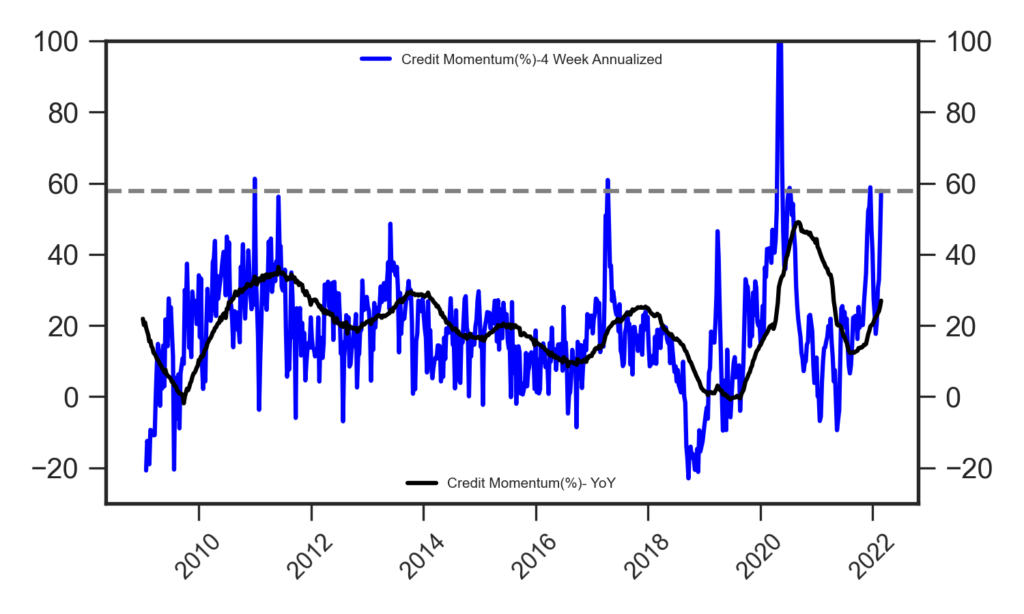

I am lecturing at universities on practical aspect of economic policy making rather than ideas and theories. One of the topics I cover is the central bank balance sheet. Turkish central bank’s balance sheet is one of the most transparent one can find. Inflation targeting regime reduced the importance of monetary aggregates to some extent. Under inflation targeting regime, monetary policy implementation means controlling short term interest rates. Having reached the zero lower bound, central banks of the advanced economies used balance sheets to continue expansionary monetary policy. These operations inflated the balance sheet of central banks and resulted in appreciation of the value of assets purchased. So, analysis on central bank balance sheet’s quantities have become very crucial to understand the mindset of policy makers and possible implications on markets.

