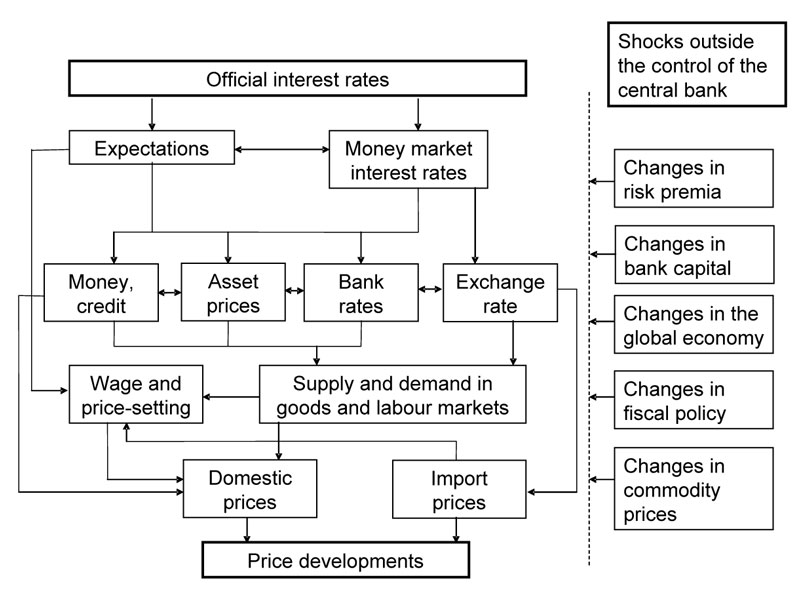

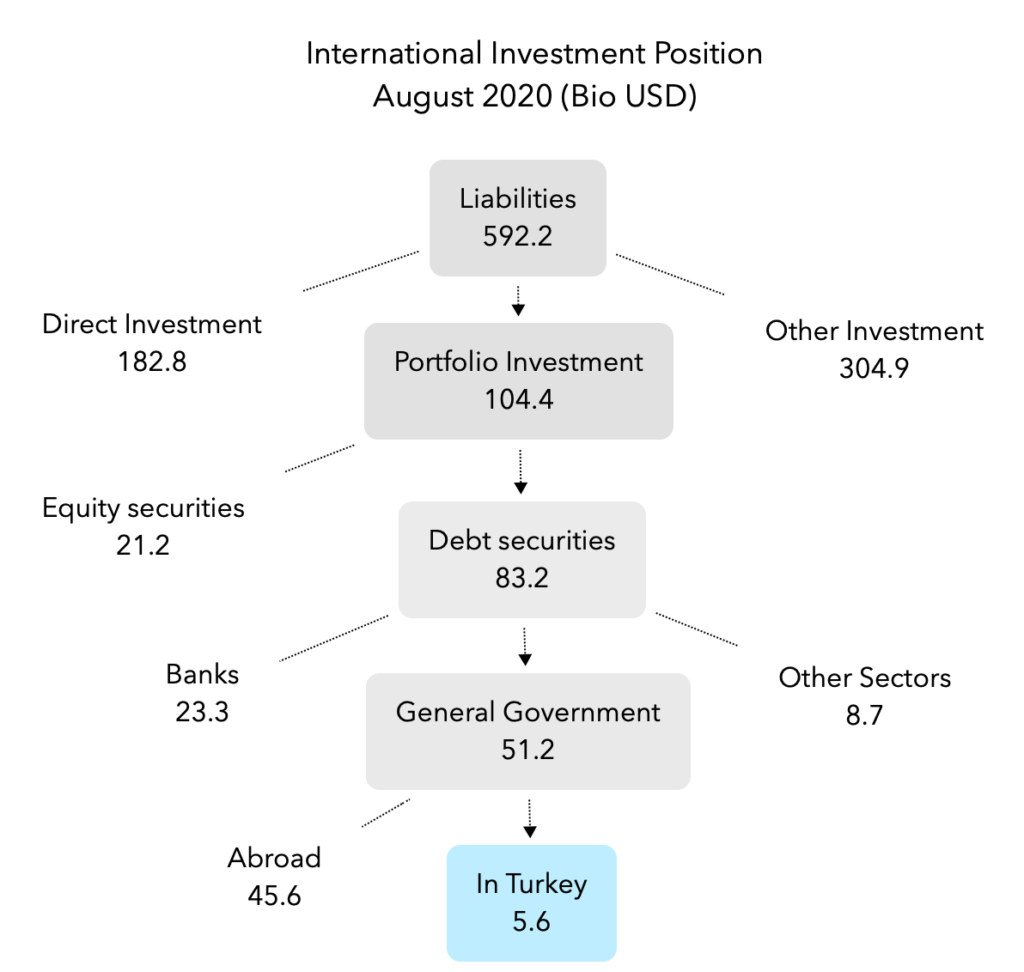

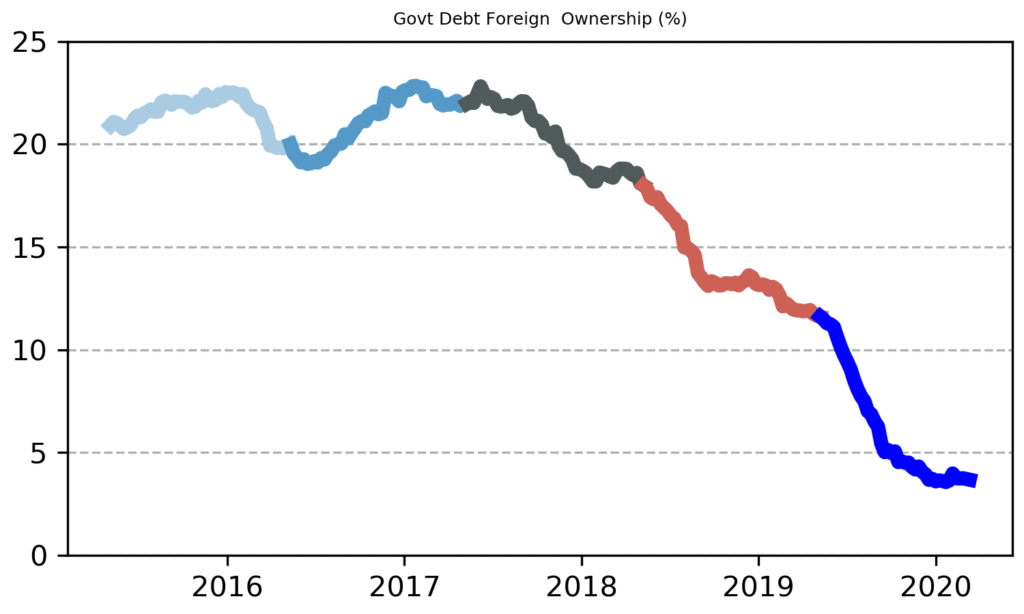

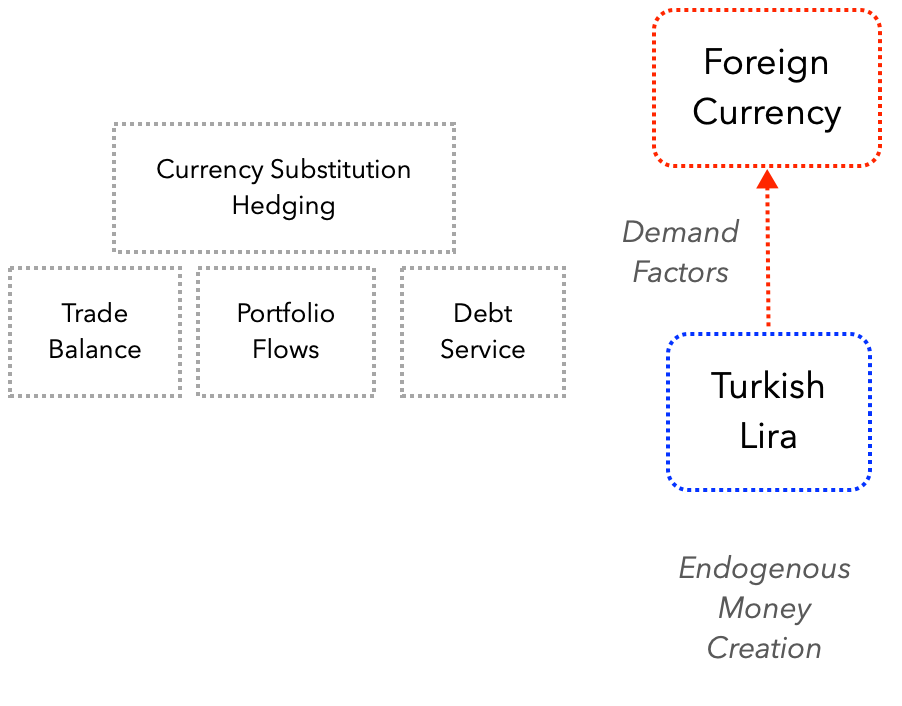

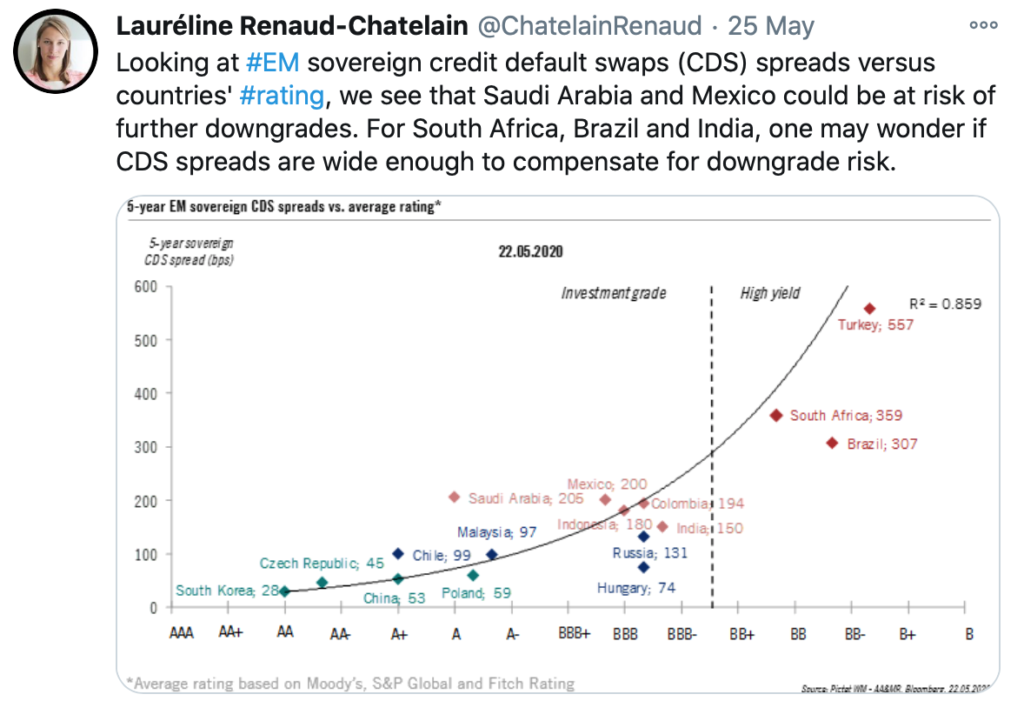

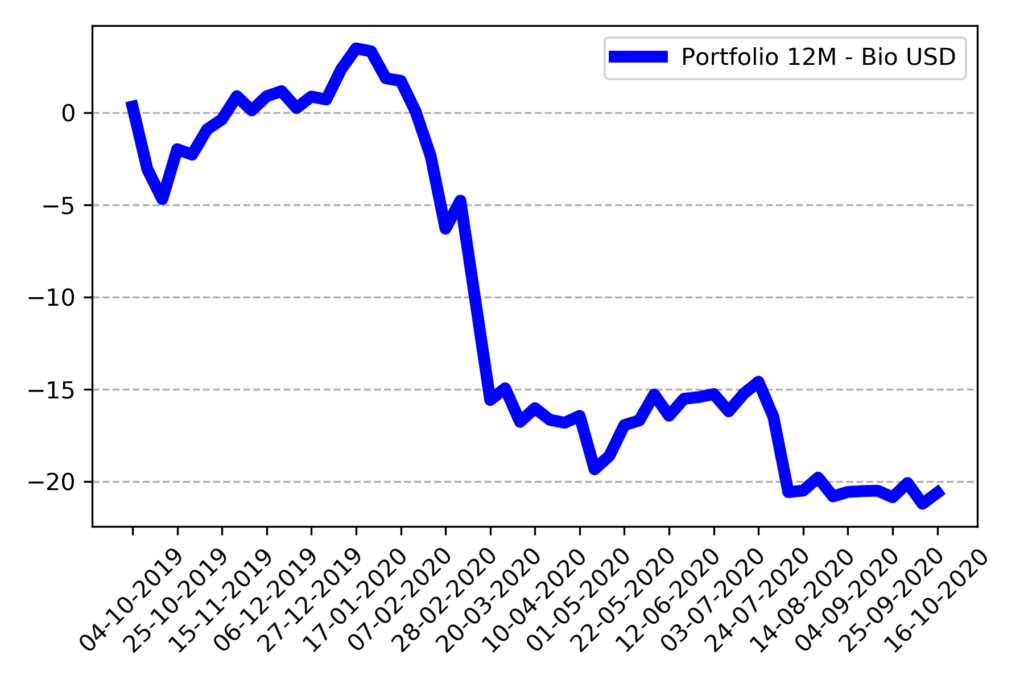

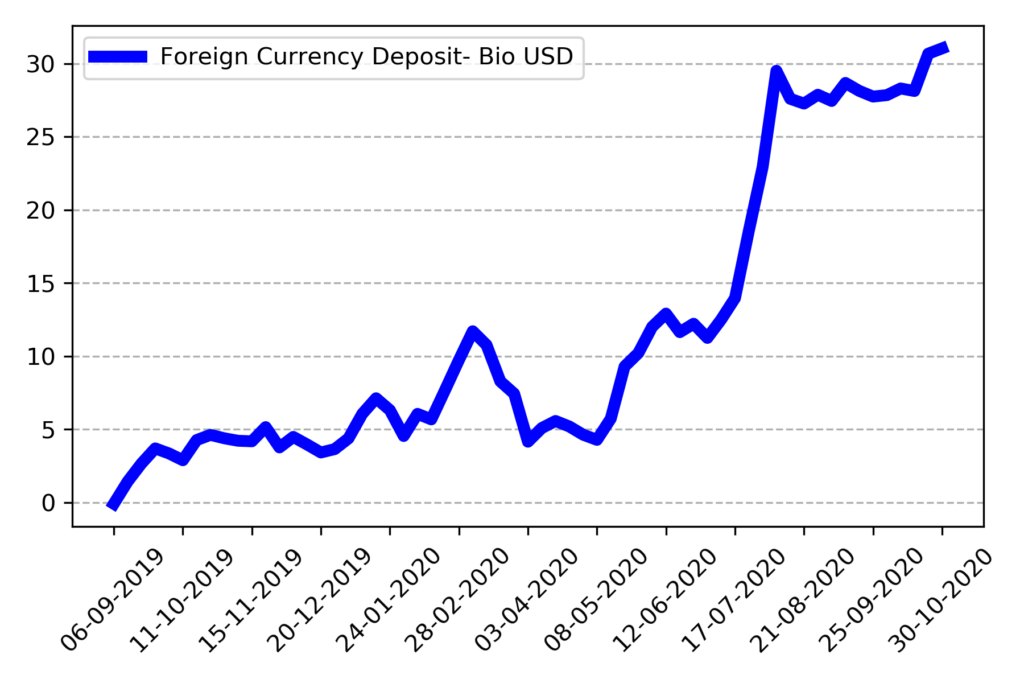

