One of the topics that still requires close attention in the field of economics is the nature of money. Countries with their own currency and with their debt denominated in it, have the capacity to print money to avoid default. This is basically called monetary sovereignty. That’s also the basic explanation why we use government’s debt as the risk free rate in finance.

In practice, monetary sovereignty has its own limits. As Fitch Ratings explains it with examples of past defaults, results of avoiding default is the most costly option in some cases. Countries may prefer to default for political reasons.

Printing money is old fashioned way of exercising monetary sovereignty, today’s Central Banks are more innovative. Electronic fund transfer system is the new printing machine. Central Banks are mandated to “ensure smooth functioning of payment systems” as a lender of last resort.

Instead of M1 which only makes 8% of money supply, it is M3 that matters. Money is endogenous and banks create deposits when they lend.

If fiat money is pure debt, has no intrinsic value and easy to create, is there a risk of losing monetary sovereignty?

Money is a social convention. One party accepts it as payment in the expectation that others will also do so. Some economists argue the role of central banks and governance of economy to maintain the monetary sovereignty.

When it comes to to Turkey, risk of defaulting on foreign currency liabilities draws the limit to the monetary sovereignty of Turkish Lira. I would like to emphasize here that Turkey never defaulted on its debt and this kind of risk is more hypothetical than reality.

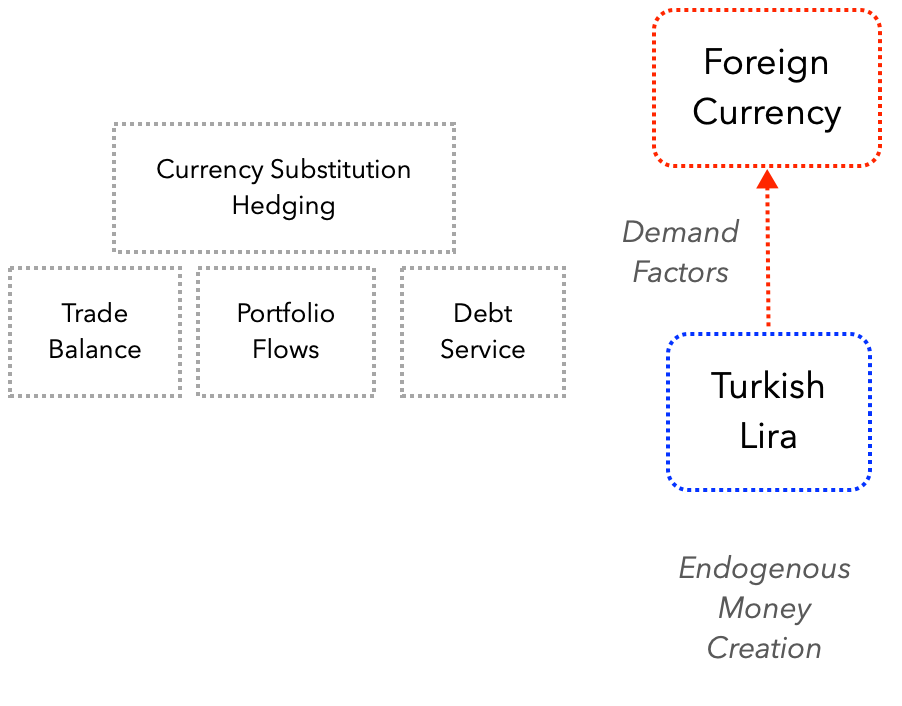

Although floating fx regime is expected to play balancing role to mitigate such macroeconomic risk in the long run, carelessness of policy makers may cause economic agents to behave disorderly in the short run. In the past 12 months, some 80 Billion USD foreign currency demand cause Turkish Lira to lose value substantially.

Turkey has accumulated large piles of foreign currency debt in the last couple of decades. This causes problem of debt intolerance which require careful macroeconomic policies. So, Turkey needs to avoid another round of increased foreign currency demand. Two important factors contributing are domestic money creation and foreign currency risk premium.