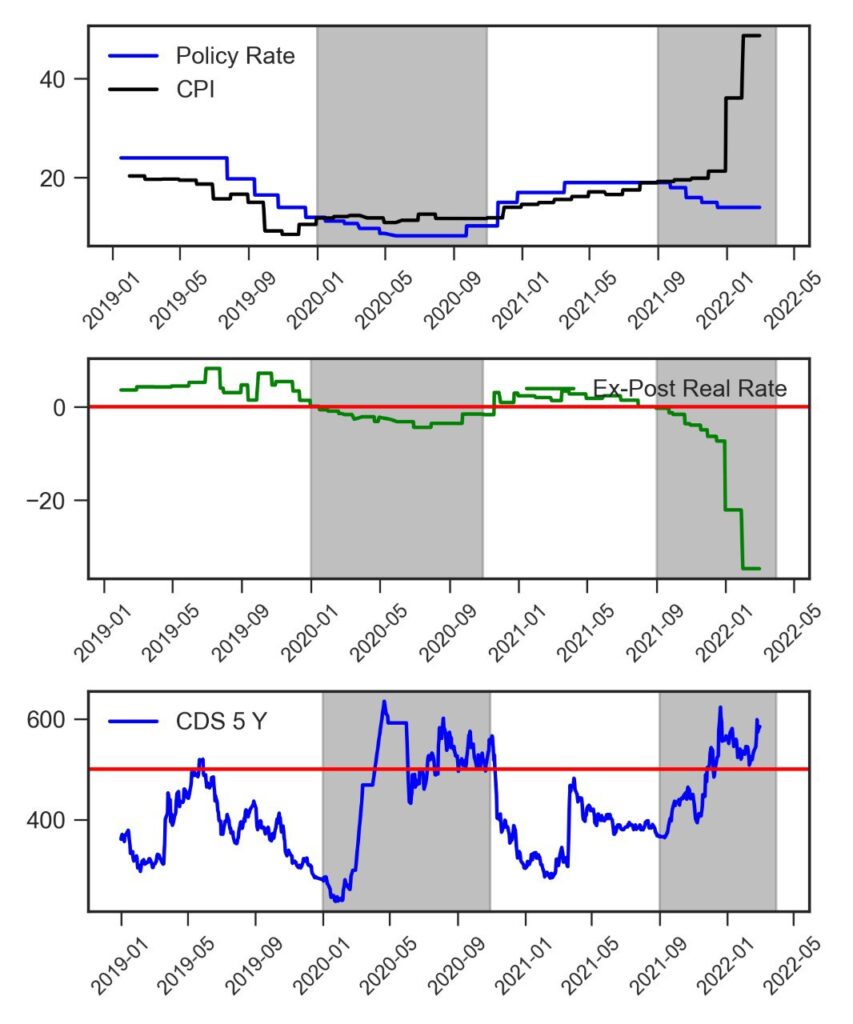

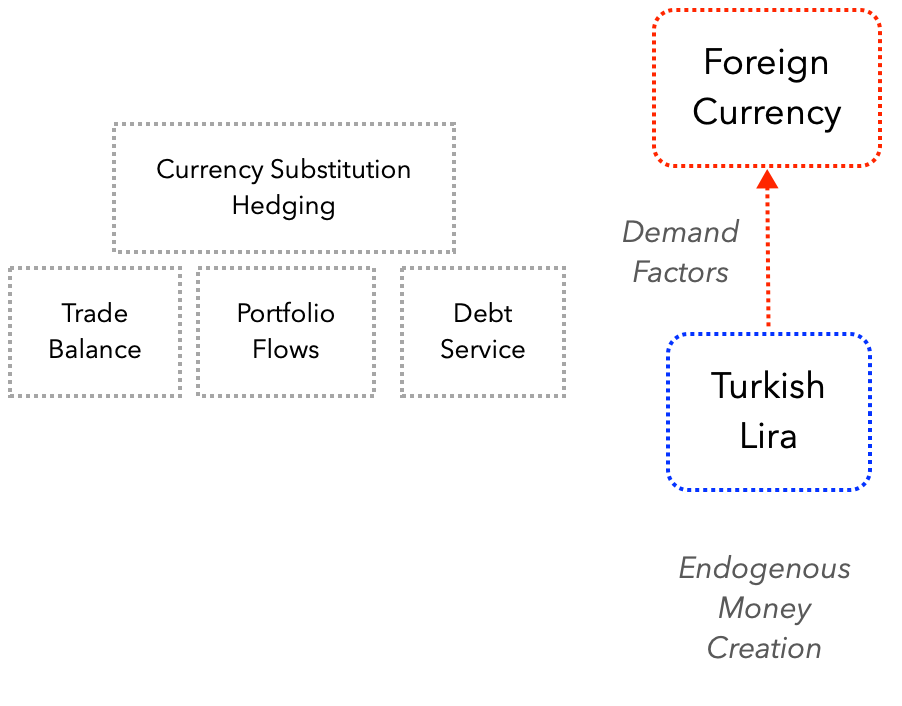

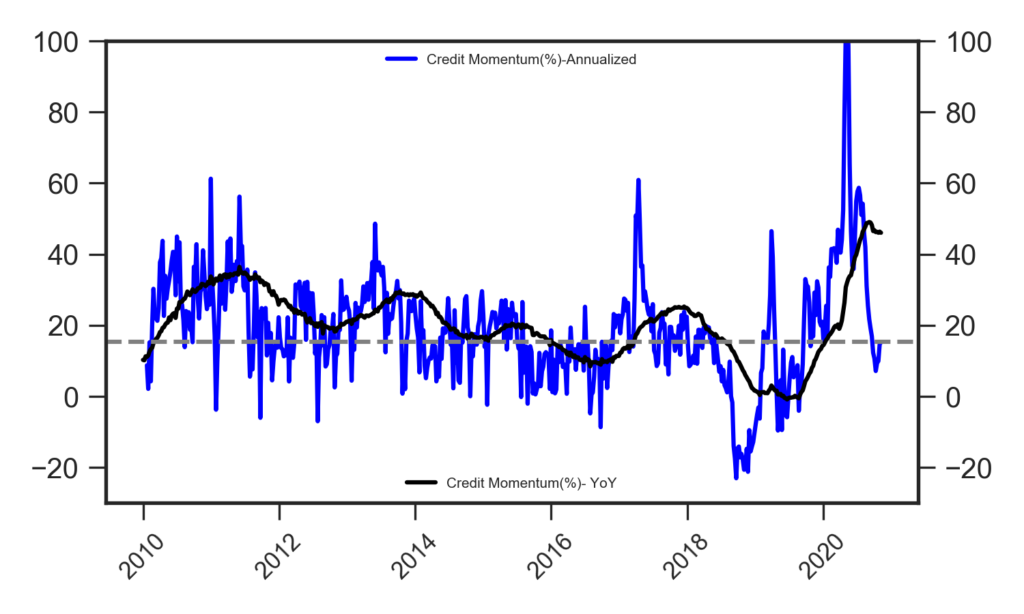

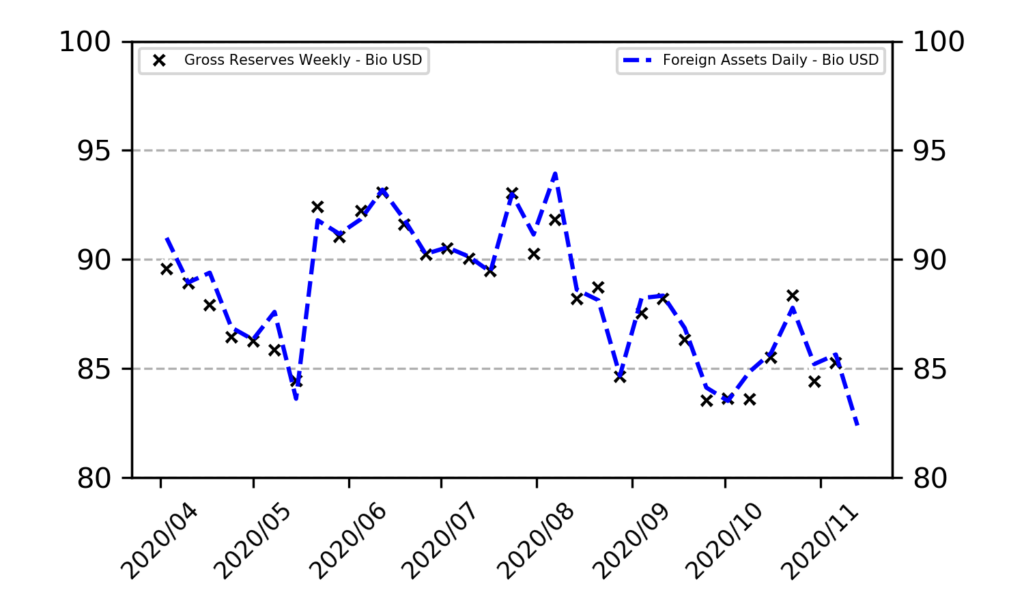

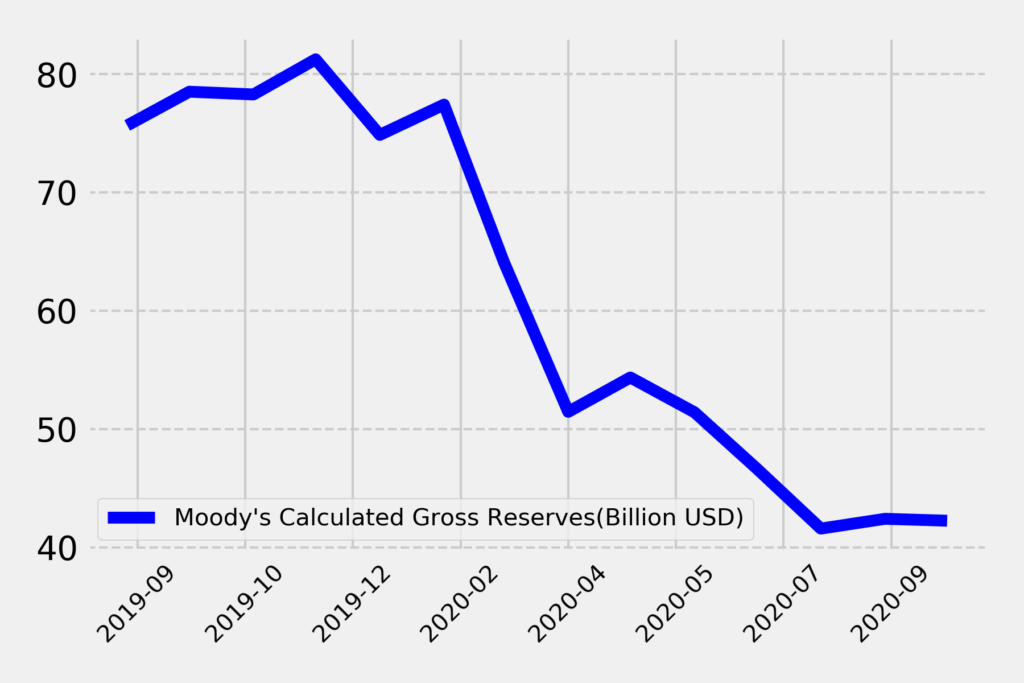

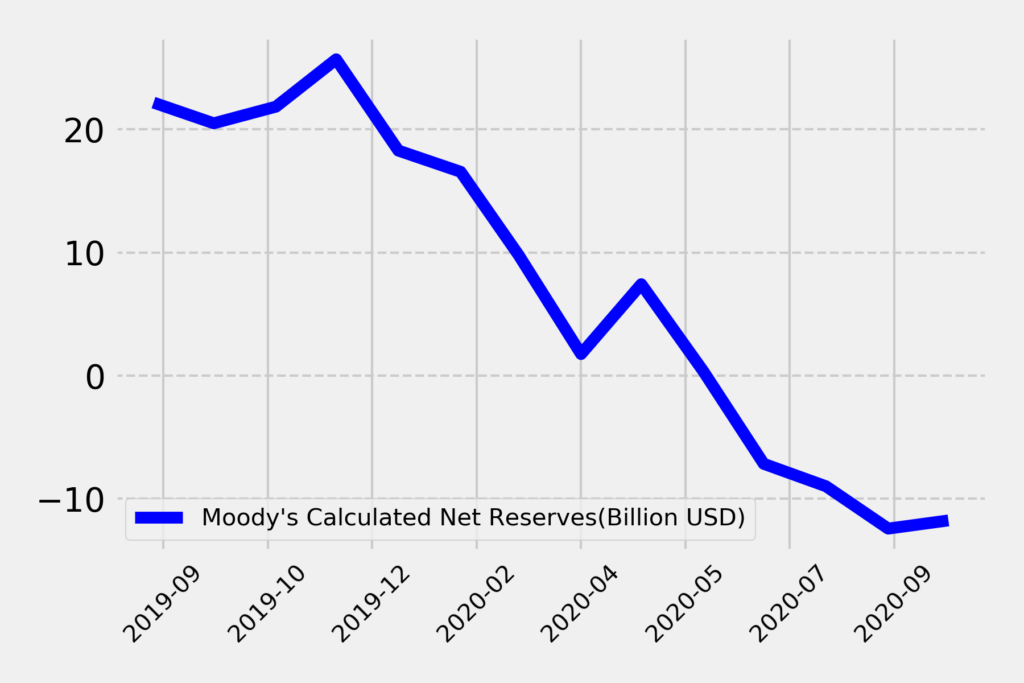