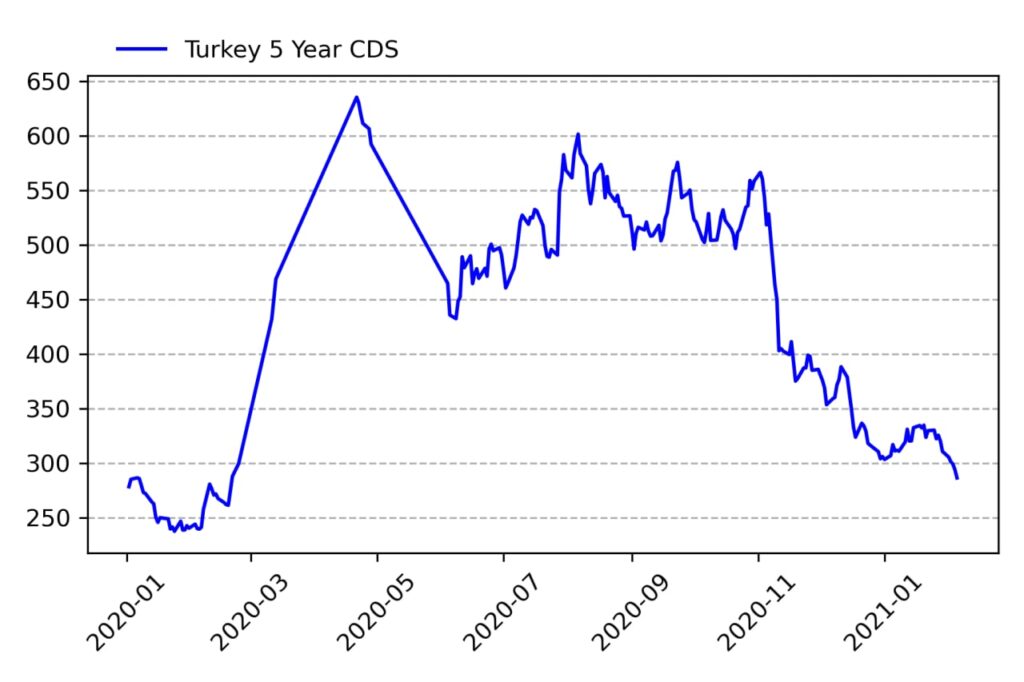

Recent macroeconomic regime shift in Turkey resulted in meaningful adjustment of risk pricing in the financial markets. Portfolio flows into money markets and capital markets considerably supported Turkish Lira assets. On the other hand, foreign currency demand has been moderated recently.

