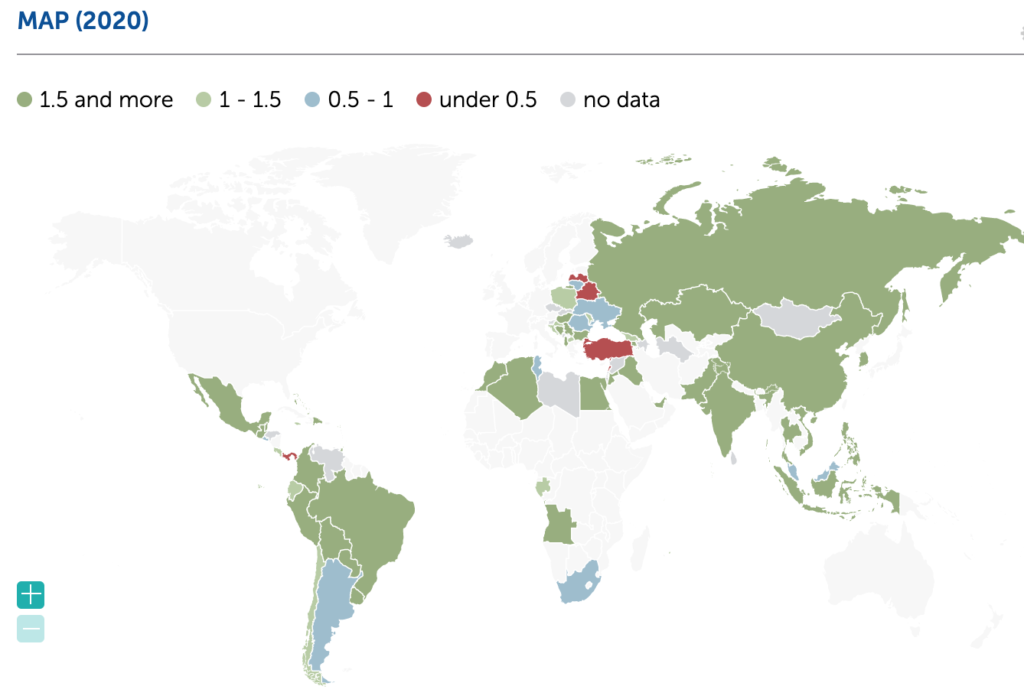

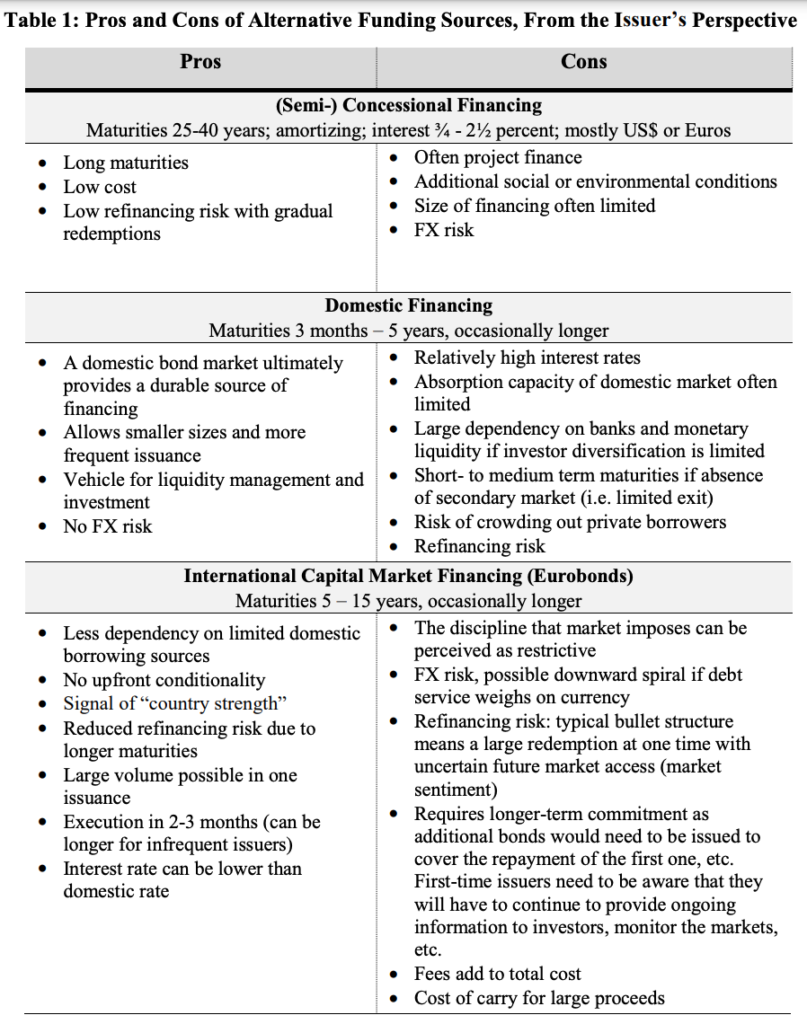

A Eurobond is a debt instrument that’s denominated in hard currency other than the home currency of the country or market in which it is issued. Access to international markets depends on the perceived credit risk, often measured by a country’s credit rating. An international rating of B- is generally considered the minimum for issuance in the international capital markets. Investors are driven by yields and, in the current low rate environment, have been accepting more credit risk, pricing in default risks. In addition, many investors actively or passively track market indices, or benchmark their investments against them; if a bond qualifies for inclusion in an index it can therefore generate some ‘automatic’ demand.

