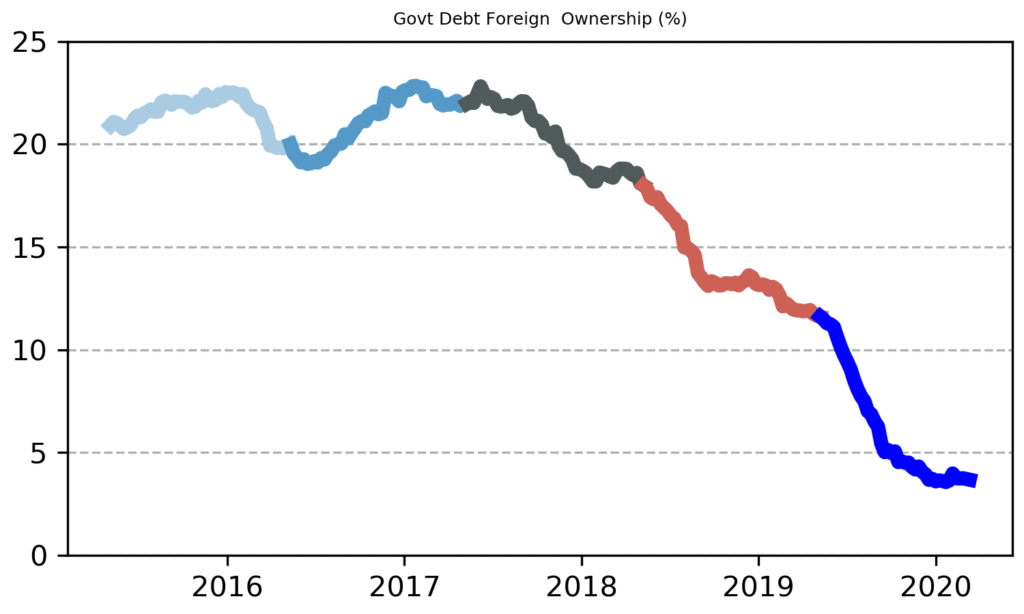

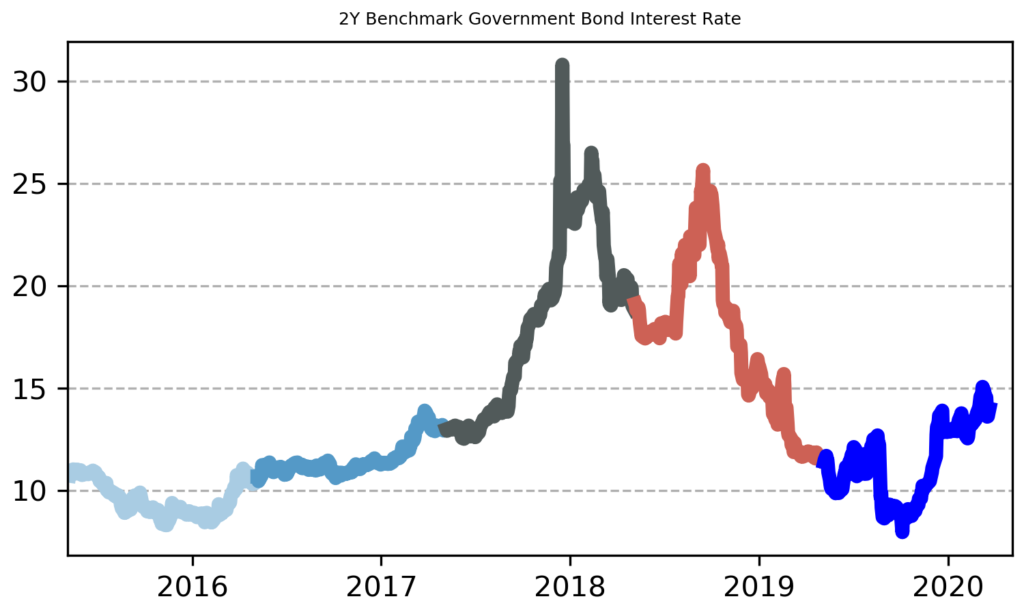

Narrative and perception outweigh reality in financial markets. The overstated role of foreign portfolio investors for the local currency bond markets is a good example. Turkey’s recent experience shows that lower yields are possible even without active participation of foreign portfolio investors. On the contrary, benefits of portfolio inflows may well exceed the costs during adverse developments. Such as sharp outflow of the foreign portfolio investments caused disruption in bond markets in 2013 and 2018 due to lack of sufficient market liquidity and one-way trading.

Foreign ownership in government debt securities is at its historical low. Since the trend is so obvious, it easier to analyze how yields reacted to this dramatic change.

Literature on the role of foreign portfolio investments in helping lower bond yields is vast and comprehensive. Obviously, bond investors earned the reputation to be smart money managers as well. So, interaction with bond investors is very valuable. This does not necessarily mean that without foreigners it is not possible to achieve lower yields.

There are two different regimes between 2017 – 2018 (1) and 2019- 2020 (2). In the first (1) period foreigners are more active in the bond markets and yields went up and in the second (2) period foreigners are less active and yield went down. It is observed that yields reflected macroeconomic developments as expected in all times. In the first period higher inflation expectations and higher short term rates priced in the higher yields, and in the second period lower inflation expectations and lower short term rates priced in lower yields.

So, economic policy makers should better focus on formulating the right decisions to fulfill their mandates. Consistent and transparent communication is important to manage expectations of all types of investors. It is the macroeconomic results that will attract long term investors at the end.