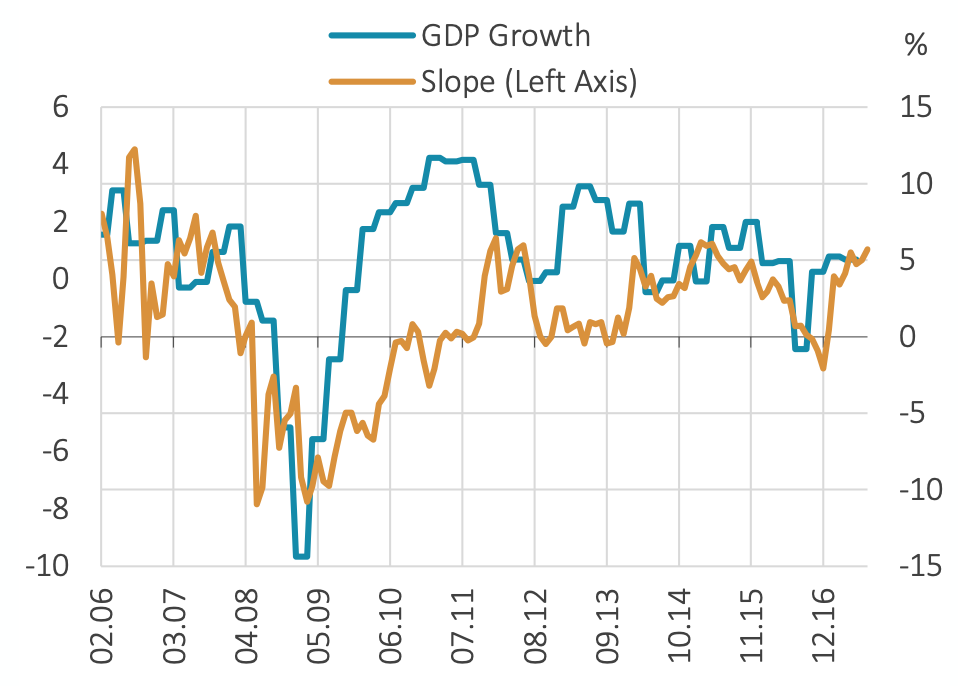

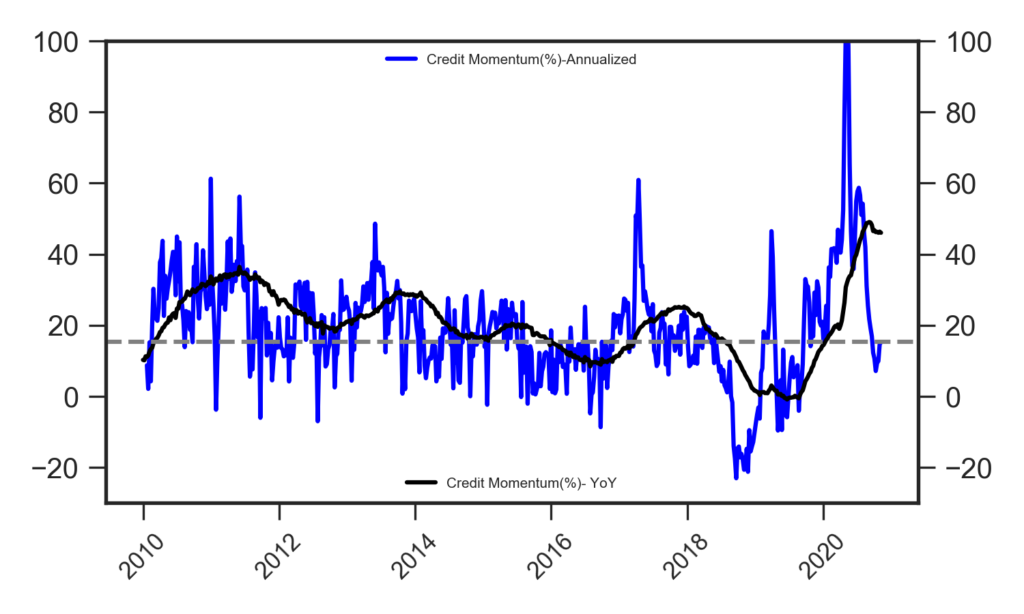

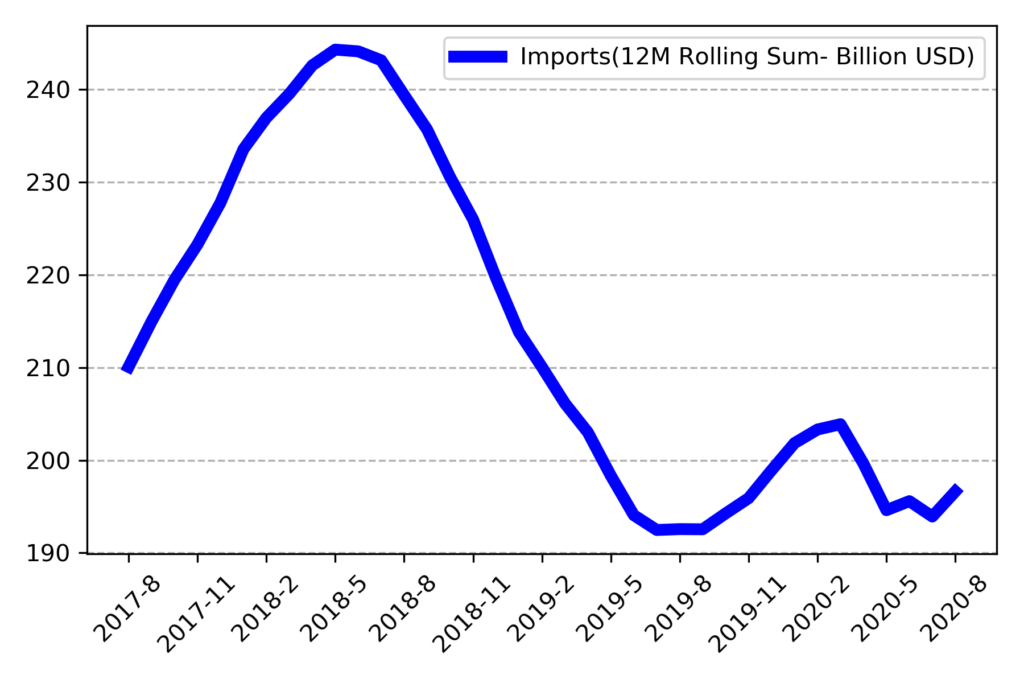

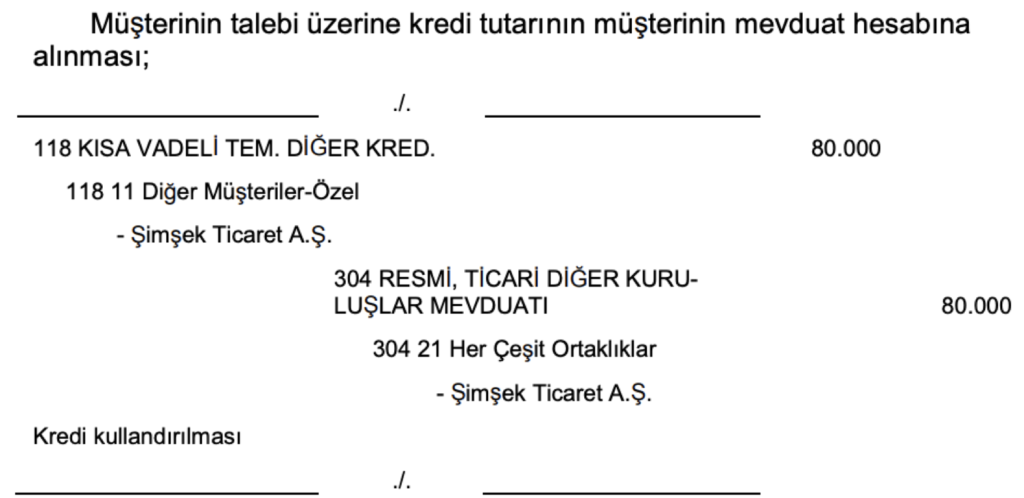

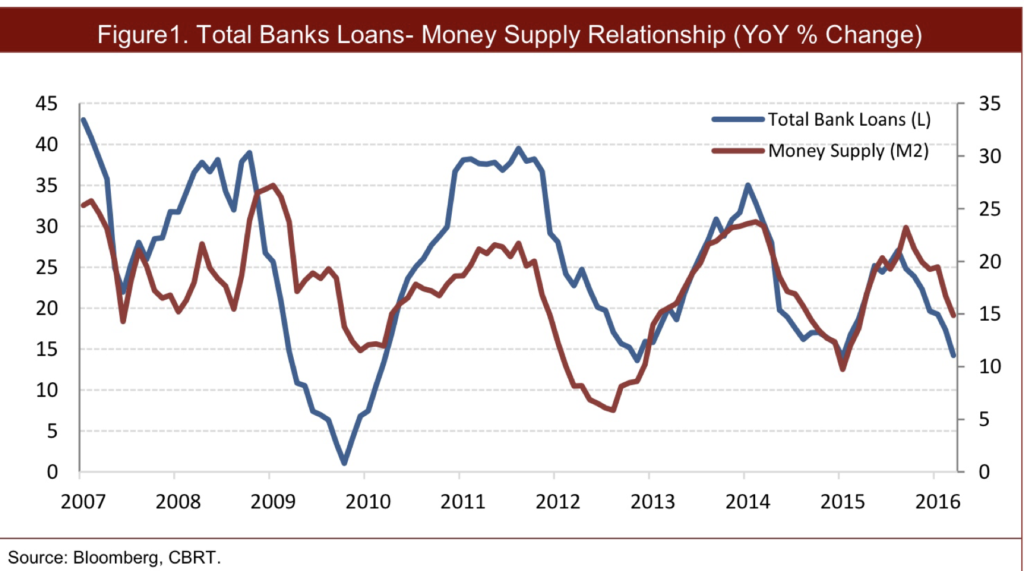

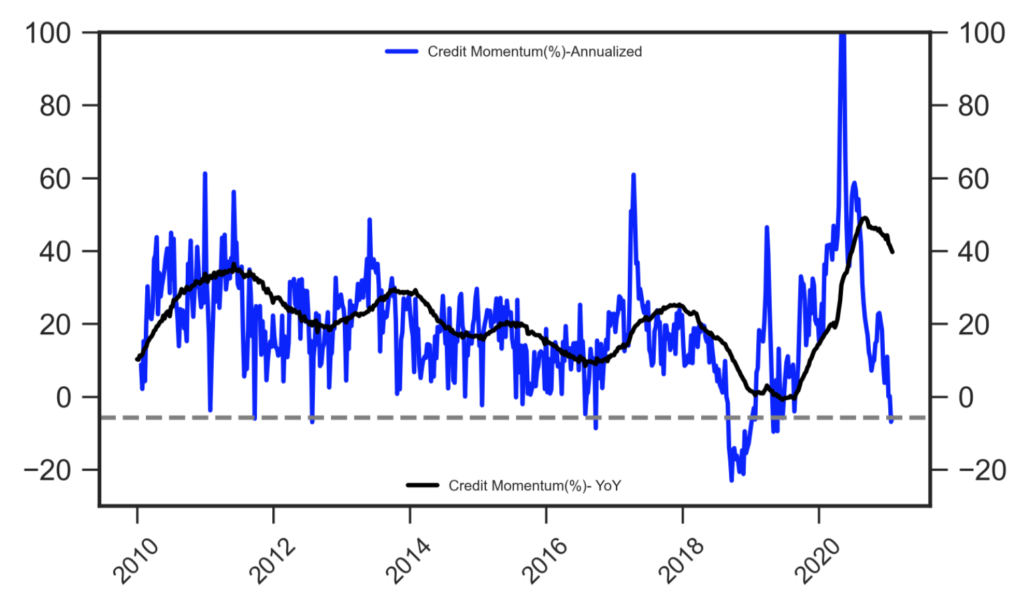

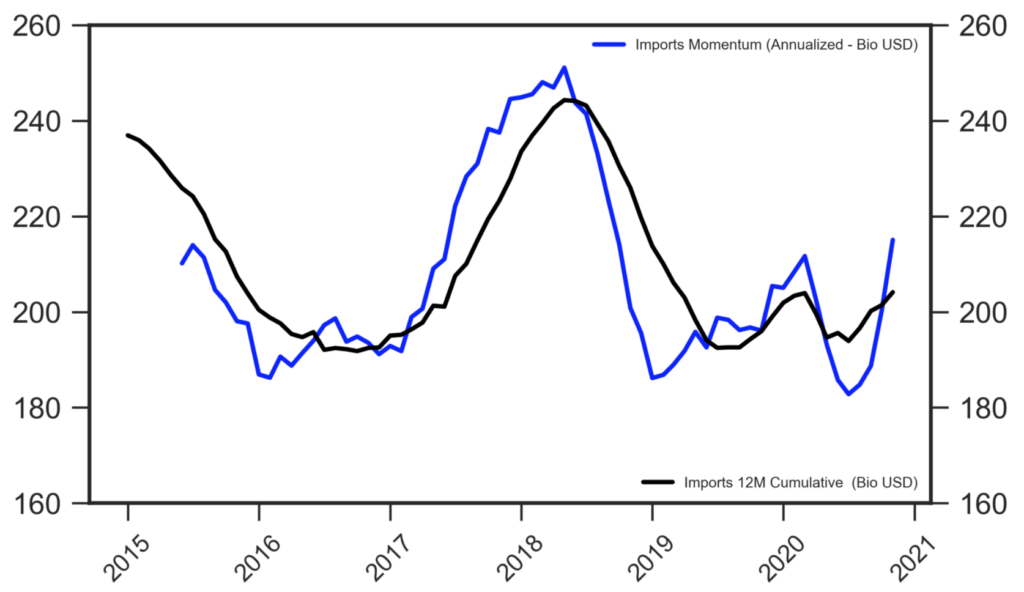

New orthodox policy framework regime will be able to control credit growth under the ongoing weakness in overall economic conditions, especially domestic demand . Recent underlying trend in Turkish lira credit momentum is strong enough to normalize abnormal loan growth during the first quarter of 2020.