The key drivers to issue Eurobonds centered around the ease at which funds can be raised, the lack ofconditionality in their use, and the drive to signal financial strength.

Turkey in International Markets

Turkish Treasury has taken international borrowing very seriously and has been one of the biggest suppliers for years. Currently, Turkey has 85 Billion USD outstanding Eurobond.

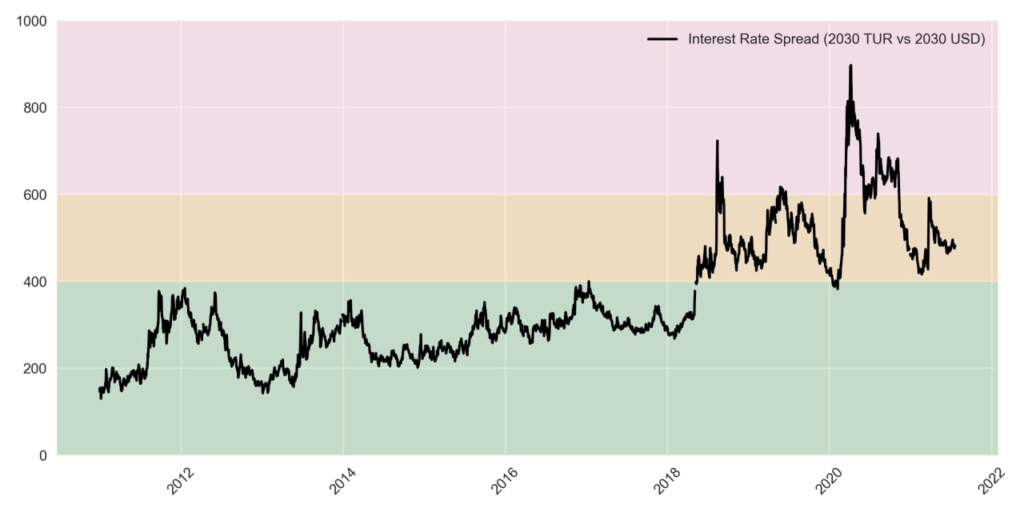

Turkey continues to borrow from international markets. Latest Euro denominated 5 year Eurobond issuance of Turkish treasury in July 2021 was priced at 468 bps spread to Euro mid swaps. Interest spread has been between 200 bps to 800 bps in the last two decades.

Below is an example of a 30 year USD denominated bond which was issued in 2000 and will be due in 2030. This Eurobond is priced at +525 bps over US Treasury’s 2029 5,25% bond at the issuance.

Who Owns Eurobonds?

