Global Monetary Conditions to Tighten

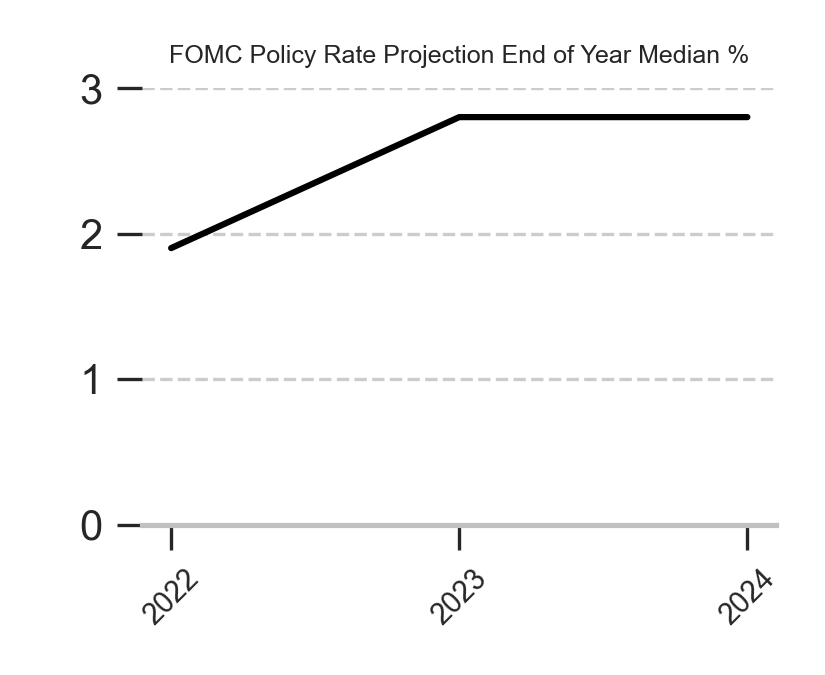

Global inflationary pressures have taken the central stage in recent months. Although at one point FED officials argued otherwise, according to New York FED economists US inflation is acknowledged to be a broad based phenomenon. Global commodity prices skyrocketed and show no sign of return in the near future. FED already started to communicate faster and bigger rate hikes. Policy normalization will include quantitative tightening. The Fed’s asset holdings — mostly Treasuries and mortgage bonds backed by government agencies — more than doubled during the pandemic, to about $8.9 trillion from $4.2 trillion. In the March meeting, the minutes of which were released in April, Fed officials discussed shrinking the balance sheet at a maximum monthly pace of $60 billion in Treasuries and $35 billion in mortgage-backed securities — in line with market expectations and nearly double the peak rate of $50 billion a month the last time the Fed trimmed its balance sheet from 2017 to 2019. When global monetary conditions tighten investors lose their appetite for risky assets.

Growth Rebalancing with Unsustainable Dynamics in Charge

Consumer confidence indicators provide an indication of future developments of households’ consumption and saving, based upon answers regarding their expected financial situation, their sentiment about the general economic situation, unemployment and capability of savings. Turkish consumer confidence indicator hovers at multi year lows. On the other hand exporters continue to enjoy favorable conditions. As a result rebalancing in growth continues. This rebalancing trajectory is threatened by unsustainable dynamics in charge: managed floating foreign currency regime and negative real rates in Turkey.