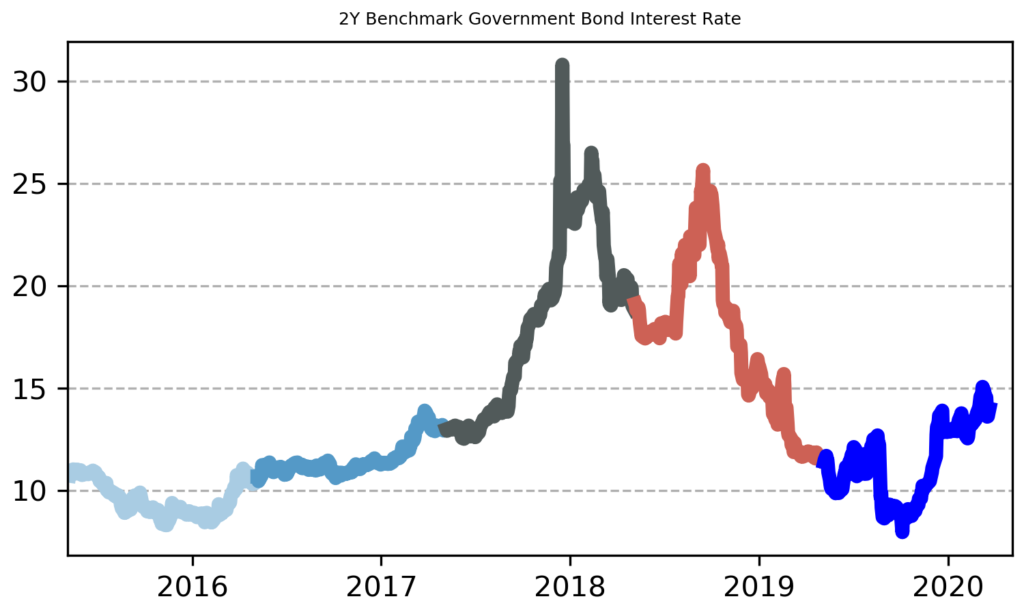

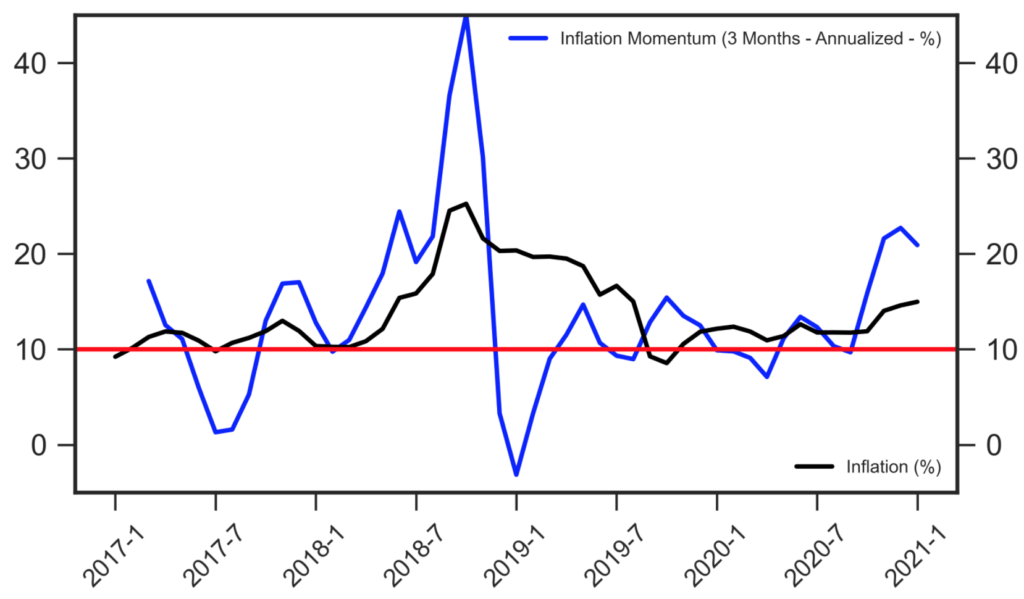

New economic management highlights the fact that inflation is still far from the 5 percent target and tight monetary policy will be implemented until inflation is under control. This kind of communication is good to attract some attention. Cyclical nature of some items even will help to achieve some sort of price stability.