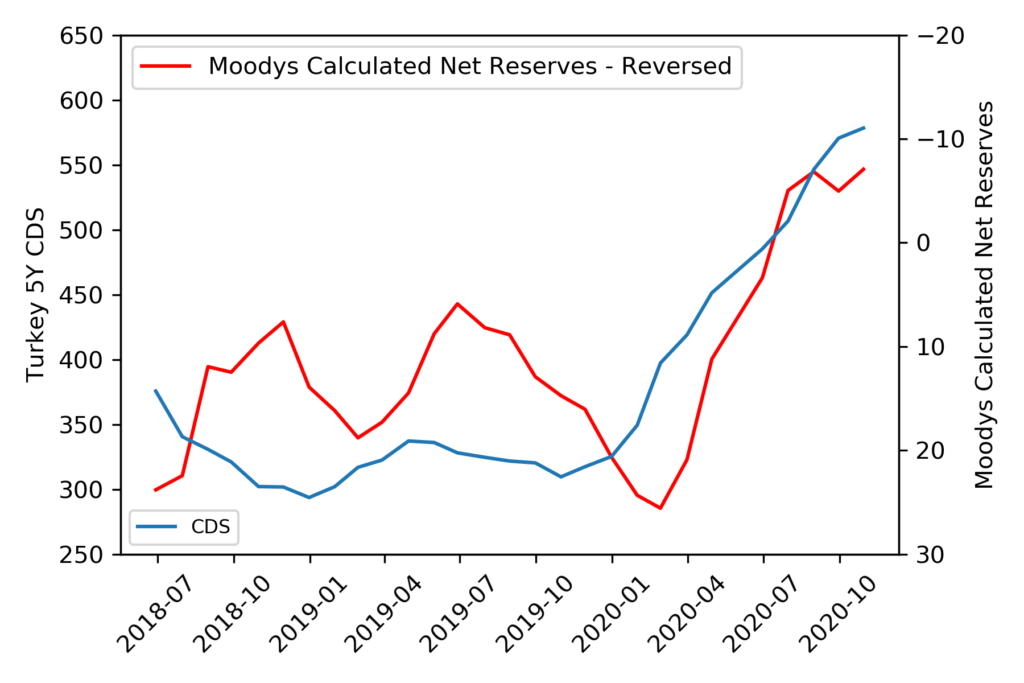

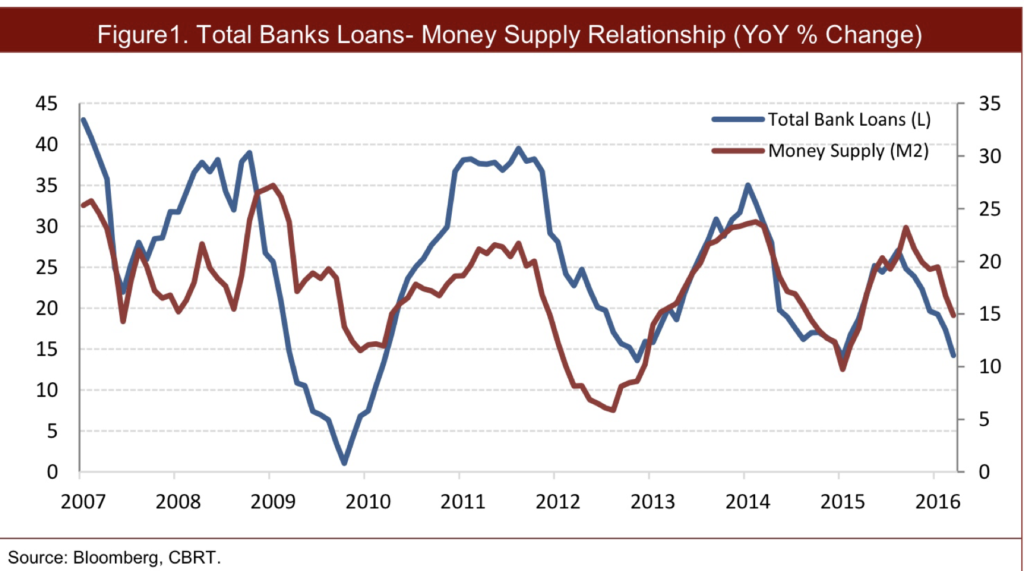

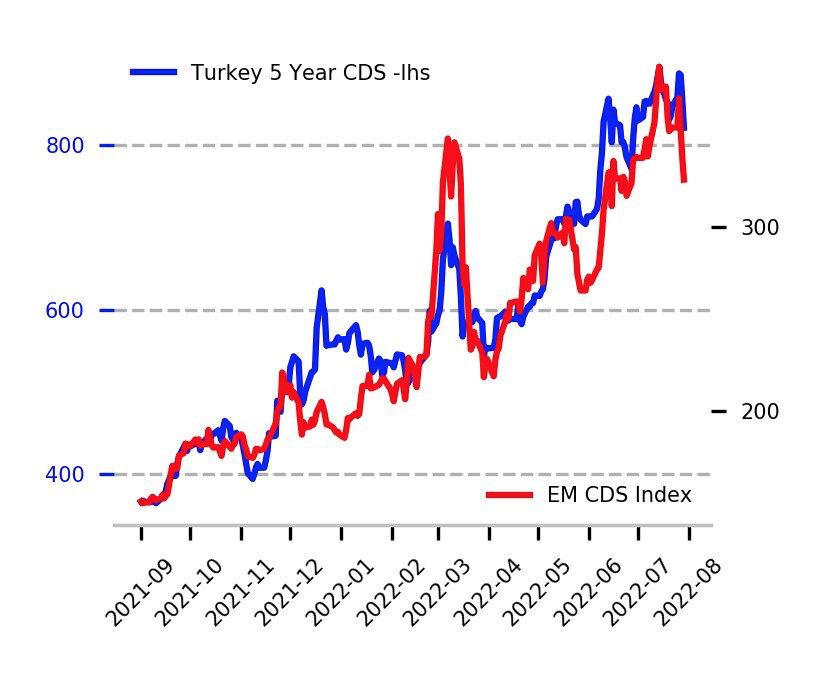

Meanwhile, central banks of emerging markets also expanded their balance sheets via accumulating international reserves, thanks to favorable global liquidity conditions. Turkish central bank is also one of them. Having accumulated large amounts of foreign debt, Turkiye has become more vulnerable to common global factor. Recent developments in foreign currency position of Turkish central bank makes investors nervous as it is observed in higher hard currency borrowing costs. High frequency data suggests deteoriating foreign currency position is main driver behind the higher sovereign risk.

