A puzzle in economics is a situation where the implication of theory is inconsistent with observed economic data. Whether exchange rates are linked to observable macroeconomic fundamentals has long been controversial in the literature and there is early evidence against such a link dating back to the work of Meese and Rogoff (1983), leading to the so-called “disconnect puzzle”.

Speculation in Currency Markets: Carry Traders

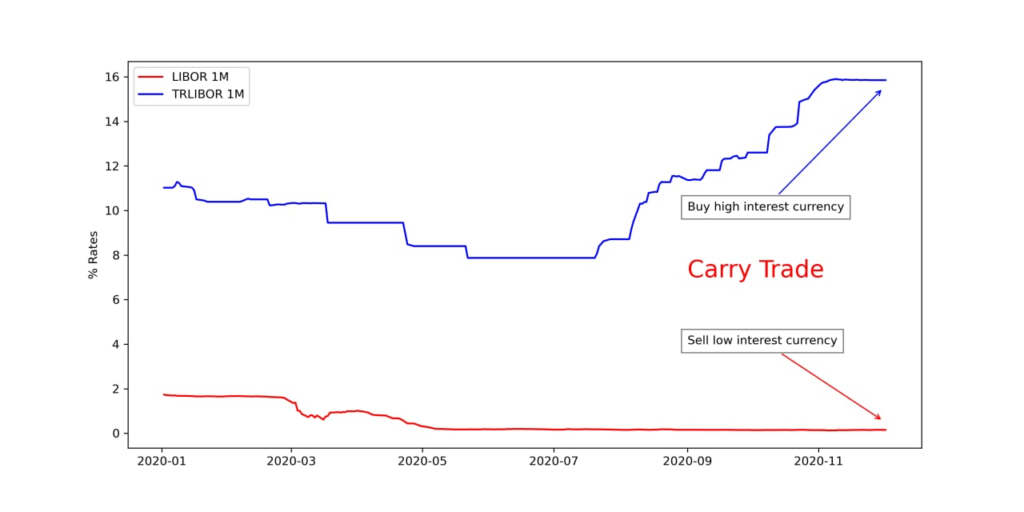

Another well know puzzle is called the forward premium puzzle. The forward premium anomaly in currency markets refers to the well documented empirical finding that the domestic currency appreciates when domestic nominal interest rates exceed foreign interest rates. Uncovered interest rate parity (UIP) condition states that high interest rate currency (target currency) will tend to depreciate against low interest rate currency (funding currency) at a rate equal to the interest differential so that expected returns are equalised in a given currency. Under UIP, any interest differential is offset by currency movements.

Carry trade on currencies is known to be a speculative bet against UIP. A currency carry trade consists in selling funding currency to fund the purchase of a target currency or in selling forward a currency that is at a significant forward premium.

Carry trade strategy is especially popular when global financial markets are upbeat. The riskiness of these positions is disregarded during these periods as risk aversion is low and the search for yield wins over prudence. Ideally, you get paid for doing nothing. Initially carry trades weaken the funding currency, because investors sell the funding currency by converting it to target currencies.

How to carry trade: FX Swaps

An FX swap agreement is a contract in which one party borrows one currency from, and simultaneously lends another to, the second party. Each party uses the repayment obligation to its counterparty as collateral and the amount of repayment is fixed at the FX forward rate as of the start of the contract. Thus, FX swaps can be viewed as FX risk-free collateralised borrowing/lending. The chart below illustrates the fund flows involved in a euro/US dollar swap as an example.

At the start of the contract, A borrows X·S USD from, and lends X EUR to, B, where S is the FX spot rate. When the contract expires, A returns X·F USD to B, and B returns X EUR to A, where F is the FX forward rate as of the start.