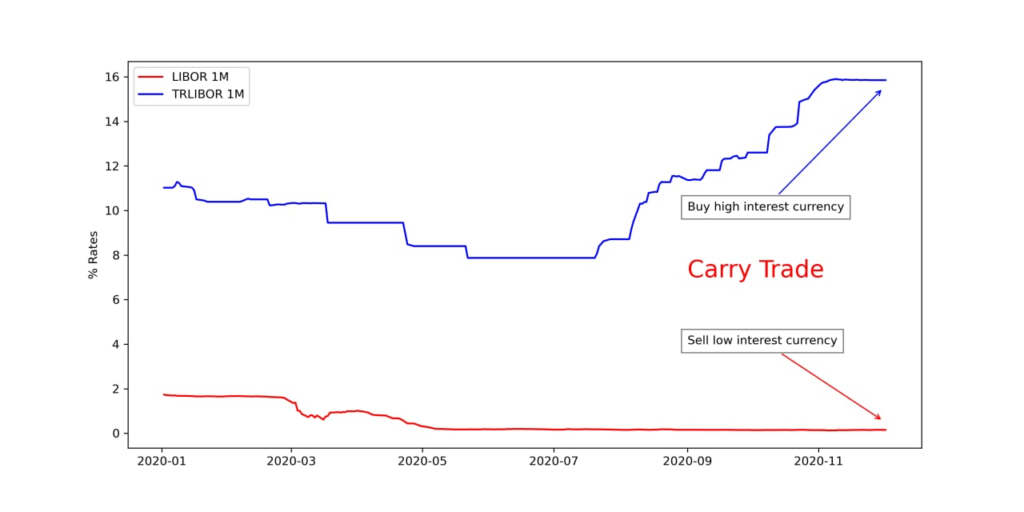

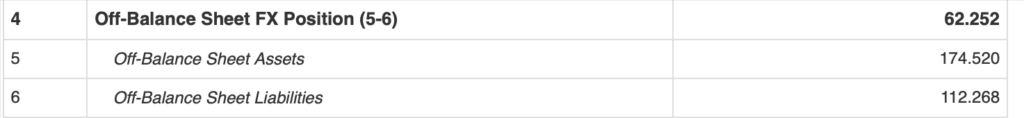

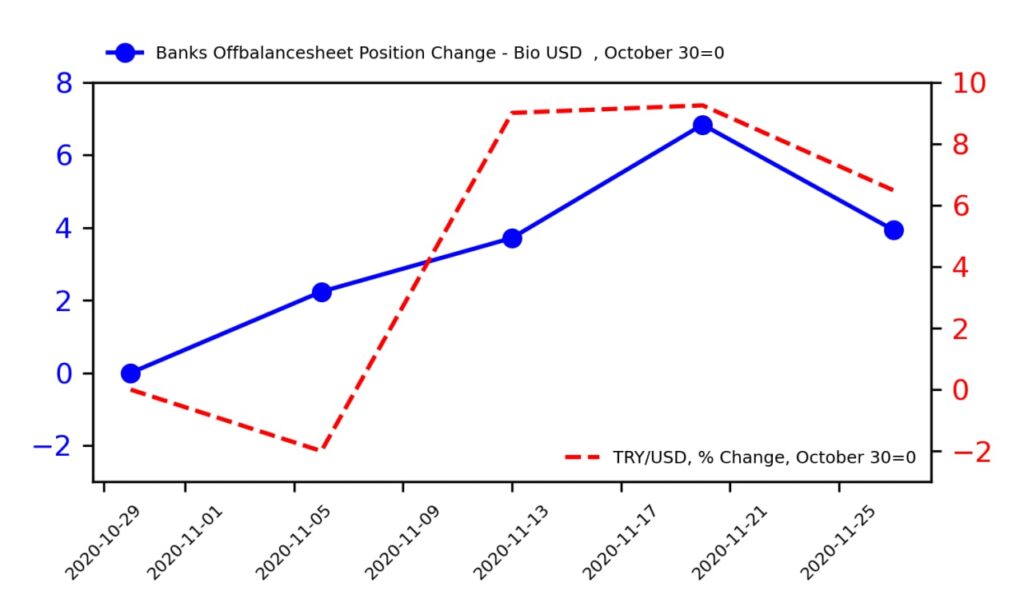

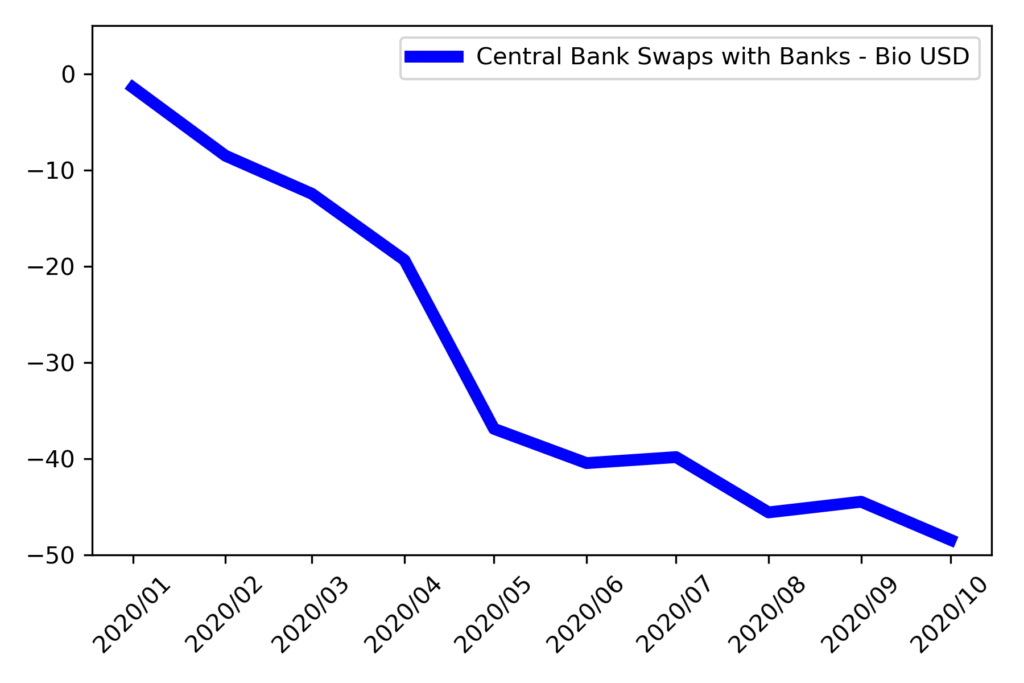

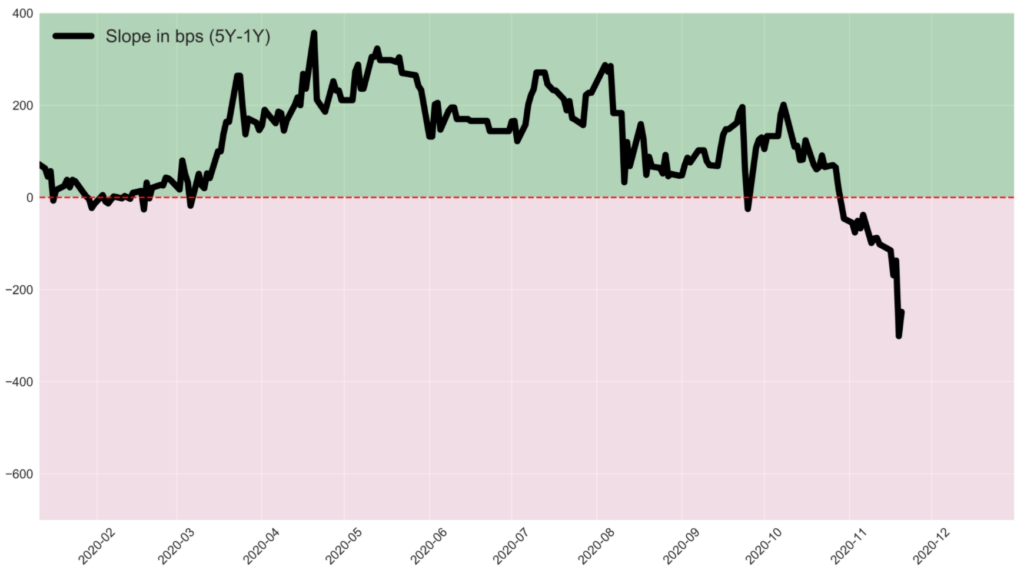

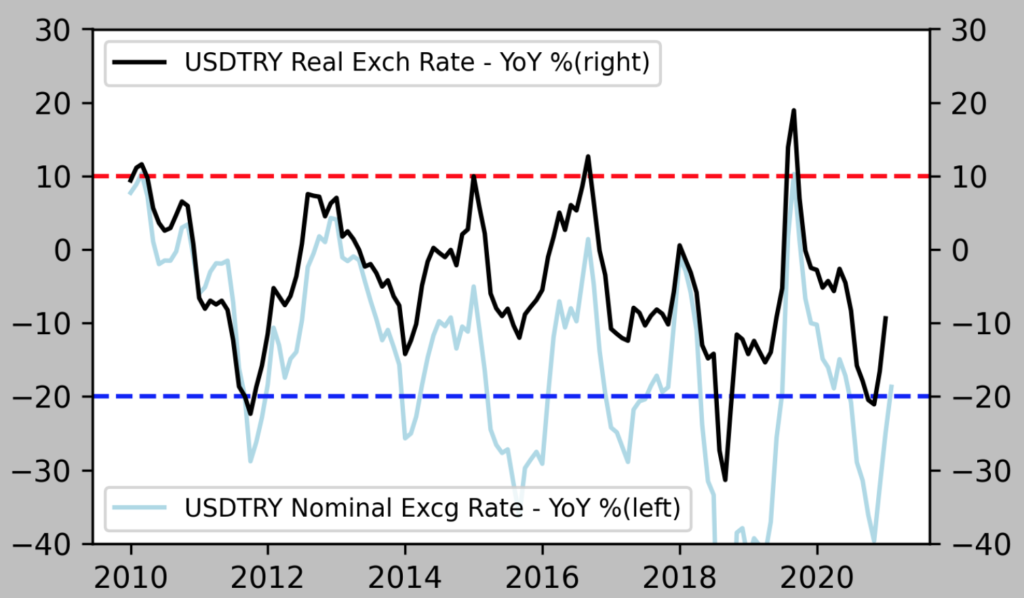

FX pass through is the principal factor that explains recent inflationary pressures. Ongoing real appreciation of Turkish Lira is underway and this will help the inflationary pressures to subside going forward. As far as the global risk appetite allows, it is possible to see Turkish Lira further strengthening in real terms. Most of the prices in financial markets are mean reverting. Even without intervention, prices revert to its long term averages. As expected Turkish lira managed to gain value from historical low levels. Fast money captured the opportunity to profit from interbank dealings with Turkish banks.

