Policy makers wish to achieve sustainable cost of borrowing for the overall economy. This kind of policy objective could be achieved with a proper macroeconomic policy framework. Monetary policy, fiscal policy and financial system policy make the three pillars to achieve policy objectives.

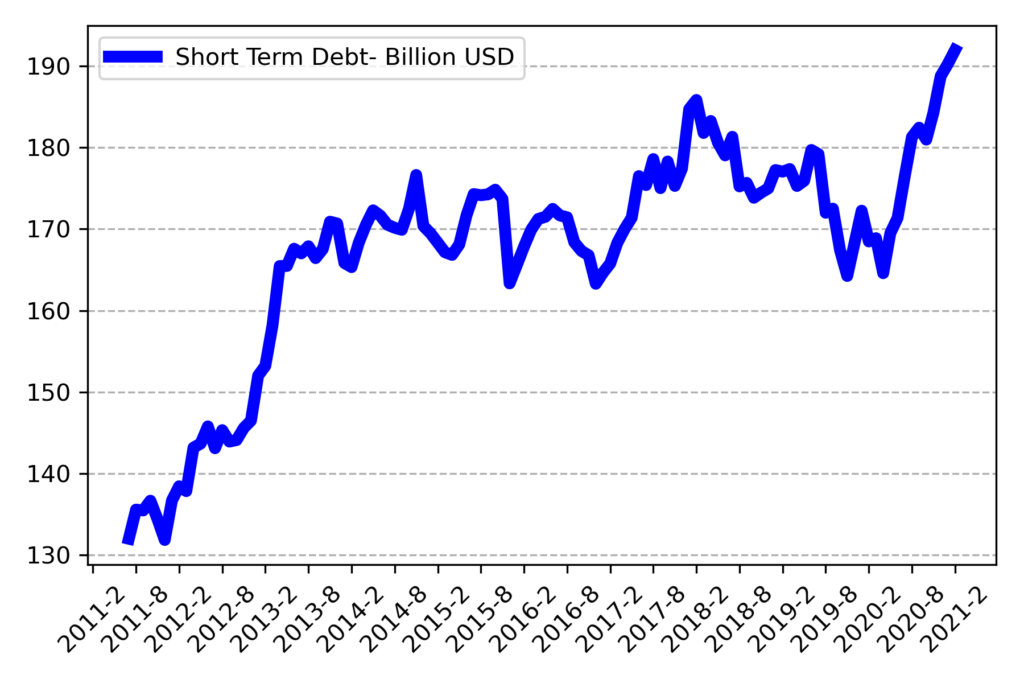

Deterioration in Short Term External Debt

One of the vulnerability indicators followed by international creditors is the level of international foreign exchange reserves relative to the short term external debt. Turkey’s short term external debt (Ticker: TP.KALVADBG.K18) on a remaining maturity reached all time high as of end of February. Such an increase results in weaker vulnerability indicators.

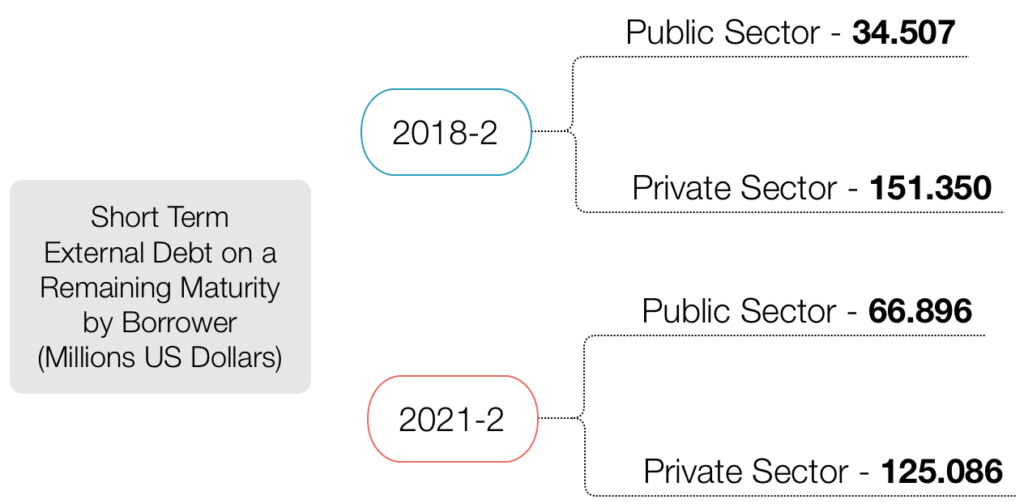

Who is responsible?