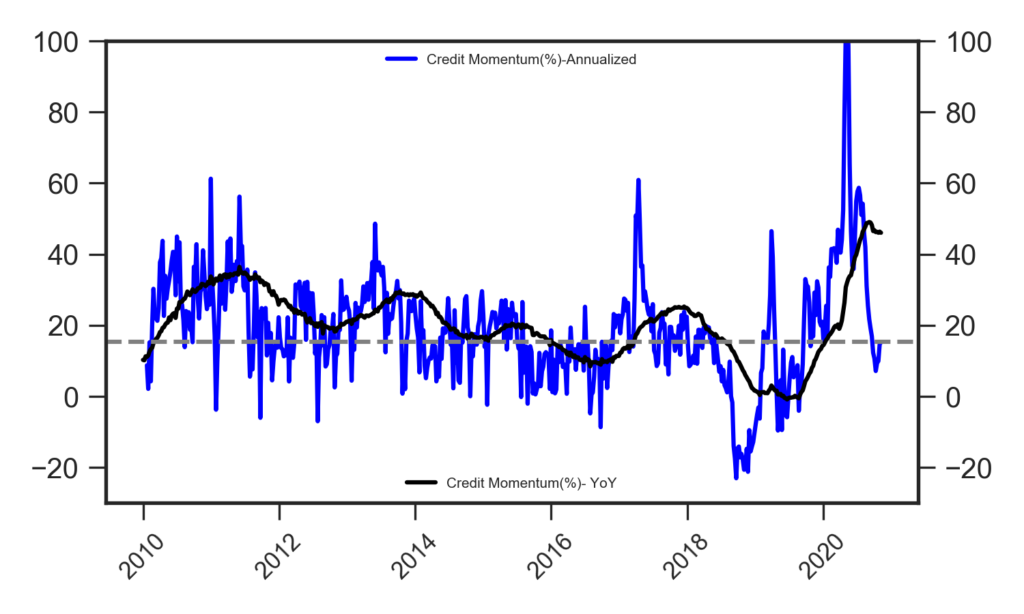

Here are the two underlying trends that capture these two factors:

1) Turkish Lira credit growth rate

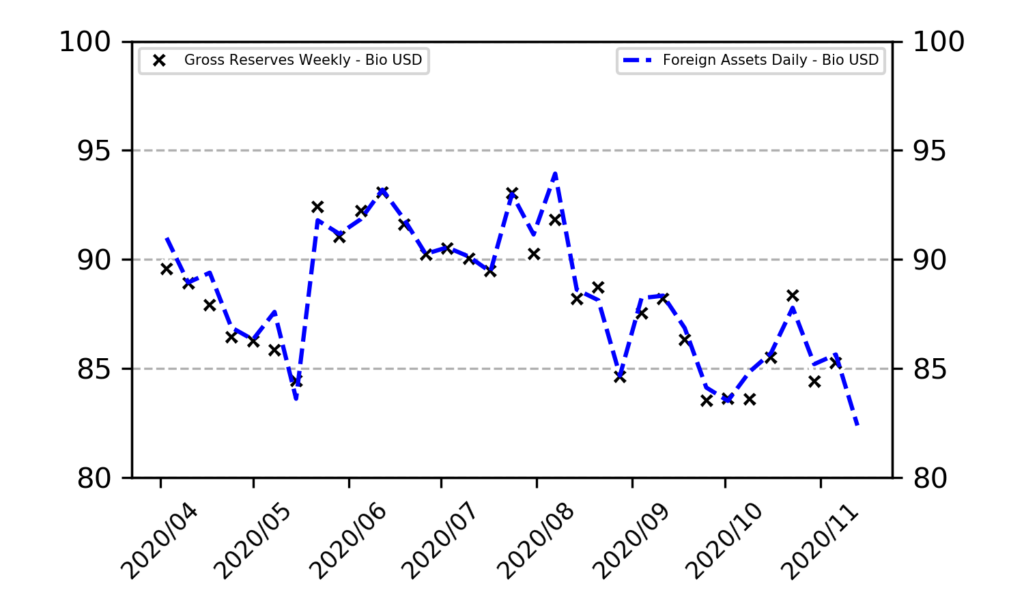

2) International Reserves

Annualised growth rates (Annualised rate of change) show the value that would be registered if the quarter-on-previous quarter or month-on-previous month rate of change were maintained for a full year. Since we have week-on-week data for bank credits, we will annualize 4 week average. Linear approximation requires to multiply weekly average by 52. In this example, outstanding Turkish Lira loan balance that is available on weekly basis (EVDS ticker: TP.BO.SBIL02) will be used.

One of the FX demand factors is external debt service and currency substitution. Government and corporates prefer not to roll over external foreign currency debt as markets charge higher foreign currency risk premium. Level of foreign currency liquidity is an important proxy to understand dynamics of foreign currency risk premium. Central Bank of Turkey publishes its foreign currency assets on a daily basis. In this example, foreign assets that is available on daily basis (EVDS ticker: TP.AB.A02) will be used.