No Standards for Analytical Representation

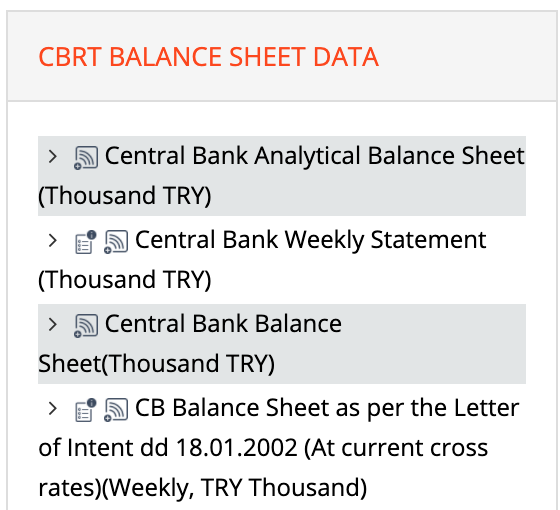

Central bank balance sheet is a result of all transactions conducted by the central bank with the rest of the world. They are usually displayed in various publications: annual reports, weekly bulletins, daily summary tables. The format and the accounting practices for analytical representation are not homogenous which is to say international standards are absent.

There are three different versions of central bank analytical balance sheet on electronic data dissemination system. They are organized to provide summary representation of main balance sheet items. These versions have daily, weekly and monthly frequency.

One of the versions of balance sheet published is prepared as per the letter of intent dated 18.01.2002. This version of the balance sheet is a result of a document which describes the policies that Turkiye intended to implement in the context of its request for financial support from the IMF.

In this part, central bank balance sheet analysis will be conducted with respect to its relevance to the monetary policy. There will be categorization into three and sub components will be discussed according to the size of balance sheet items.

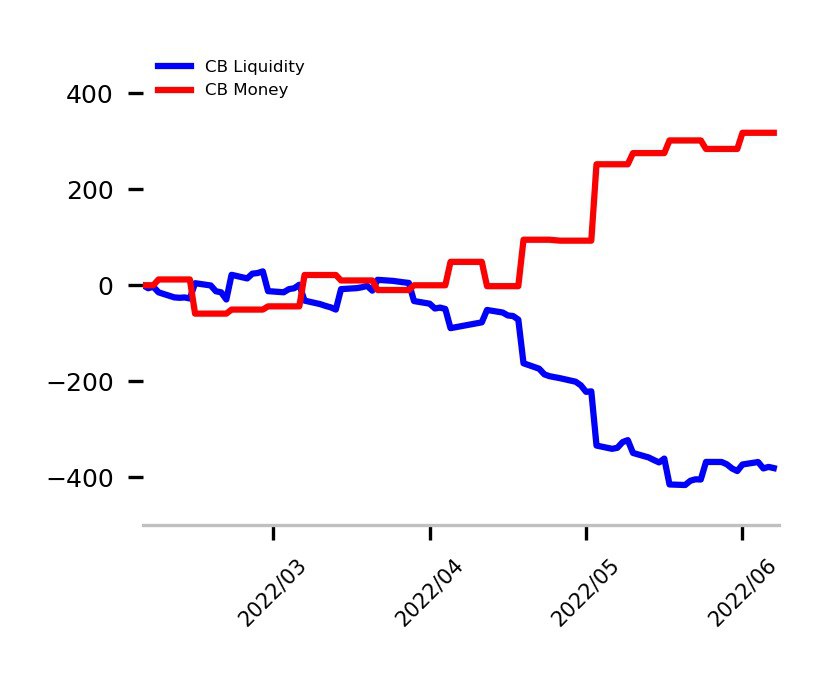

Repeat After Me: Central Bank Money is the Cause and Central Bank Liquidity is the Result