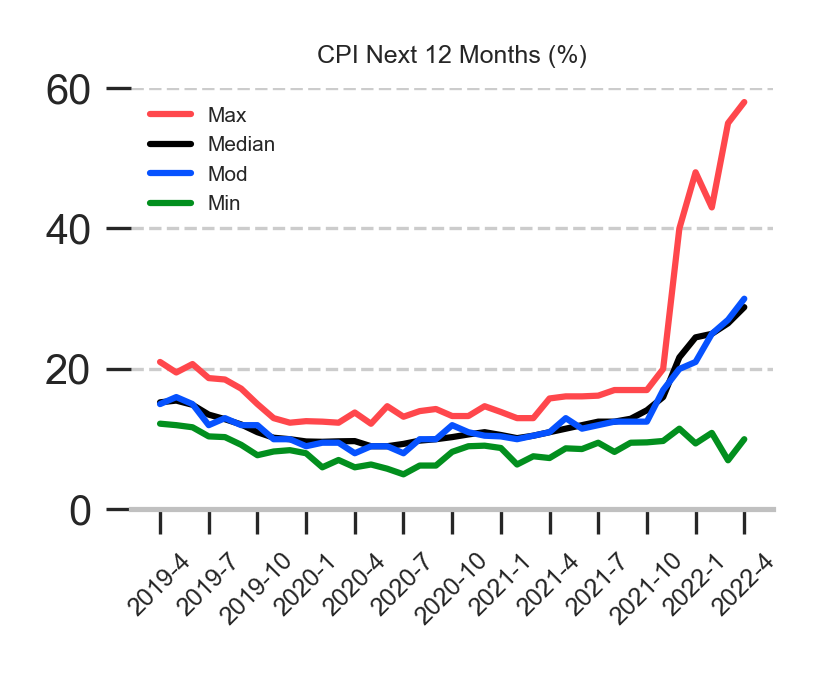

Negative real rate environment in Turkey is the main driver of new money demand under unachored inflation expectations. Market participants expect inflation to stay at elevated levels according to survey data. Annualized three month average inflation reached 100 percent which signals for worse to come.

Economic agents demand for new money if they expect higher inflation. According to Richard Cantillon, the beneficiaries from the expansion of the money supply are the first recipients of the new money. As new money is created by banks, those who have the best access to bank credit benefit the most. If real rates are in deep negative like Turkey, it is not a suprise to see huge money demand. Annualized four week Turkish lira loan growth will eventually destabilize an unstable economy.

How to Finance Current Account Deficit?