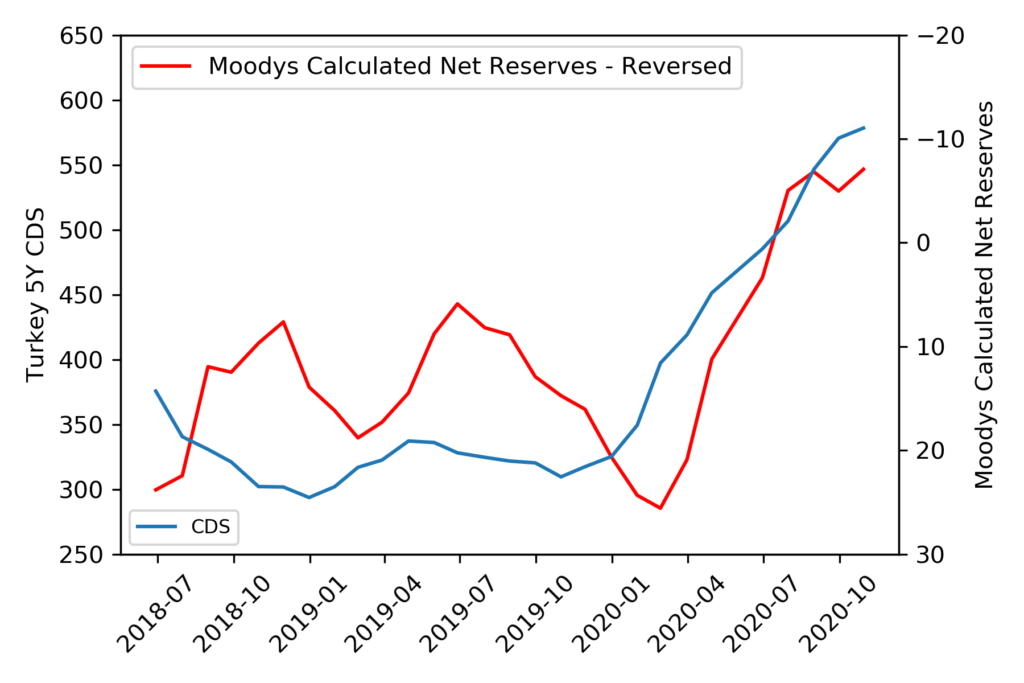

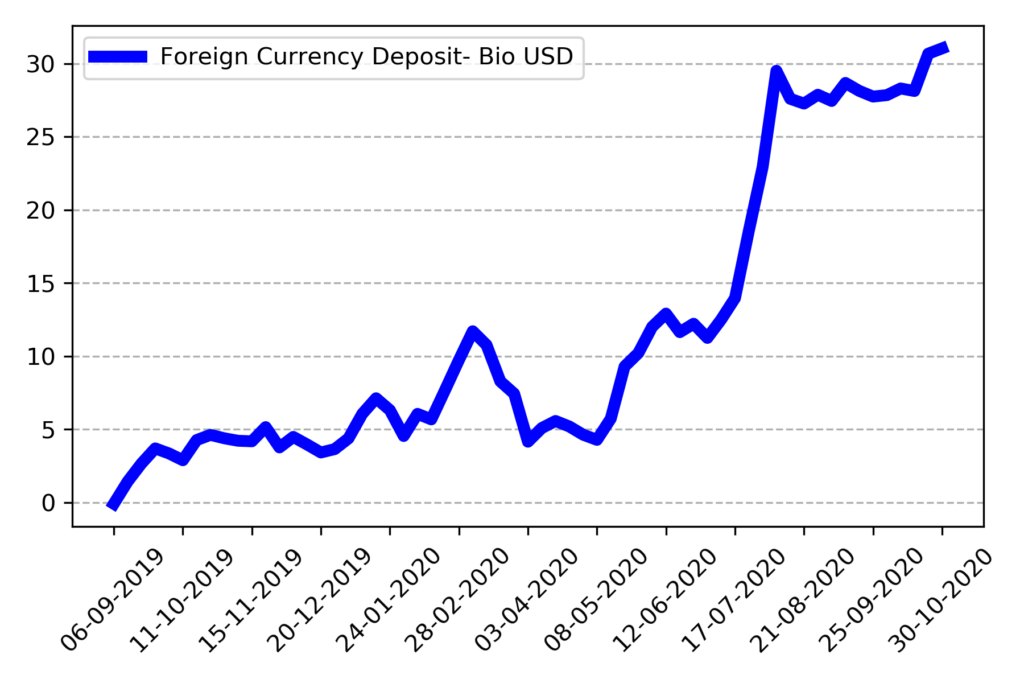

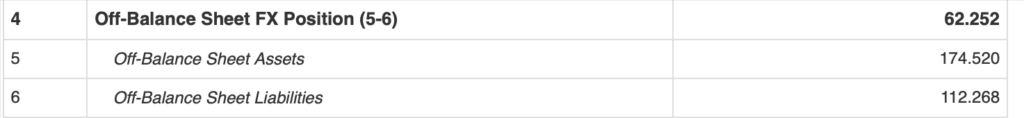

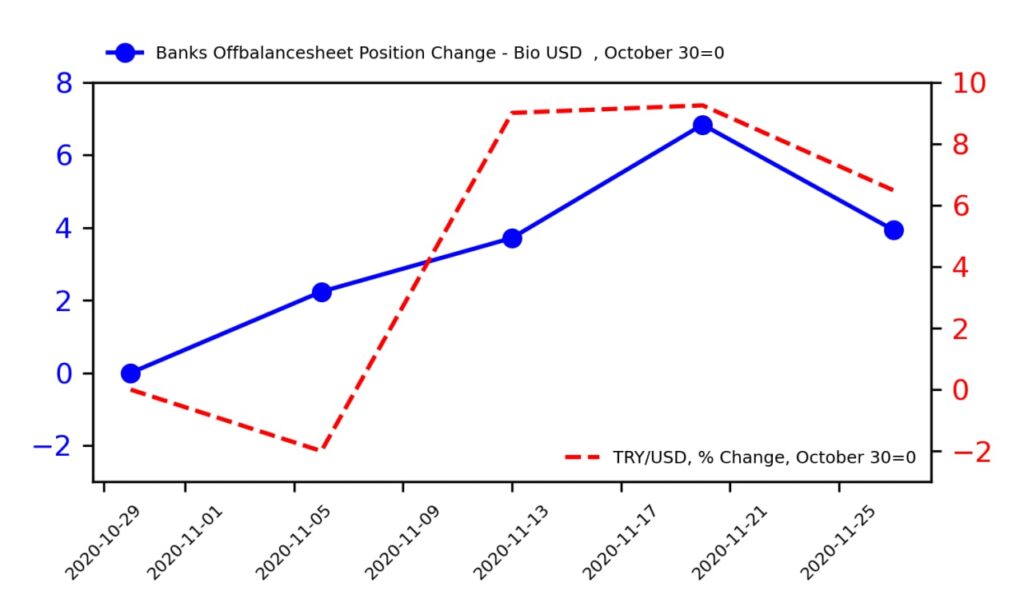

Turkey’s banking watchdog publishes weekly foreign exchange position of Turkish banks. Forward leg of foreign exchange transactions are reported as “off-balance sheet assets” of Turkish banks.

According to economists, foreign investor appetite for the Turkish Lira carry-trades has revived thanks to the return of the Central Bank to orthodox monetary policy, the relatively high interest rates, and the reversal of some regulatory steps. Turkish Lira appreciated by 8% in the last month.

One big problem with carry trades is that they become self-fulfilling. The carry trade is built gradually and initially seems to be very successful as the establishment of positions will tend to encourage the target currency to appreciate relative to the funding currency. However, the more of these positions that have been put in place, the greater the risk of a reversal when they are unwound. The unwinding is often dramatic as everyone tries to exit the trade at the same time.