All prices are driven by expectations. Depending on the financial architecture, it is easier to analyze how expectations realized in the cash accounts of market participants. This kind of exercise is only possible in analyzing demand and supply in the cash foreign exchange markets. Otherwise derivatives volume in fx markets far exceed the cash volume.

Why do we need to analyze cash accounts? Basically, following the gold standard and several experiments on fixed exchange rates, it is common that name of the new financial order is floating exchange rates regime. On the other hand, this is not the case at all times. Especially fear of floating is very common in emerging markets. Given the side effects of disorderly movements in the exchange rates, it is inevitable for the analysts to detect the underlying cause of the movement and act accordingly. So, this kind of exercise to understand demand and supply conditions in cash markets is important.

In this exercise, we will try to calculate demand and supply for foreign currency in the last 12 months using Turkey’s balance of payments data and financial accounts. Here are the items that we will take into account:

– Current Account

– Debt Service

– Portfolio Flows

– Currency substitution & hedging

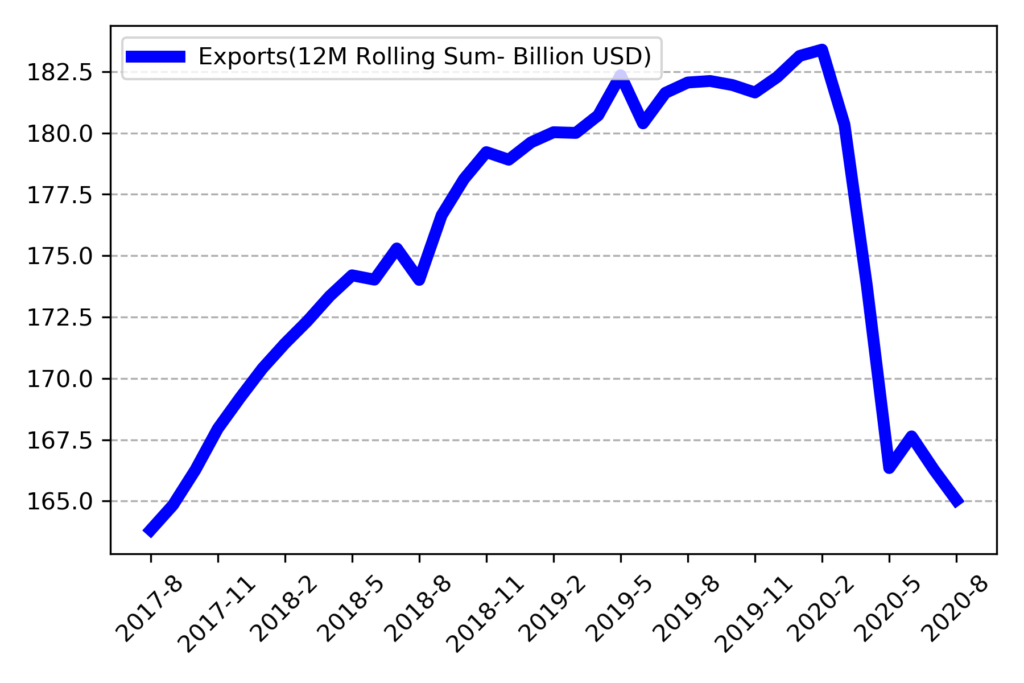

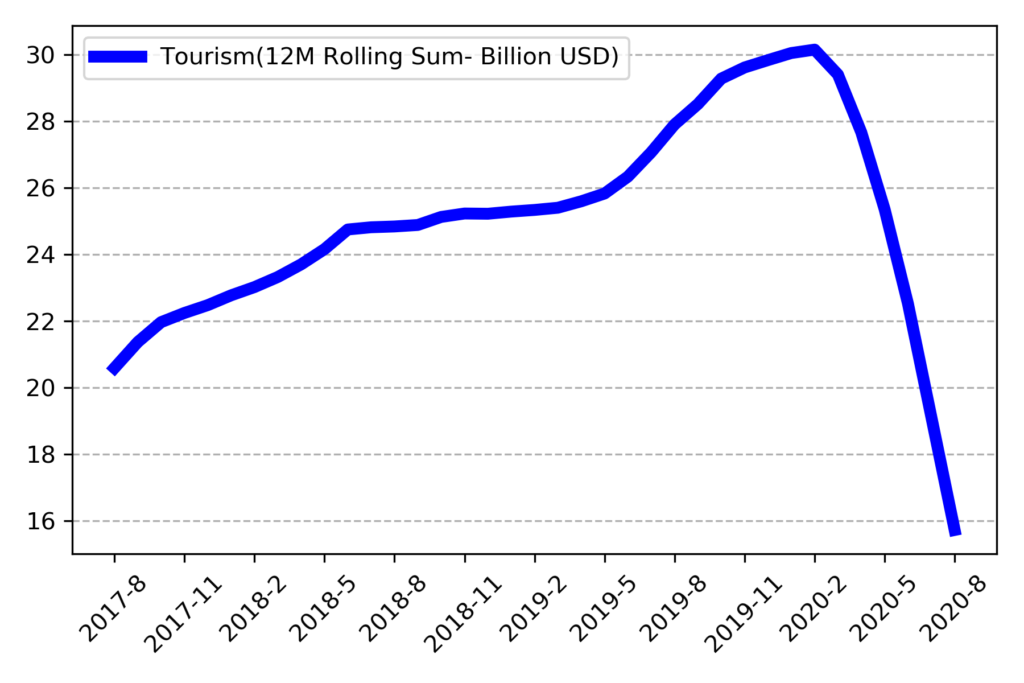

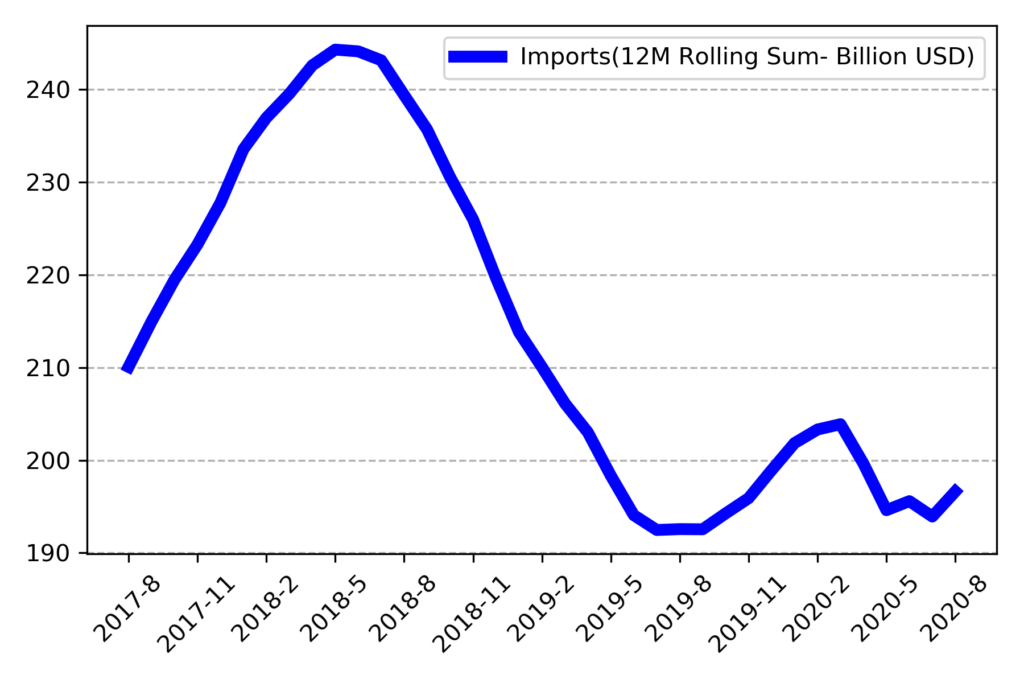

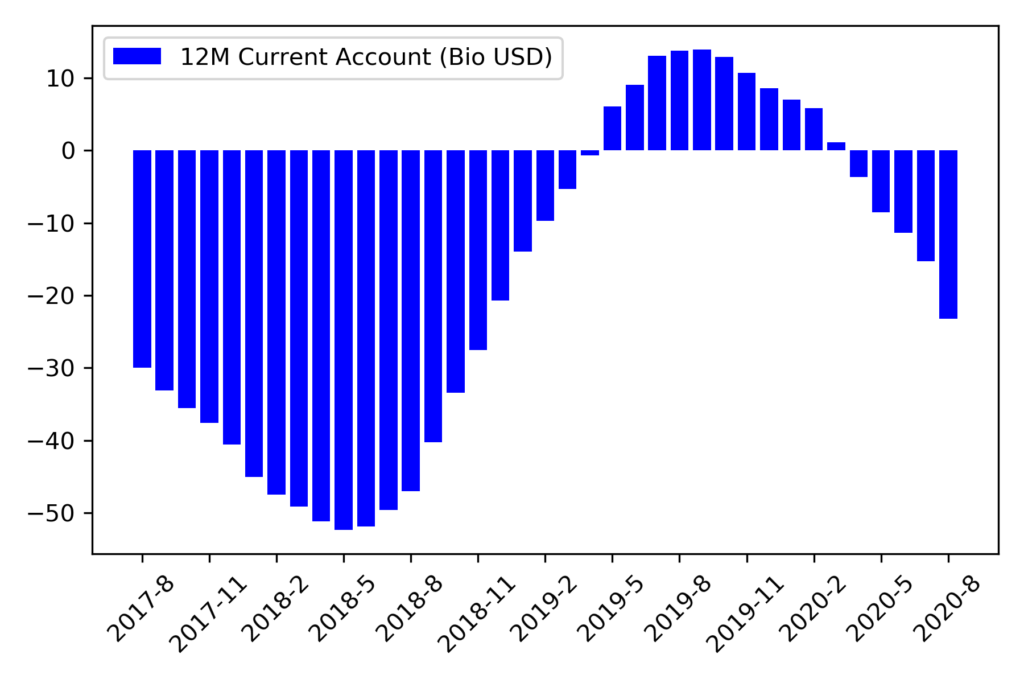

1) Exports, tourism revenues and imports are major components of balance of payments. Understanding the underlying trend in these items will also help us to project the future supply & demand conditions as well. 12 month sum of monthly current account deficit makes