Details of the statistics show that this deterioration was a result of increase in short term public sector debt. Increase in public sector debt even offseted the decrease in private sector debt. There are a lot of details regarding composition of the short term external debt which makes the picture to look better. Still most of the analysts simply use the headline figure in their calculations.

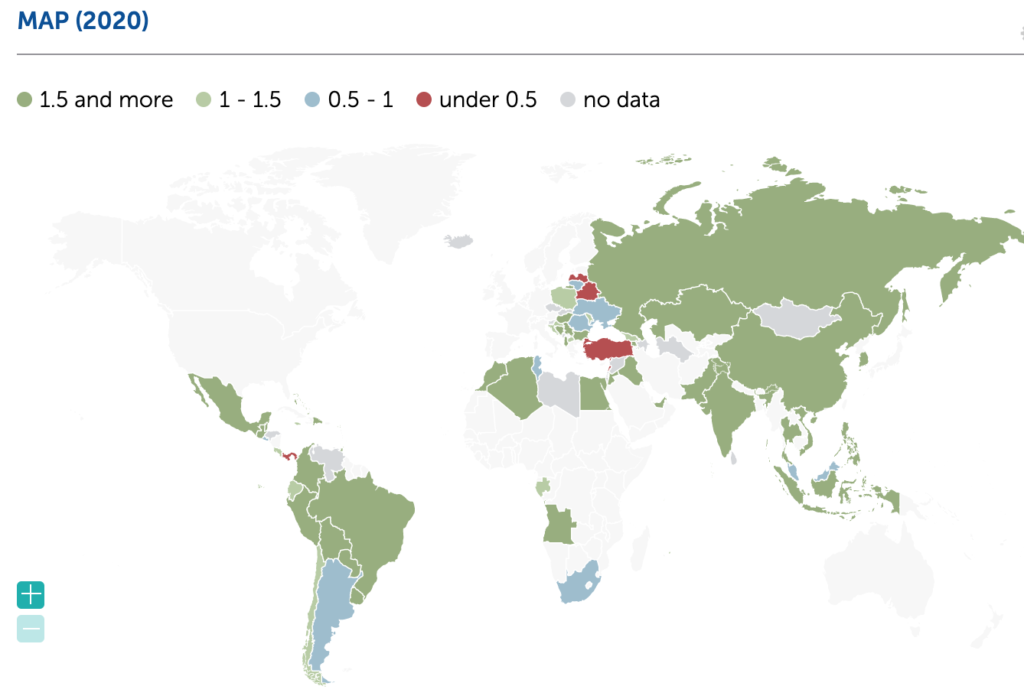

Where Turkey stands in the World?

Turkey is one of the most vulnerable economy in the world to the external shocks given the short term external debt. This position also explains why Turkey fails to maintain lower cost of international financing. Deteriorating short term external debt position continue to put pressure on Turkey’s external debt dynamics.