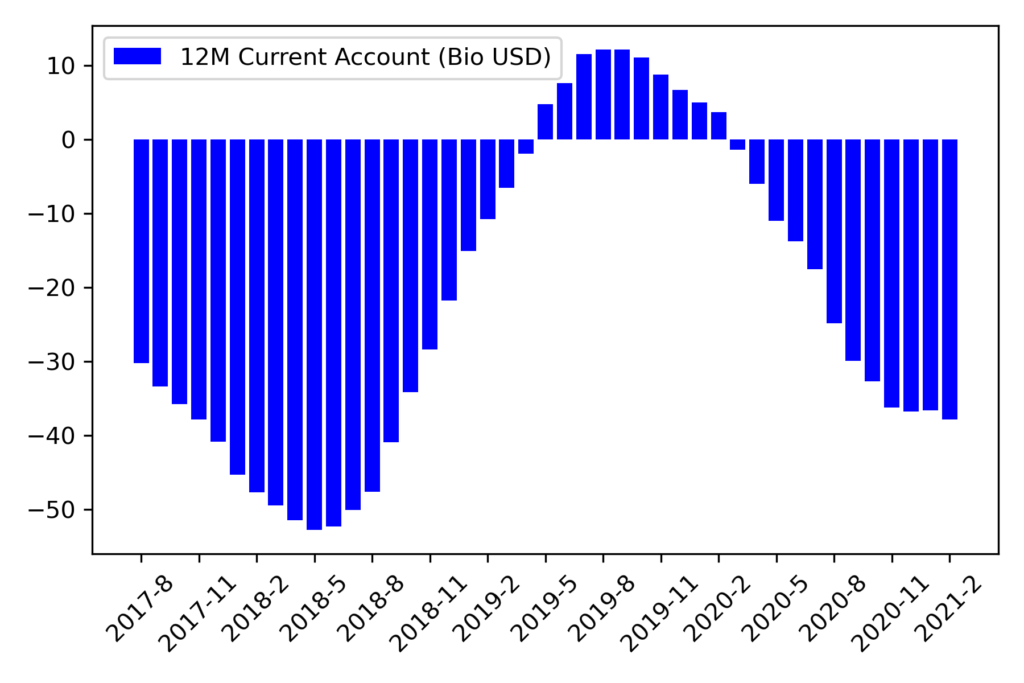

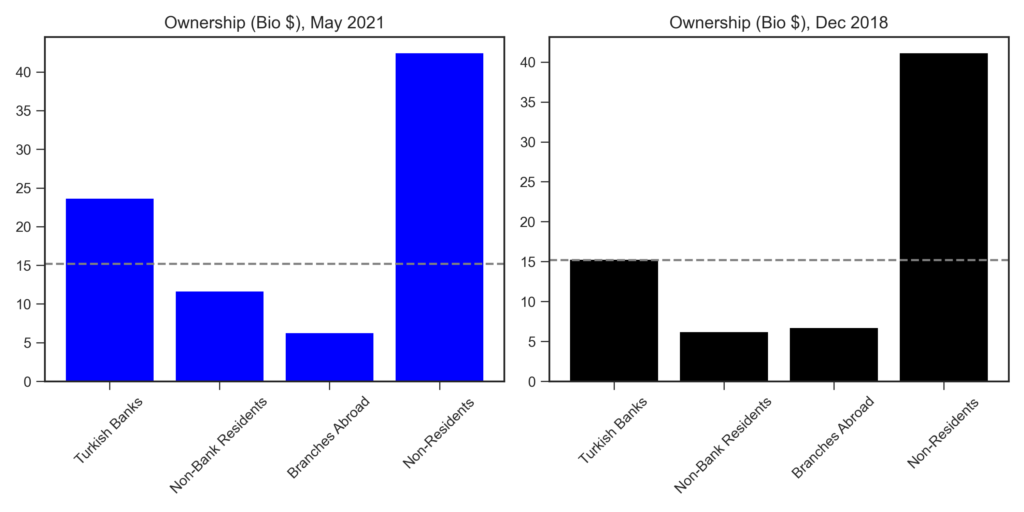

Countries that are not able to raise long term funds in its domestic currency from international markets issue hard currency bonds. One of the reasons to borrow from international markets is to attract foreign portfolio investors.