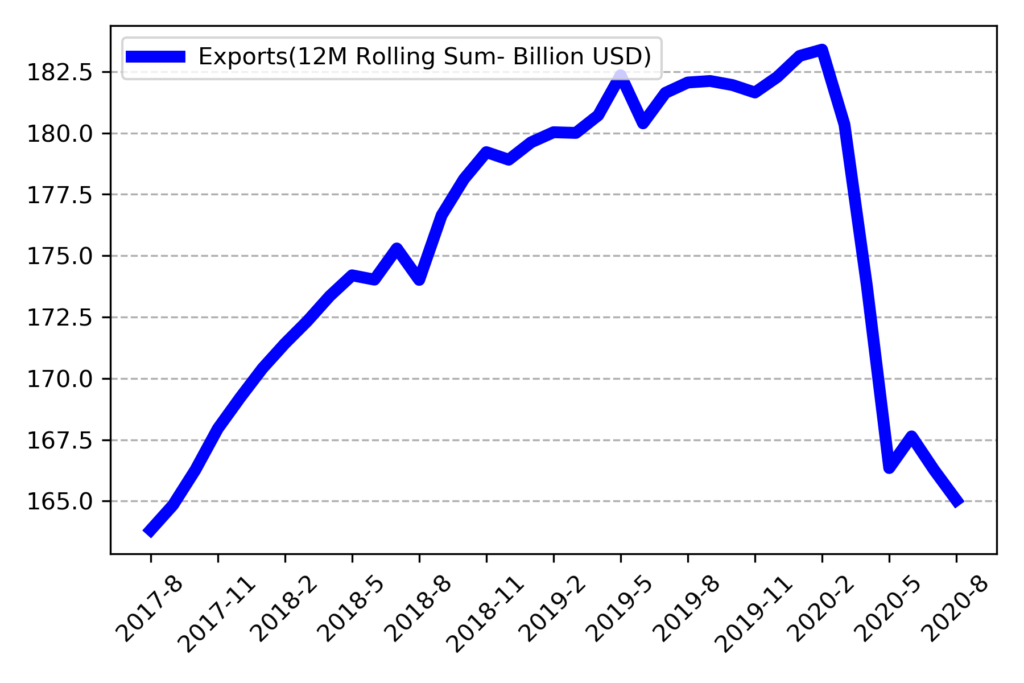

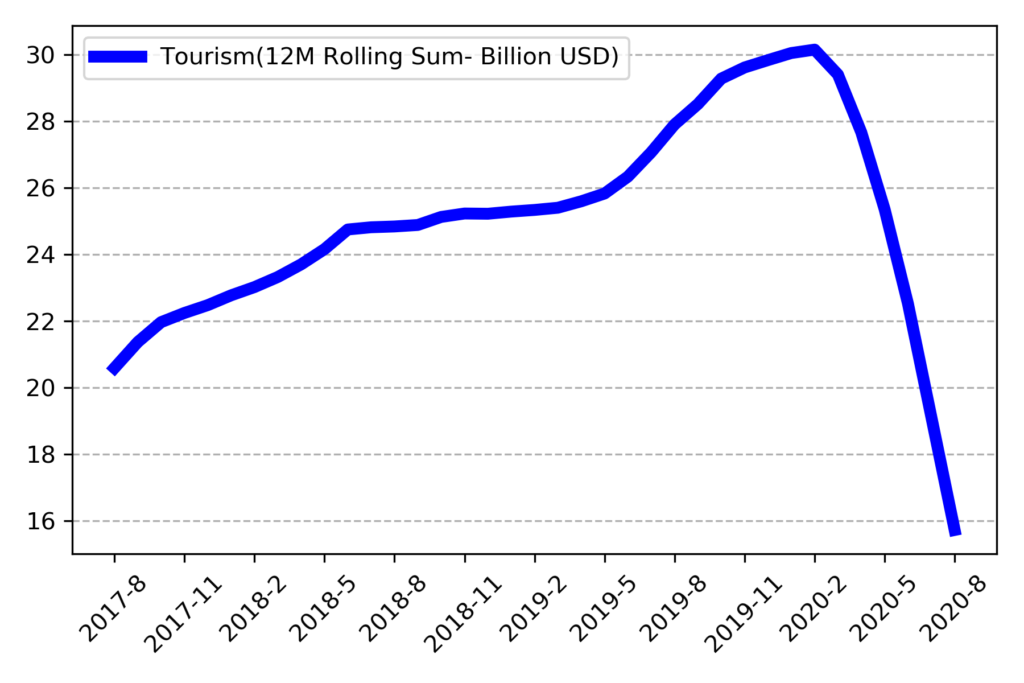

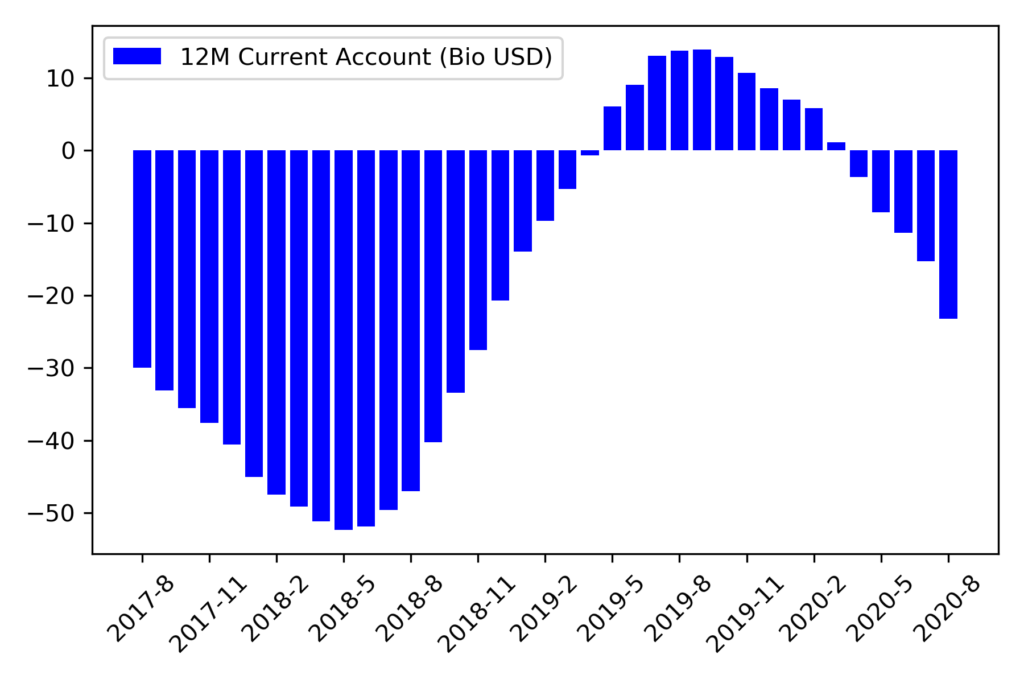

Consumer confidence increases with the appreciation of Turkish Lira. Firms unwind fx hedges and increase fx borrowings as a result of lower risk premium and central bank put to control foreign currency. As it has been observed in the previous episodes current account deficit increases even under tight financial conditions.