around 23 Billion USD. Deterioration in the current account balance is remarkable in the last 12 months. The impact of global pandemic on exports and tourism revenues mostly explain the widening gap in current account. On the other hand imports remain strong which need to be addressed with domestic financial conditions.

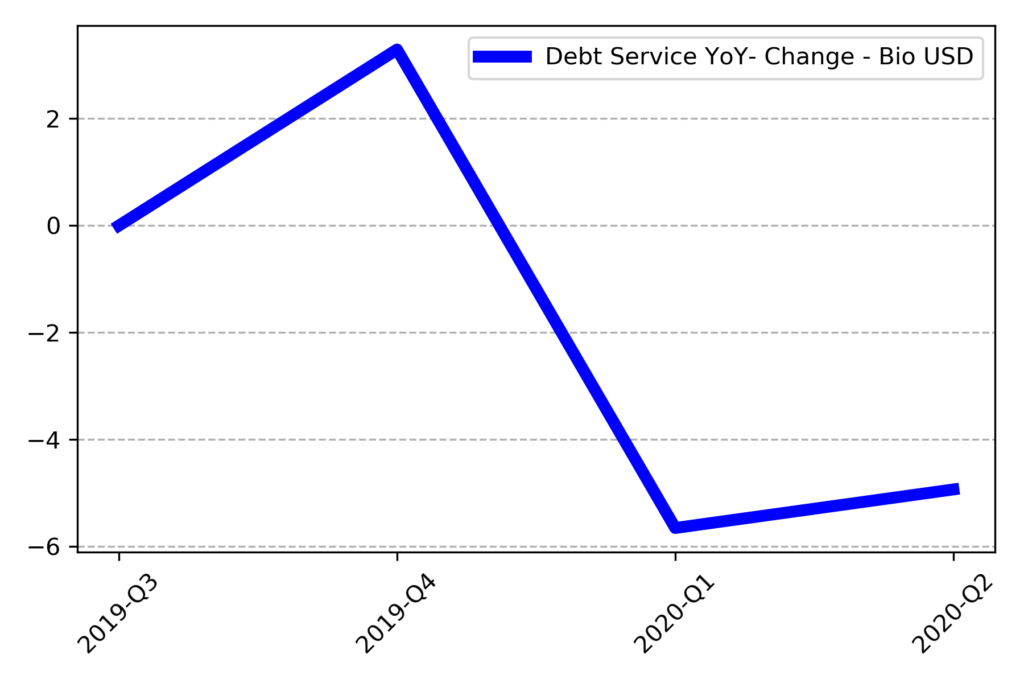

2) Literature of financial crises in emerging economies discuss the motivation and possible risks of foreign currency debt. Turkey accumulated foreign currency debt like other emerging economies. Deleveraging of the foreign currency debt is one of the channels for foreign currency demand. In this exercise we will use year on year change in Turkey’s net international investment position. Outstanding liability from international markets decreased by 5 Billion USD in the past year.