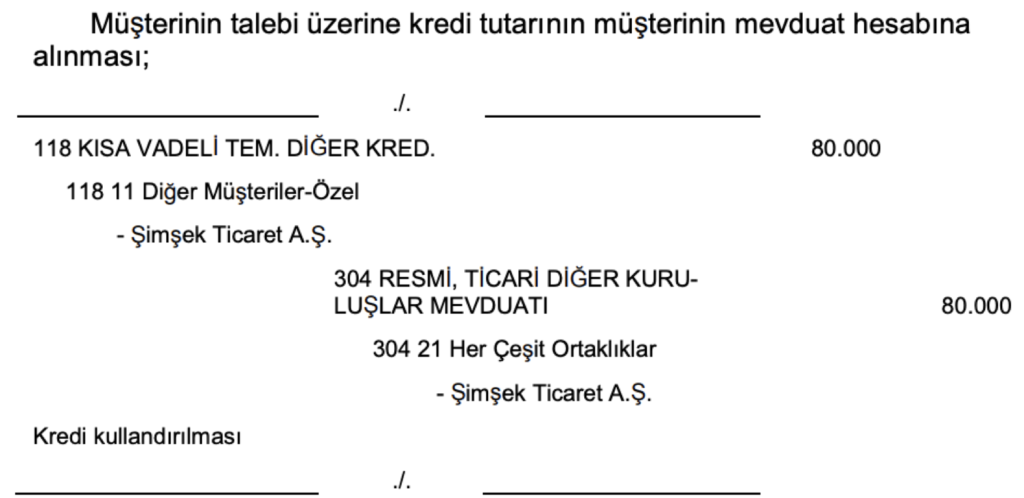

Let’s start with Central Bank money. The liabilities of the central bank like any other credit institution is a form of money. The economy requires central bank money because it is the ultimate means of payment, carrying no credit risk; and the banking system intermediates between the central bank and the rest of the economy in obtaining the required liquidity.

Central bank banknotes are easy to understand what central bank money looks like. Banknotes are liabilities of the central bank and whenever deposit holders of the banks demand for banknotes, it is satisfied. Turkish Lira bank notes are printed at a factory owned by the central bank. Since central bank is a joint stock company, this liability is no different than unsecured debt since banknotes are not securities.

Second largest item is banks deposits. Banks deposits are result of the central bank’s required reserves policy. This policy aims to provide reasonable assurance to deposit holders in case of a sudden deposit withdrawals and required by central bank law. Central bank continue to use required reserves as macro prudential policy as one of the main tools of financial stability.

Third largest item is the balance of treasury at the central bank. Central bank is the bank of the Treasury, tax collections and other incomes are transferred to the Treasury accounts at the central bank.

When there is an increase in demand for central bank money (tickers: TP.AB.N01, TP.AB.N21), central bank is the provider of it (tickers: TP.AB.N26 and Turkish Lira provided via offbalance sheet swap transactions ).Below is a simple illustration of how central bank money and liquidity interact with each other.

Deteoriating Foreign Currency Position

One of the jobs of the central bank is to manage foreign currency liquidity. Main principle in managing foreign currency liquidity is capital preservation. This principle also requires taking limited liquidity risk. Assets in the portfolio are expected to have solid funding liquidity. That would also mean that markets of those assets need to be liquid.

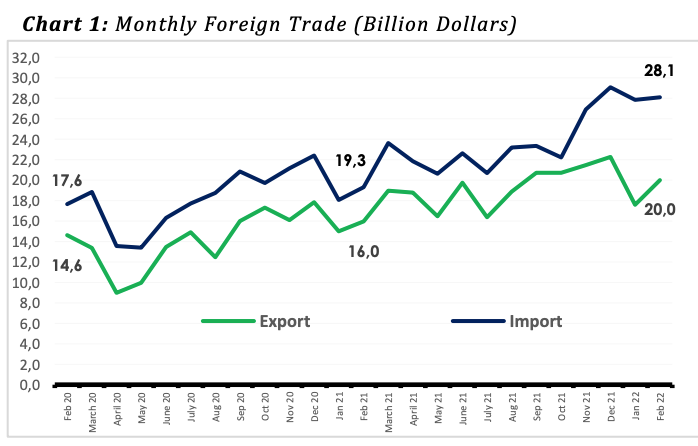

Most of the central banks of the emerging market economies construct a portfolio of assets that will give assurance to investors that short term liabilities will be met under extreme financial stress . There are ratios that are used to analyze the level of foreign currency liquidity. One of the famous adequacy ratio is the Guidotti–Greenspan rule. The Guidotti–Greenspan rule states that a country’s reserves should equal short-term external debt (one-year or less maturity), implying a ratio of reserves-to-short term debt of 1. IMF has a particular page that calculates reserve adequacy for countries. Reserves are discussed mostly in relation to external vulnerability of economy. Short term external debt (EVDS Ticker: TP_KALVADBG_K18) of Turkiye is around 180 Billion USD as of May 2022.