Recent developments in ownership of Eurobonds suggest otherwise recently. Turkish banks and citizens are also clients of high yielding Eurobonds. Eurobonds are good substitute of foreign currency deposits. As of May 2021, more than two third of Turkish foreign currency deposit holders have deposit balance above 100.000 USD in their bank accounts. In total, this means purchasing power of approximately 150 Billion USD. Turkish residents hold 42% of outstanding Turkish Eurobonds. Turkish banks hold 26 Billion USD amount of Eurobonds. Nonbank residents hold 11 Billion USD amount of Eurobonds. Eurobond ownership by Turkish bank and non bank residents almost doubled in the last 2 years.

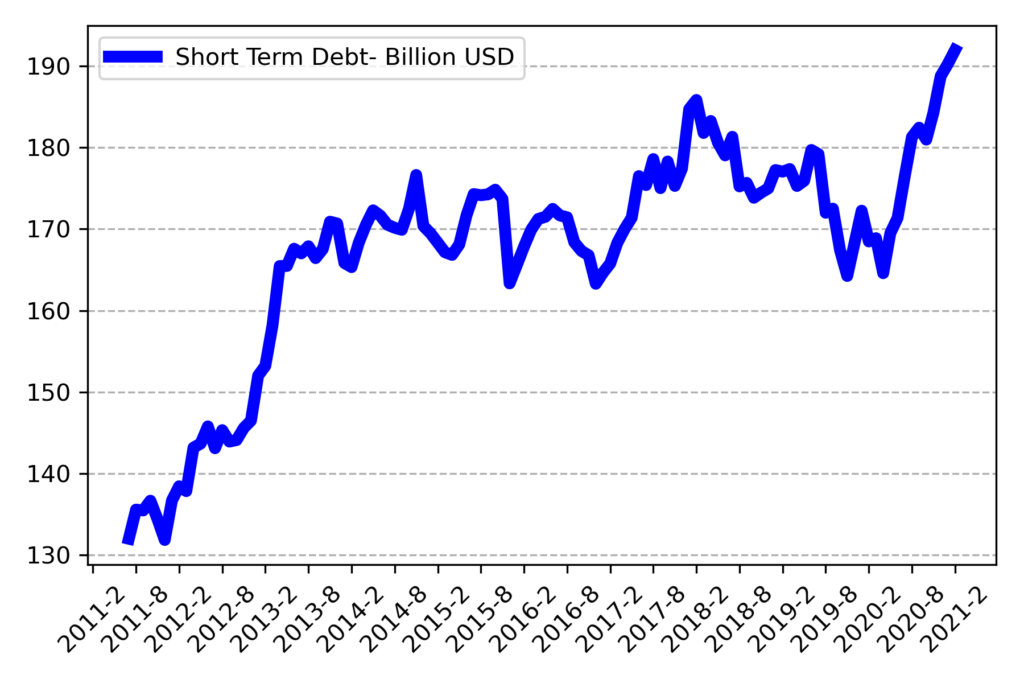

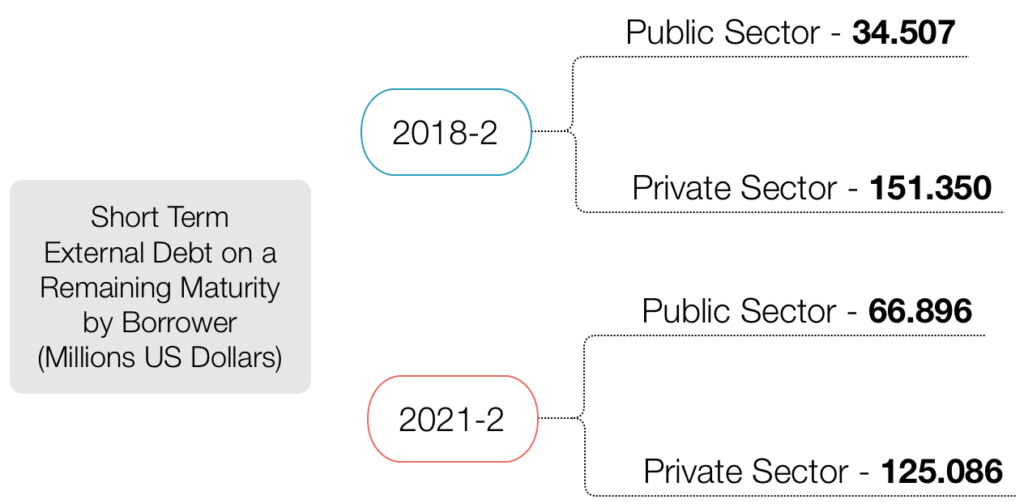

Maturity Shortening as a Risk

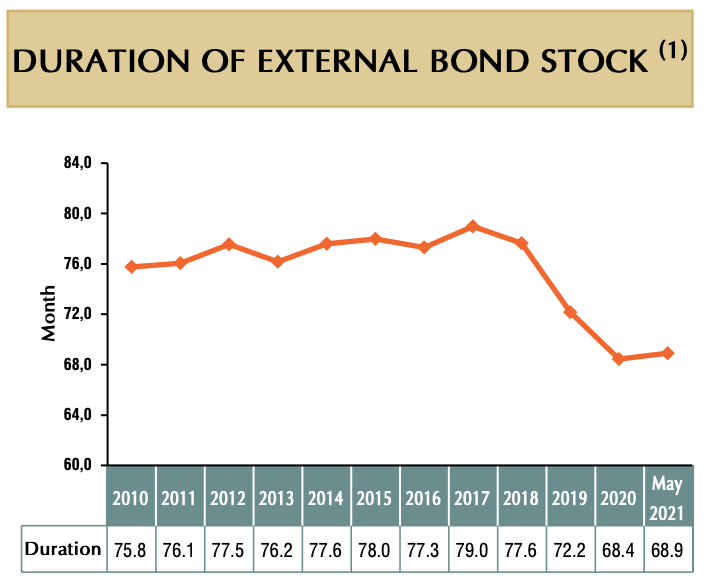

The original sin hypothesis was first defined as a situation “in which the domestic currency cannot be used to borrow abroad or to borrow long term even domestically” by Barry Eichengreen and Ricardo Hausmann in 1999. Original sin has important consequences. Countries with original sin that have net foreign debt will have a currency mismatch on their national balance sheets. Movements in the real exchange rate will then have aggregate wealth effects. In addition to original sin, debt intolerance is another term that needs to be understood well. Debt intolerance is a term coined by Carmen Reinhart, Kenneth Rogoff and Miguel Savastano referring to the inability of emerging markets to manage levels of external debt that, under the same circumstances, would be manageable for developed countries, making a direct analogy to lactose-intolerant individuals. It is already a well documented fact that the maturity structure of emerging market debt issuances correlates with their domestic conditions. That is, emerging markets issue long-term debts more in tranquil times, and issue short-term debts more when they are near crisis. Long-term spread is generally higher than short-term spread and this difference increases as the country approaches crisis (Broner, Lorenzoni and Schumukler (2005)). The refinancing challenges are often ignored at the time of issuance, since refinancing takes place in the distant future.