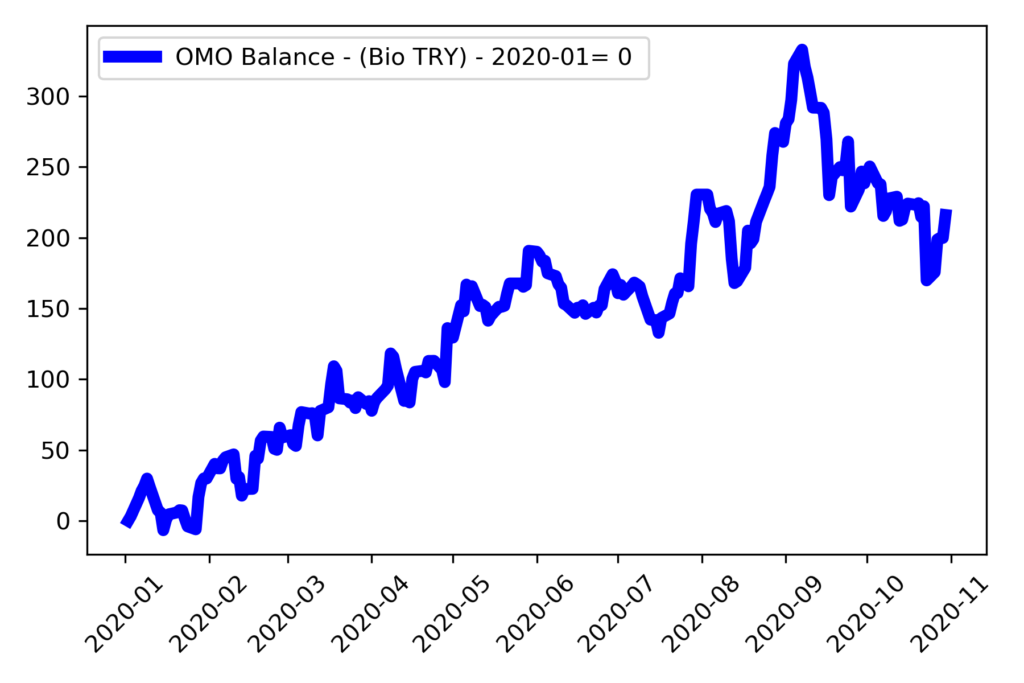

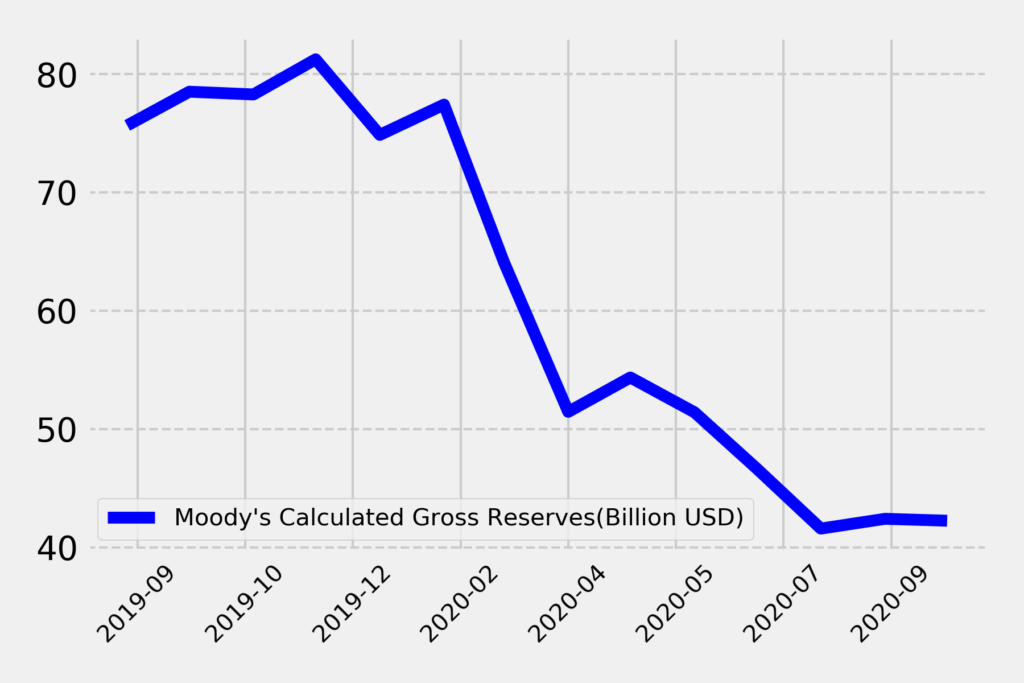

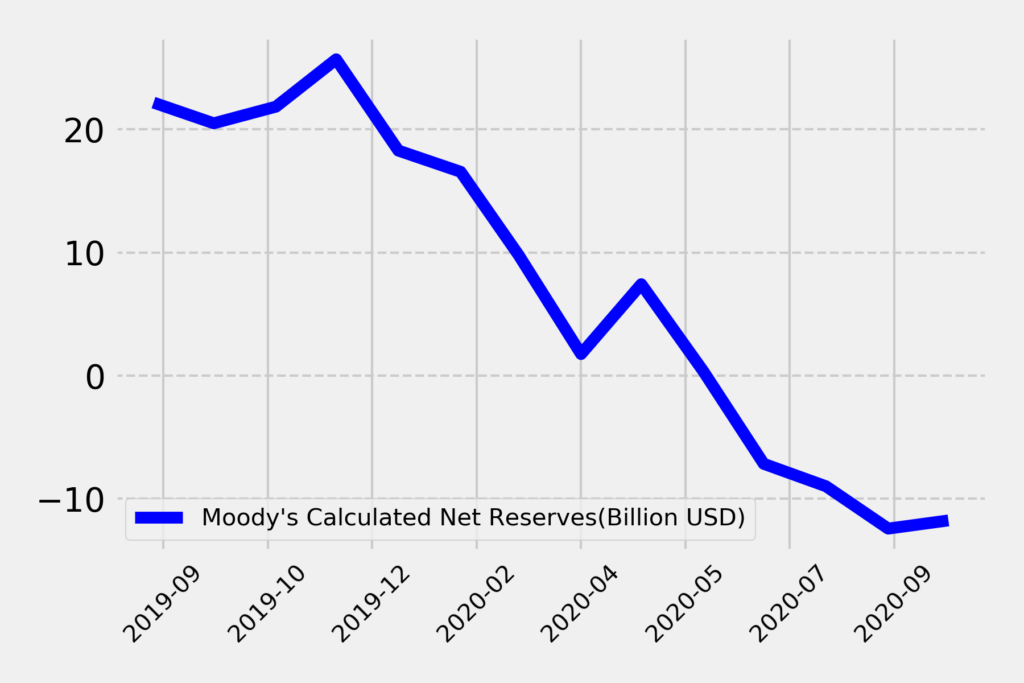

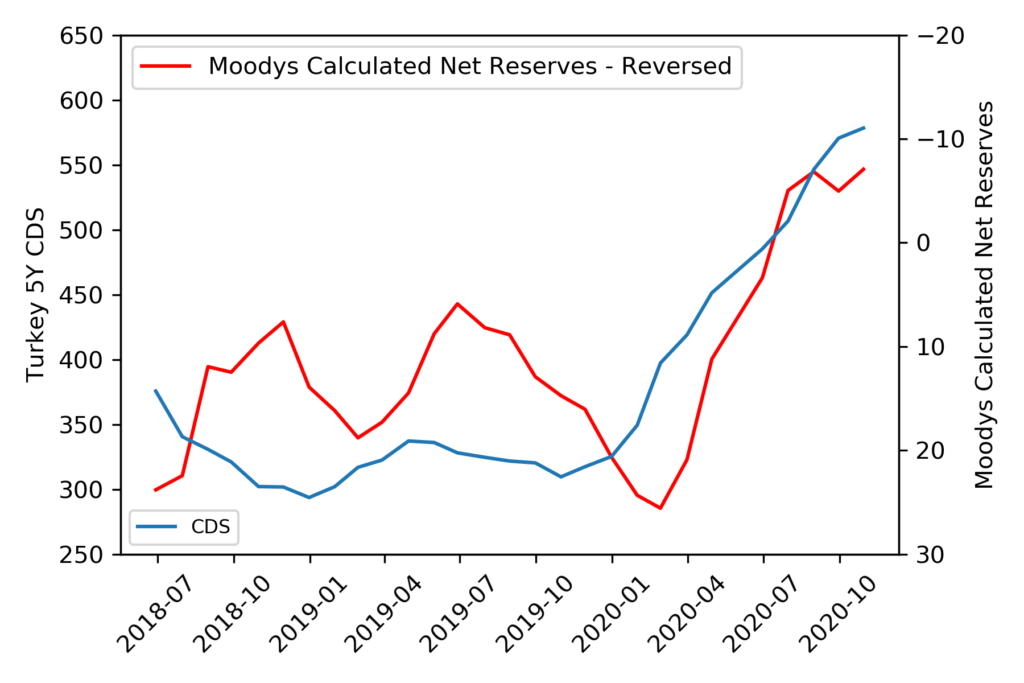

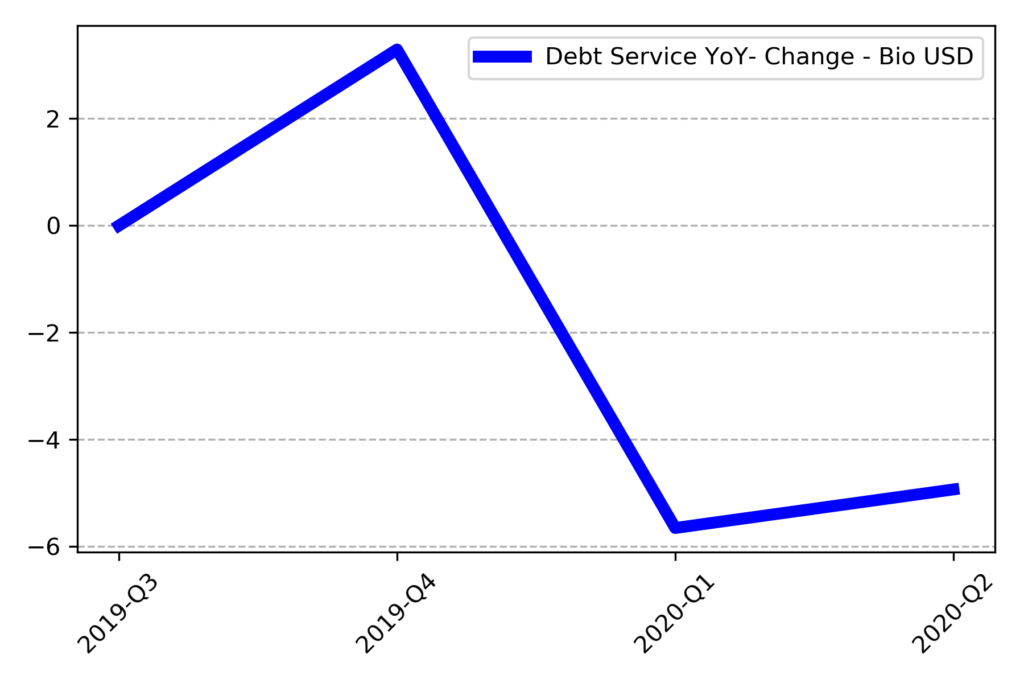

Fast money positioning and tight monetary policy are not a remedy to fundamental problems of Turkish economy. Although external vulnerabilities require moderate level of money creation, lack of liquidity will create its own problems.