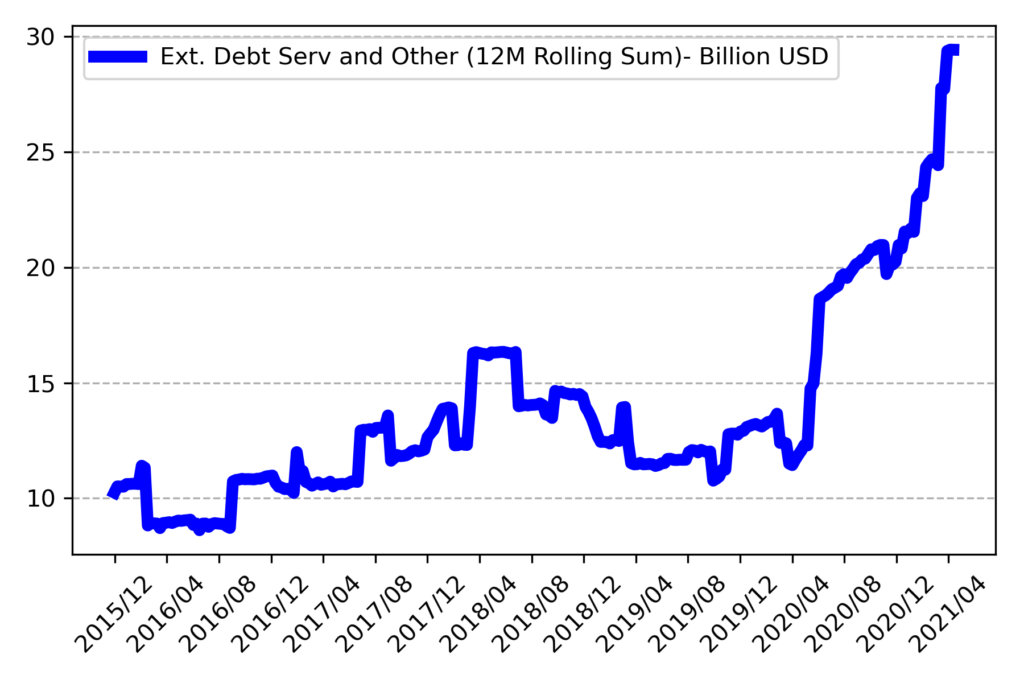

Government of Turkey’s payments in foreign currency (Ticker: TP.D1TOP) reached 30 Billion USD in the last 12 months including external debt service and other transfers.

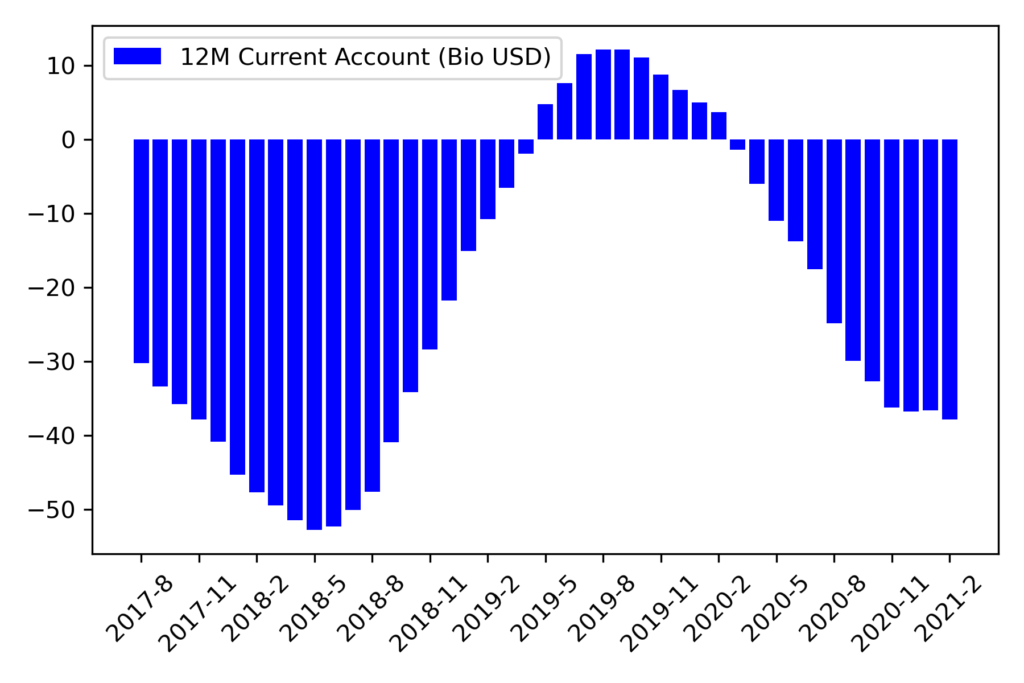

Turkish economy’s current account deficit reached 40 Billion USD in the last 12 months.

It is obvious that Turkey is in the need of continuous foreign currency inflows and to roll over external debt. But this is only part of the story, Turkey also needs to extend the maturity structure of its external debt.