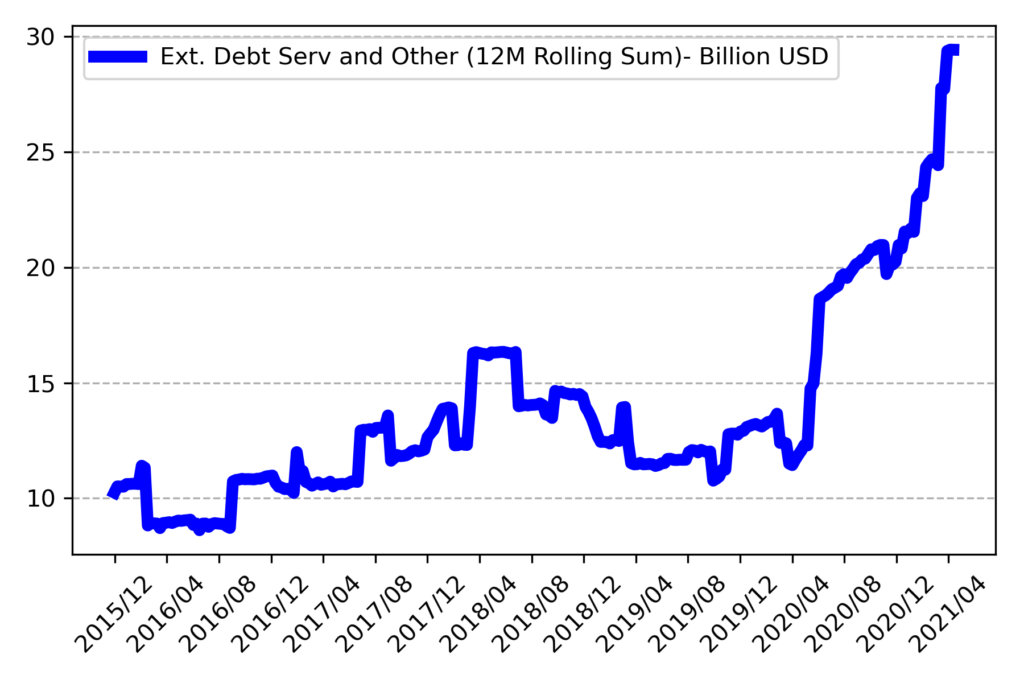

Duration of external debt bond stock continue shortening as Turkish Treasury is not willing to pay high interest rate spreads. On the other hand there is a lack of appetite by foreign investors to lend Turkish Treasury. Turkish residents become the main investors of Turksh Eurobonds. Given the high level of Turkey’s short term external debt, shortening maturity of external bond stock is not favorable in the long run.

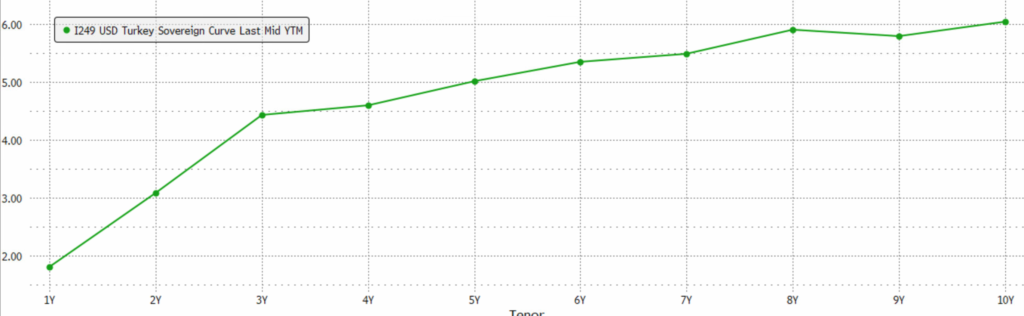

Interest Rate Spread as a Sovereign Risk Indicator

Historically some governments defaulted on their foreign currency debt. Default risk is priced in terms of interest rate spread. The interest rate spread between Eurobonds and U.S. treasury securities should reflect sovereign default risk.

Default on sovereign bonds is mostly observed at the times of crises. IMF defines crisis period as follows in one of research notes:

- Sovereign spreads above 1,000 basis points. Crisis periods are counted as those weeks during which sovereign spreads as measured by JP Morgan’s Emerging Markets Bond Index (EMBI) exceed 1,000 basis points on at least five consecutive trading days. Temporarily lower spreads during periods of up to 150 trading days are disregarded to avoid splitting crises into several events.

- Sovereign ratings below B2/B. Crisis start dates are defined as downward rating revisions to or below B2 (Moody’s) or B (Standard and Poor’s, Fitch), respectively. Crisis end dates are defined as upward rating revisions to above B2/B. If ratings by more than one rating agency are available, we use the lowest rating to make the event window as wide as possible.

Below is the historical development on interest rate spread between due 01/15/2030 Turkey USD Bond and 05/15/2030 US Bond. Although Turkish sovereign risk deteoriated after 2018, it is still far away from crisis mode. Turkey needs to tackle short term external debt problem in order to cheapen cost of external borrowing.