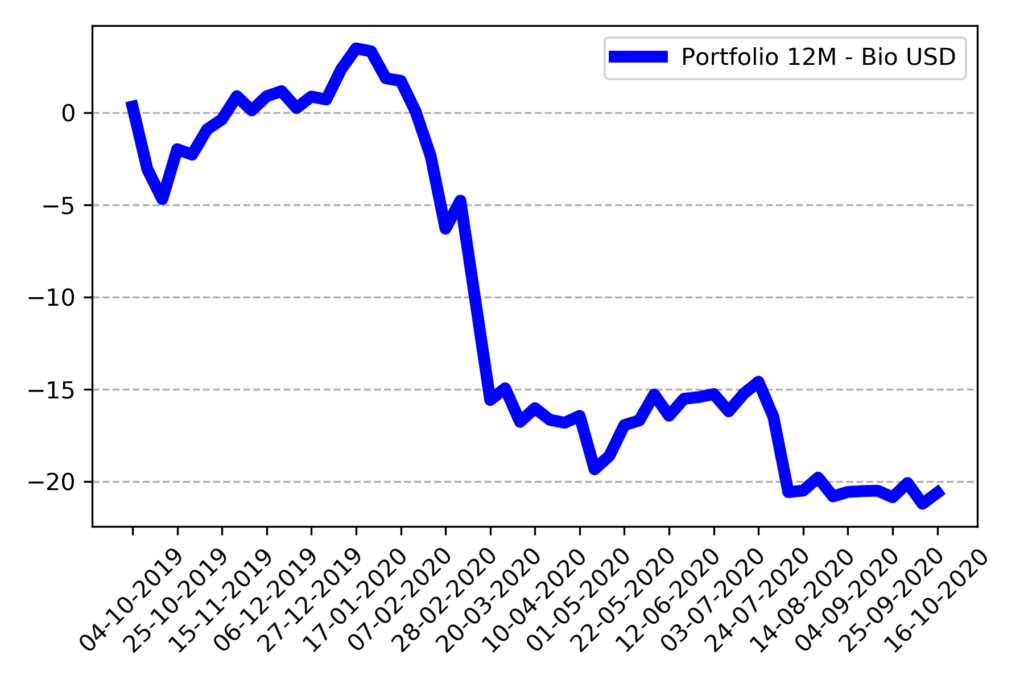

3) After the global financial crisis with quantitative easing policies, Turkey also enjoyed portfolio inflows into Turkish assets. This trend changed right after FED announced tapering in 2013. Portfolio outflows deepened during pandemic and outflows reached 20 Billion USD in the past 12 months.

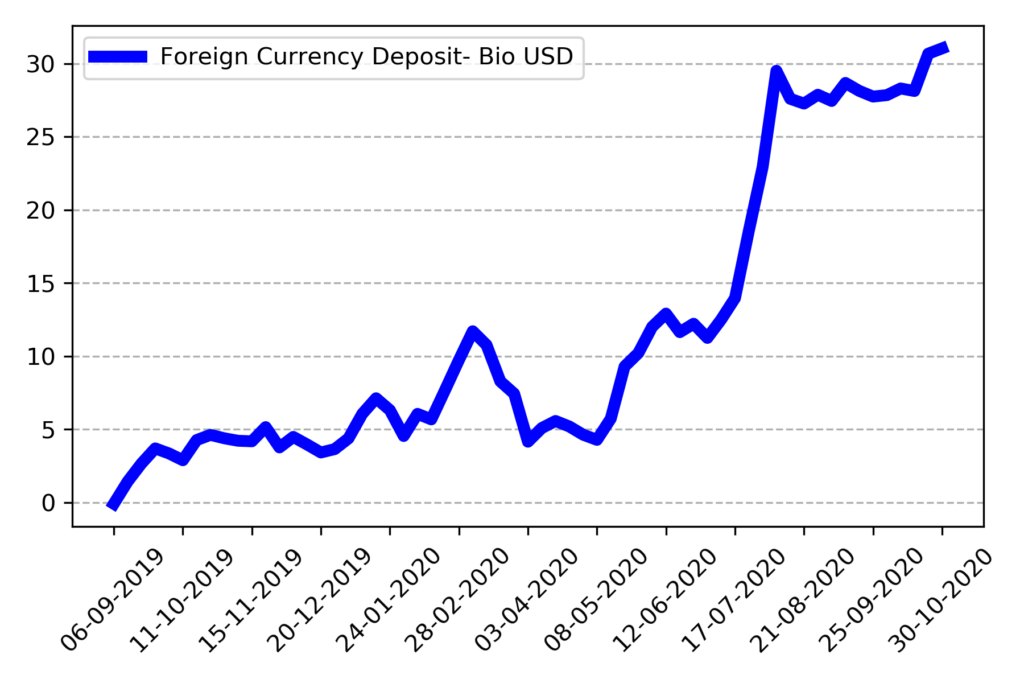

4) Currency substitution is just another term used for deposit dollarization. Given the open position of the corporate sector in Turkey, dollarization goes hand in hand with front loaded hedging. For the sake of simplicity we will use change in the outstanding foreign currency deposits in banks in Turkey. In the past 12 months foreign currency deposits increased by 31 Billion USD.

In this analysis, we summed up major items that are directly or indirectly related to demand and supply conditions in fx markets. Total net demand reached 80 billion USD in the past 12 months. This simplified calculation is in line with the change in the net position of the central bank international foreign exchange reserves.