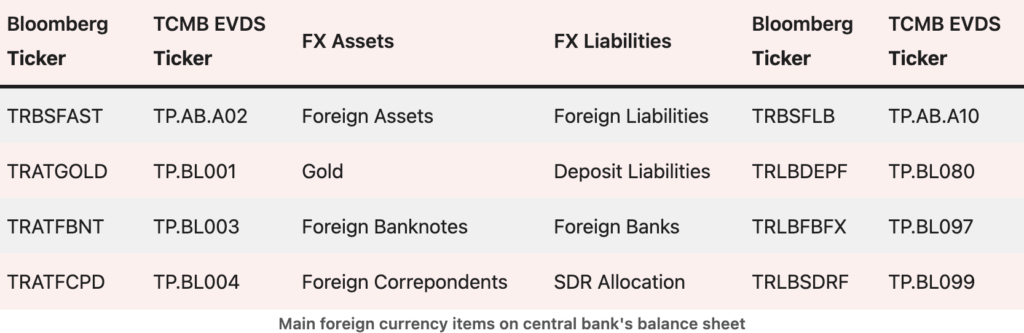

According to recent data (July 22) Turkish central bank has 101 Billion USD foreign assets and 103 Billion USD foreign liabilities on its balance sheet. This is a good picture excluding central bank’s off balance sheet position.

Central bank prepare monthly “The International Reserves and Foreign Currency Liquidity” table within the framework of the Special Data Dissemination Standards – SDDS – set by the International Monetary Fund (IMF). The monthly table disseminated by the CBRT covers detailed information on official foreign currency assets and predetermined short-term net drains on foreign currency assets (including residual maturity) and contingent short-term net drains on foreign currency assets. According to the report published for June 2022, Turkish central bank has 60 Billion USD short position recorded off the balance sheet as these transactions are mostly forward leg of currency swaps with local banks and other central banks. Moreover, %42 of central bank reserves are in the form of physical gold held in the country and in currencies (%18) not in SDR market which lack immediate liquidity.

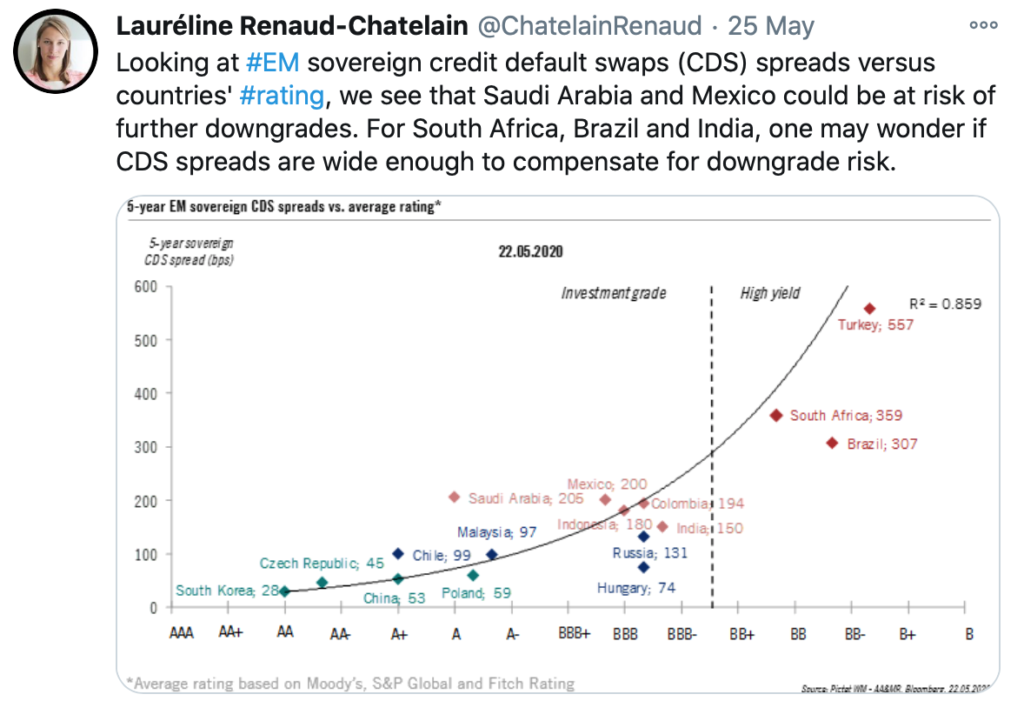

As a result of adverse developments on foreign assets on the central bank’s balance sheet , external vulnerability ratios detariorate and liquidity risk increases. Credit default swap markets price Turkish sovereign credit risk almost three times more than peer emerging markets.