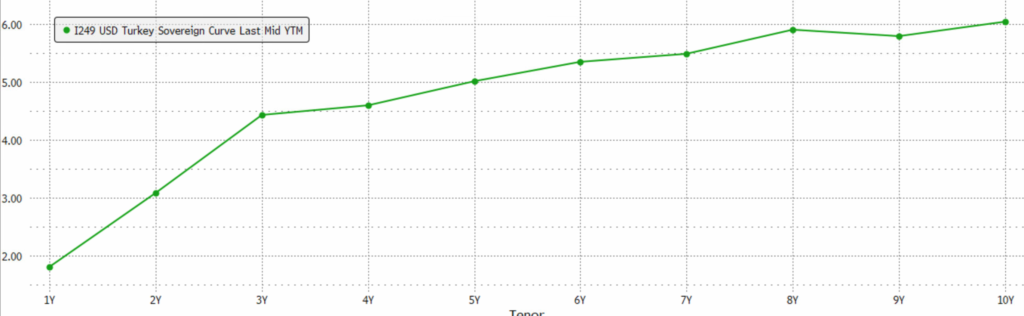

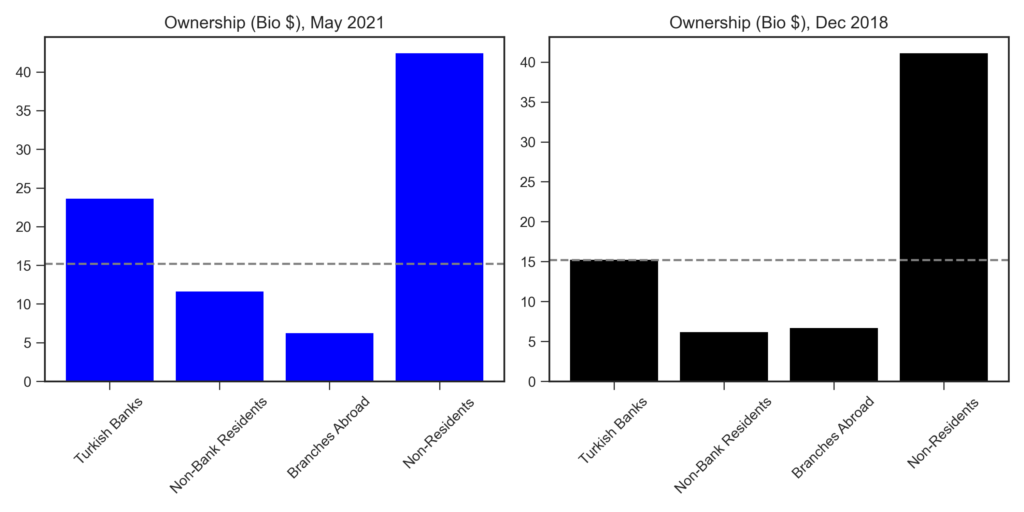

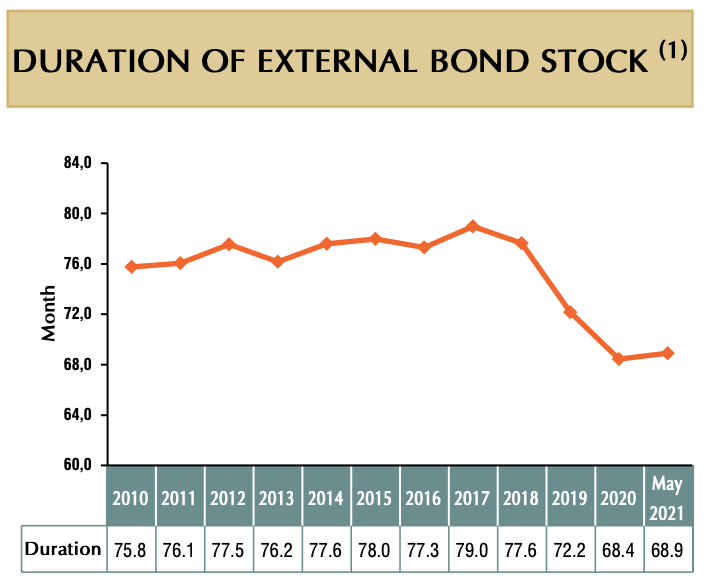

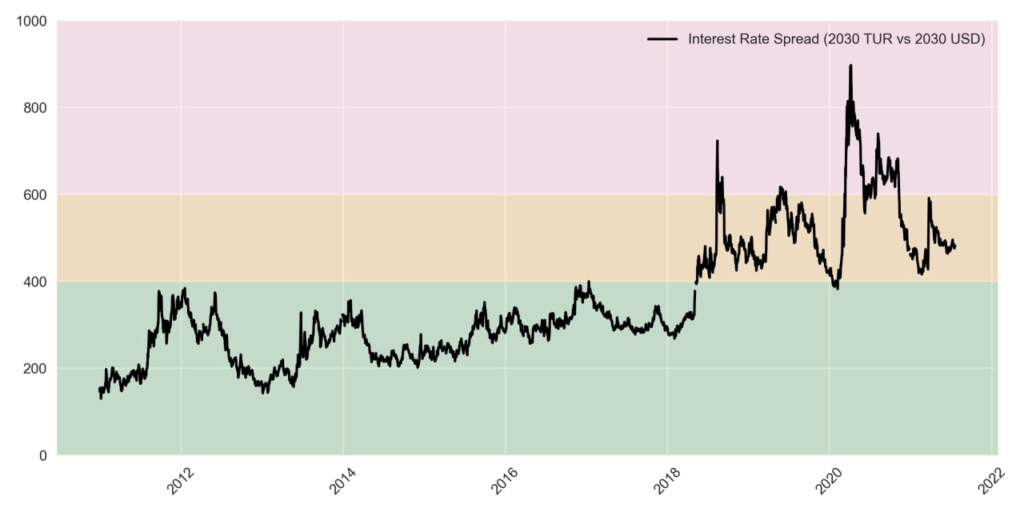

It is obvious in Turkey’s case that negative real rates and accelerated loan growth become a poisonous mix for the external balance. Domestic economic agents prefer to purchase foreign currency linked assets in a front loaded fashion amid uncertainty in global prices. Turkey finances current account deficit in 2 ways: first, absorbing banking system’s foreign currency liquidity and second, borrowing from international capital markets. Foreign debtors are not willing to accept Turkish risk despite high risk premium offered by the markets. Given the latest development in US, also it is going to be very costly to borrow from international markets under current macroeconomic policy framework. On the other hand Central Bank of Turkey already utilized 40 Billion USD from local banks in the form of swap arrangement. Recently, Central bank introduced foreign currency deposit guarantee scheme to continue financing current account deficit with banking system’s liquidity. In summer period,there will be some relief with income from tourism sector to current account, but Turkey needs to tackle with external balance at the soonest possible.