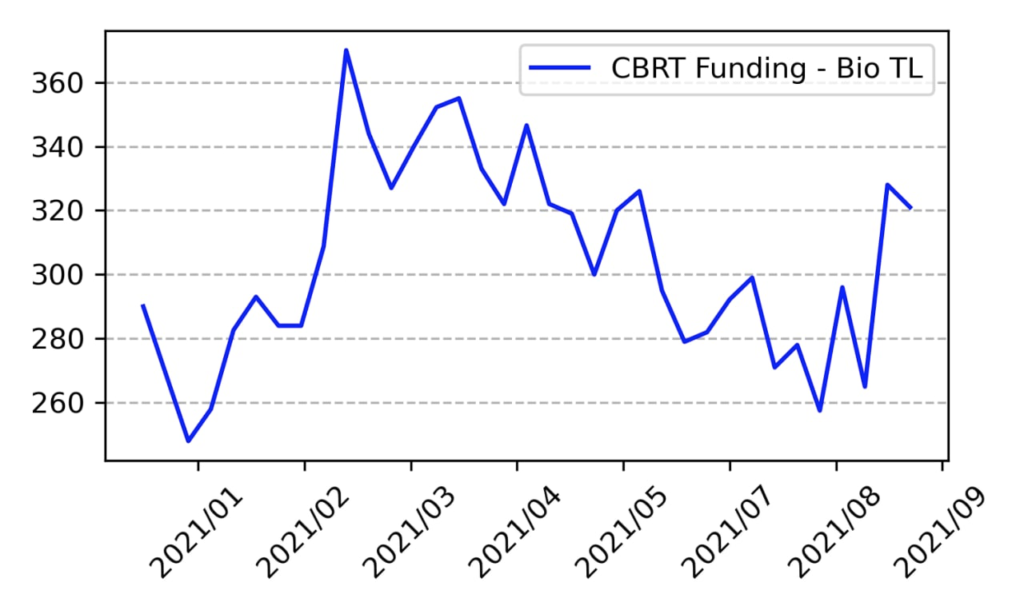

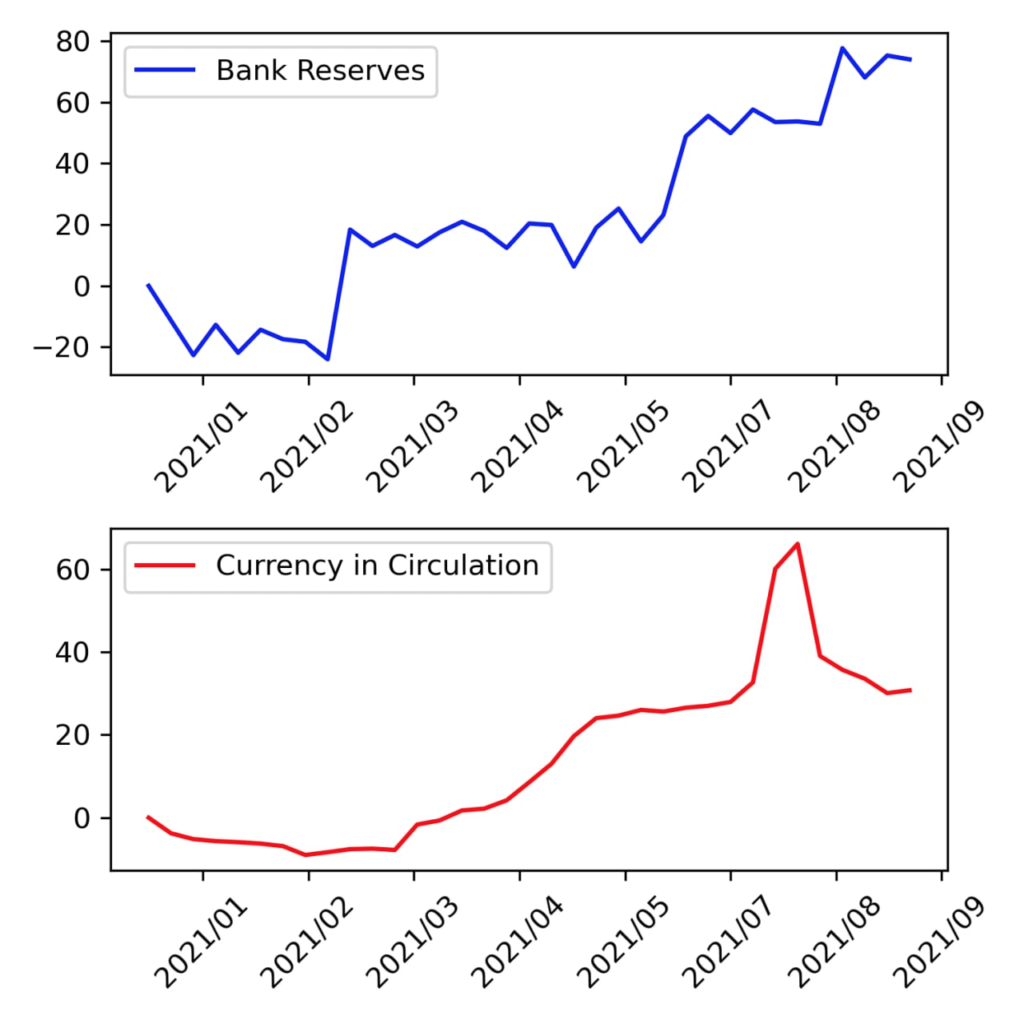

The funding need of the banking system has risen to 320 Billion Turkish Lira from 290 Billion Turkish Lira in 2021. Change in money base caused (Emission + Bank Reserves) increase in the funding need of the system by 104 Billion Turkish Lira. Especially this increase comes from the change in reserve requirements obligations of the banks. After substantial loan growth in 2020, Central Bank implemented normalization measures to curb the loan growth.

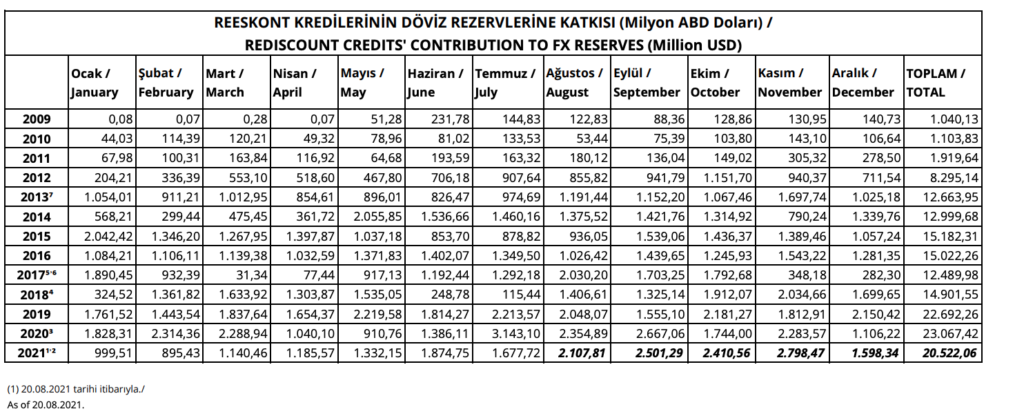

Central Bank lends TL loans to exporters via the acceptance of FX bills for rediscount. Repayments are made in hard currency which is the main channel to to increase central bank reserves. In order to find how much Central Bank of Turkey supplied liquidity to Turkish Banks under export rediscount loan programme which is one of the latgest factors affecting liquidty, we need to make a simple calculation. Central Bank of Turkey publishes outstanding loan receivables to Turkish Banks which is appr. 162 Billion Turkish Lira. The change in outstanding balance is around 23 Billion Turkish Liras. Meanwhile banks repaid total of 9.1 Billion USD loans which corresponds to 73 Billion Turkish Lira as of July 2021. So, total of 99 Billion Turkish Liras supplied to the banking system under rediscount loan programme.

Rest of the changes are mainly coming from autonomous factors that are volatile in nature. Since Turkey needs to continue accumulating foreign currency reserves, underlying trend is supplying permanent Turkish Lira liquidity to the banking system in the long run. For today, liquidity deficit in the banking system is mostly related to the bank reserves held at the central bank.